Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1645115

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1645115

Flexible Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 140 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

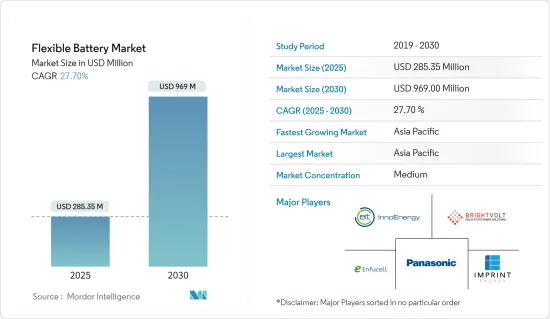

The Flexible Battery Market size is estimated at USD 285.35 million in 2025, and is expected to reach USD 969.00 million by 2030, at a CAGR of 27.7% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the rapid adoption of healthcare wearable devices, coupled with penetration of Internet of Things (IoT) applications, is expected to increase the demand for the flexible battery market.

- The high cost associated with flexible batteries and the availability of alternate battery technologies existing for various applications are expected to hinder market growth during the forecast period.

- Characteristics of these batteries, such as lightweight and compact designs, make them suitable for military applications, which is expected to create vast opportunities for the flexible battery market.

- Asia-Pacific dominates the market and is also likely to witness the highest CAGR during the forecast period. The growth is mainly due to the growing emphasis on foldable electronics and wearable devices, especially in economies such as China, South Korea, and Japan.

Flexible Battery Market Trends

Consumer Electronics Segment will Dominate the Market

- Consumer electronics are expected to dominate the flexible battery market due to the increasing demand for smaller, lighter, and more efficient power sources in this sector. The proliferation of portable devices, such as smartphones, wearables, and tablets, has led to a burgeoning need for compact and flexible energy solutions.

- Throughout Europe, there is a mature consumer electronics industry supported by a high-tech connectivity environment. As technology advances and smart offices and homes become more common, consumer electronics products are in demand. According to Startseite Bitkom e. V., smartphone sales volume in Germany was 21.4 million units sold thus far in 2023.

- The trend toward miniaturization in consumer electronics has created an imperative for power sources that can adapt to various form factors and design requirements. Flexible and thin film batteries, owing to their thinness, flexibility, and customizable shapes, align perfectly with this demand, enabling their seamless integration into a wide array of consumer electronic devices.

- For instance, in August 2023, a group of scientists from German and British universities announced that they completed the development of T-Nb2O5 thin films, facilitating the accelerated movement of Li-ion, a noteworthy stride forward. This breakthrough holds the potential for enhanced batteries and progress in computing and lighting, signifying a considerable advancement in consumer electronics. Forecasts suggest a boost in battery energy density and recharge cycles, offering substantial prospects in the consumer electronics sector.

- The evolving landscape of consumer preferences emphasizes convenience, longer device lifespans, and a desire for more sustainable energy solutions. The flexible batteries, with their potential for improved energy density and longer cycle life, meet these consumer demands by offering extended device usage and reduced environmental impact compared to traditional bulky batteries.

- This resonates with the growing consciousness of consumers towards environmentally friendly and recyclable energy sources. The advent of new functionalities and features in consumer electronics, such as IoT capabilities, smart wearables, and connected devices, fuels the need for compact and long-lasting power sources, which thin and flexible batteries can efficiently provide.

- The market's dominance by consumer electronics is also influenced by the expanding global penetration of these devices, especially in emerging economies. The increasing consumer base in these regions have led to a demand for devices that are not only affordable but also equipped with reliable and durable power sources.

- Therefore, as per the points mentioned above, the consumer electronics market segment is expected to dominate the market during the forecast period.

Asia-Pacific will be the Fastest-Growing Region

- Asia-Pacific is poised to witness remarkable growth in the flexible battery market due to various factors contributing to its expanding dominance in this sector. One of the primary driving forces is the expanding consumer electronics industry in countries like China, Japan, South Korea, and India.

- Asia-Pacific is home to a massive consumer base, with a strong inclination towards adopting the latest technological advancements in electronic devices. The escalating demand for smartphones, wearables, tablets, and other portable gadgets in these nations amplifies the need for efficient, smaller, and longer-lasting power sources, precisely the niche fulfilled by thin and flexible batteries.

- * The rapid industrialization and technological advancements in Asia-Pacific have paved the way for substantial innovations and investments in research and development activities related to flexible battery technologies.

- Governments and private entities in countries like China, Japan, and South Korea are investing significantly in the development and commercialization of advanced battery technologies, including thin and flexible batteries. Such investments fuel the growth of the domestic flexible battery market and strengthen the regional manufacturing capabilities, thereby positioning Asia-Pacific as a frontrunner in the global market.

- For instance, in February 2023, the Japanese government revealed a battery strategy budget totaling USD 2.55 billion designated for the research and development of new battery technologies. This budget encompasses diverse types, such as all-solid-state lithium batteries, thin and flexible film batteries, and a range of emerging battery technologies. This initiative is anticipated to bolster Japan's position in the realm of battery technology.

- Asia-Pacific strong manufacturing capabilities, coupled with a favorable regulatory environment and a robust supply chain infrastructure, are expected to support the region as a potential player in flexible battery production. The cost-effective manufacturing processes, increasing investments in technological advancements, and a growing emphasis on environmentally friendly energy sources reinforce the region's foothold in the flexible battery market.

- For example, Shenzhen Grepow Battery Co. Ltd, a leading battery company based in China, produces ultra-thin, flexible batteries. These batteries are designed and manufactured to meet the demand for novel wearable smart electronics that require high spatial utilization while offering high energy density.

- The lithium-ion battery giant CATL demonstrated a flexible battery using a polymer composite inorganic solid electrolyte. The battery can be twisted and even cut with scissors without causing safety problems. However, CATL does not disclose further technical parameters, such as the number of twists, and there are no plans for mass production or short-term delivery of samples. All these highlight the region's significance in the development of advanced battery technologies, including thin and flexible batteries.

- Therefore, as per the points mentioned above, Asia-Pacific is expected to witness significant growth during the forecast period.

Flexible Battery Industry Overview

The flexible battery market is semi-fragmented. Some of the key players in this market include Panasonic Corporation, Enfucell OY Ltd, Imprint Energy Inc., BrightVolt Inc., and EIT InnoEnergy SE, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50002232

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD million, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Rapid Adoption of Healthcare Wearable Devices

- 4.5.1.2 Growing Penetration of Internet of Things (IoT) Applications

- 4.5.2 Restraints

- 4.5.2.1 Availability of Alternate Battery Technologies Existing for Various Applications

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Thin-Film Batteries

- 5.1.2 Printed Batteries

- 5.2 Application

- 5.2.1 Consumer Electronics

- 5.2.2 Medical Devices

- 5.2.3 Smart Packaging

- 5.2.4 Smart Cards

- 5.2.5 Other Applications

- 5.3 Geography [Market Size and Demand Forecast till 2029 (for regions only)]

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 NORDIC

- 5.3.2.7 Turkey

- 5.3.2.8 Russia

- 5.3.2.9 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Malaysia

- 5.3.3.6 Thailand

- 5.3.3.7 Indonesia

- 5.3.3.8 Vietnam

- 5.3.3.9 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 Saudi Arabia

- 5.3.4.2 UAE

- 5.3.4.3 South Africa

- 5.3.4.4 Qatar

- 5.3.4.5 Egypt

- 5.3.4.6 Nigeria

- 5.3.4.7 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Colombia

- 5.3.5.4 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Panasonic Corporation

- 6.3.2 Enfucell OY Ltd

- 6.3.3 Imprint Energy Inc.

- 6.3.4 BrightVolt Inc.

- 6.3.5 EIT InnoEnergy SE

- 6.3.6 ROCKET Poland Sp. z o.o.

- 6.3.7 Molex

- 6.3.8 Blue Spark Technologies

- 6.3.9 Energy Diagnostics Limited

- 6.3.10 Jenax Inc.

- 6.4 Market Ranking/Share (%) Analysis

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Lightweight and Compact Designs of Flexible Batteries Holds a Significant Opportunities for Military Applications

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.