Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1645110

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1645110

India Micro Batteries - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 110 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

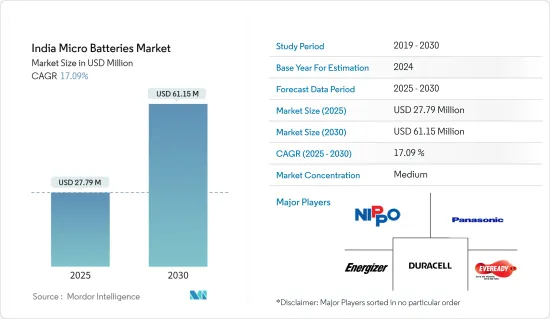

The India Micro Batteries Market size is estimated at USD 27.79 million in 2025, and is expected to reach USD 61.15 million by 2030, at a CAGR of 17.09% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as declining prices of lithium-ion batteries and a surge in micro battery applications are likely to drive India's micro battery market during the forecast period.

- On the other hand, the demand-supply mismatch of raw materials, like lithium, will likely hinder the growth of the Indian micro battery market during the forecast period.

- However, the rising use of micro batteries in the consumer electronics industry and technological advancements in new battery technologies to store energy will likely create lucrative growth opportunities for the Indian micro battery market during the forecast period.

India Micro Batteries Market Trends

Declining Cost Of Lithium Ion Battery Drive the Market

- Lithium-ion batteries have traditionally been used mainly in consumer electronic devices like mobile phones and PCs. Lithium-ion batteries are gaining more popularity than other battery types due to their favorable capacity-to-weight ratio. Other factors boosting its adoption include better performance, better shelf life, and a decreasing price.

- Lithium-ion battery manufacturers are focusing on reducing the cost of Lithium-ion batteries. The price of lithium-ion batteries declined steeply over the past 10 years. In 2023, an average lithium-ion battery was valued at around USD 139 per kWh. It witnessed a decrease in the price of more than 82.17% in 2023 compared to 2010.

- The two principal reasons for the drastic cost decline are the steady improvement of battery performance achieved through sustained R&D aimed at improving battery materials, reducing the amount of non-active materials and the cost of materials, improving cell design and production yield, and increasing production speed.

- As a result of increased production volume, economies of scale were achieved in lithium-ion battery manufacturing. These significant capacity additions also resulted in more competition among manufacturers, further reducing prices at the expense of manufacturers' profitability.

- BloombergNEF anticipates that battery costs will decline again in 2024 as more extraction and refinery capacity becomes operational and lithium prices begin to ease. According to BNEF's 2022 Battery Price Survey, by 2026, the average pack price is expected to drop below USD 100/kWh.

- The country imports the majority of lithium from China and aims to decrease its reliance in the future. The country is focused on exploring domestic minerals to meet the increasing demand from numerous applications.

- For instance, in February 2023, the Geological Survey of India (GSI) discovered lithium reserves of about 5.9 million tonnes in the Salal-Haimana area of the Reasi district of Jammu and Kashmir for the first time. Lithium is a non-ferrous metal and is one of the critical components in micro batteries. These discoveries help countries fulfill the increased demand for micro batteries across the region during the forecast period.

- Therefore, owing to the above factors, the declining cost of lithium-ion batteries is expected to drive the market during the forecast period.

The Consumer Electronics Segment to Dominate the Market

- Portable consumer electronic applications become more popular as the size of electronic components continually reduces and processing power increases. These new electronic devices require sophisticated and lightweight battery packs. The availability of ever-smaller micro batteries has increased the demand for energy-efficient appliances. The rapid proliferation of lithium batteries has increased their use in portable and handheld electronic devices.

- Lithium-ion micro batteries are increasingly used in consumer electronics such as smartphones, laptops, tablets, cameras, clocks, watches, remote controls, and portable gaming devices due to their high energy density, longer lifespan, and low self-discharge rate.

- The increasing consumption of smartphones and laptops across India in the past few years has aided the demand for micro batteries used in smartphones and headphones. As of January 2024, the Indian smartphone market was significant after China, reaching 144-145 million shipments in 2023. The development significantly boosts India's "Make in India" initiative, as government and industry sources revealed mobile phone exports worth USD 5.5 billion during the April-August period of the 2023-2024 fiscal year. This marks a substantial increase compared to the USD 3 billion recorded during the same period in FY22-23.

- India is on track to surpass USD 14.4 billion in mobile phone exports in the current fiscal year 2024-2025. The emergence of 5G technology is also expected to boost smartphone demand.

- According to the Central Electricity Authority (CEA), in 2023, consumer electronics sales in India were USD 70 billion, an increase of 7.7% compared to 2022. The number will likely increase significantly as the demand for electronics products rises exponentially in the region.

- Additionally, the trend toward miniaturization and lightweight designs in consumer electronics has further propelled the adoption of lithium-ion batteries, as they allow for slimmer and more compact device form factors without compromising performance.

- Therefore, the consumer electronics segment battery is expected to drive the Indian micro battery market during the forecast period.

India Micro Batteries Industry Overview

The Indian micro batteries market is fragmented. Some of the major players in the market (in no particular order) include Duracell Inc., Panasonic Energy Co. Ltd, Indo National Limited, Energizer Holdings Inc., and Eveready Industries India Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50002221

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Surge in Micro Battery Applications

- 4.5.1.2 Declining Cost Of Lithium-ion Batteries

- 4.5.2 Restraints

- 4.5.2.1 Demand-supply Mismatch Of Raw Materials

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Technology

- 5.1.1 Alkaline

- 5.1.2 Lithium-ion

- 5.1.3 Other Battery Technologies

- 5.2 Application

- 5.2.1 Automotive

- 5.2.2 Watches

- 5.2.3 Medical Devices

- 5.2.4 Consumer Electronics

- 5.2.5 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Duracell Inc.

- 6.3.2 Panasonic Energy Co. Ltd

- 6.3.3 Renata Battery

- 6.3.4 Indo National Ltd

- 6.3.5 Murata Manufacturing Co. Ltd

- 6.3.6 Maxell Ltd

- 6.3.7 Energizer Holdings Inc.

- 6.3.8 Eveready Industries India Ltd

- 6.3.9 VARTA Microbattery

- 6.3.10 Sony Corporation

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Need for Efficient Micro Batteries in the Consumer Electronics Industry

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.