PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521723

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521723

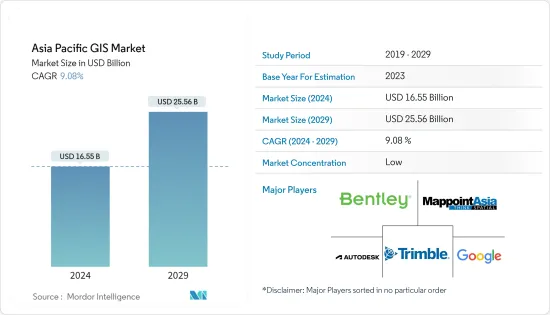

Asia Pacific GIS - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Asia Pacific GIS Market size is estimated at USD 16.55 billion in 2024, and is expected to reach USD 25.56 billion by 2029, growing at a CAGR of 9.08% during the forecast period (2024-2029).

The Asia-Pacific GIS market is experiencing robust growth driven by increasing demand for location-based services, government initiatives for infrastructure development, and the rising adoption of GIS in various industries.

Key Highlights

- Advancements in geospatial technologies, including cloud-based GIS solutions and real-time data analytics, enhance market growth. Integrating GIS with emerging technologies like IoT and AI creates new opportunities for market players. The Asia-Pacific GIS market is poised for continued growth, driven by evolving customer needs and technological innovations.

- In the sustainable energy sector, GIS technologies are utilized to assess the availability and plan and successfully create renewable energy projects. The rise in renewable energy projects is expected to drive the market studied. According to the Clean Energy Council (CEC), Australia added 5.9 GW of renewable capacity to the grid in 2023, up from 5 GW in 2022. Rooftop solar contributed 3.1 GW, while utility-scale projects added 2.8 GW. This marked an increase from 2022 when rooftop solar provided 2.7 GW, and utility-scale projects contributed 2.3 GW.

- GIS maps can analyze and optimize the whole supply chain, from raw materials to end products. By mapping the flow of materials and goods, one can identify inefficiencies and bottlenecks and drive strategic decisions to enhance the efficiency and cost-effectiveness of the supply chain. GIS solutions can provide inputs on vehicle capabilities, consumers' and intermediaries' availability time windows, and additional information required for creating the most efficient routes and schedules.

- The rise in investments in the maritime sector in the region might create an opportunity for the market to grow. For instance, the Australian government is expected to invest USD 64 million over the next four years, including USD 40 million in new funding, to enhance Australia's Southeast Asia maritime partnerships.

- The market is witnessing strategic partnerships, product launches, and investments by key players as part of its crucial strategy to improve business and their presence to reach customers and fulfill their requirements for various applications. In September 2023, Orbica introduced the Roadshow, the Geospatial Platform, which combines AI, AWS Cloud, and geospatial technologies.

Asia Pacific GIS Market Trends

Cloud Deployment Segment to Hold Significant Market Share

- The increasing realization among businesses in Australia about the importance of saving money and resources by transferring their data to the cloud instead of building and supporting new data storage is causing the need for cloud-based solutions and, therefore, the adoption of on-demand security services in the region.

- The developments in the cloud environment in Australia should create an opportunity for the GIS players in the region to deploy their solutions in cloud servers. For instance, in August 2023, VMware announced that VMware Cloud on Amazon Web Services (AWS) is obtainable in the AWS Asia-Pacific region. This brings the number of regions with VMware Cloud on AWS in Australia to two, including Sydney, and eight across the Asia-Pacific. This expanded presence in Australia will enable more customers to run VMware vSphere-based workloads in consistent hybrid cloud environments, with optimized access to native AWS services, without changing their existing infrastructure.

- Similarly, in October 2023, Microsoft planned to invest AUD 5 billion (USD 3.26 billion) in expanding its hyperscale cloud computing and AI infrastructure in Australia over the next two years, the single largest investment in its forty-year history. This investment will also grow Microsoft's local data center footprint from 20 sites to 29 spread across Canberra, Melbourne, and Sydney. To realize the full potential of this new digital infrastructure investment, Microsoft is working with TAFE NSW toward establishing a Microsoft Datacentre Academy in Australia.

- Furthermore, recently, ST Engineering announced the launch of GEOEARTH. This cloud-based geospatial analytics platform delivers one-stop and direct access to satellite imagery data and analytics tools that will permit companies to derive renewed insights and accelerate decision-making. Moving away from conventional standalone procedures that are costly, time-consuming, and limited by system capabilities, GEOEARTH's open platform provides direct streaming access to high-resolution imagery from TeLEOS-1, Singapore's commercial earth observation satellite, with a suite of data analytics tools. Applications that can help from GEOEARTH include airport processes, business intelligence, monitoring of maritime activities, land-use surveys, and scene-change analysis.

Australia Holds the Largest Market Share

- Australia has a relatively advanced GIS infrastructure with well-developed policies, data, and technology. Over recent years, this infrastructure has been described as the Australian Spatial Data Infrastructure (ASDI), which, to a large extent, works with other National Spatial Data Infrastructures.

- In March 2024, the Geospatial Council of Australia (GCA), the professional body for the geospatial sector, announced a new partnership with Australian Spatial Analytics (ASA), one of Australia's largest and fastest-growing work-integrated social enterprises. This marks a significant milestone for the geospatial sector, with GCA strategically supporting ASA's initiatives through a partnership that leverages their unique strengths and shared values.

- Implementing GIS in agriculture has made it feasible to generate thematic, interactive, and layered maps that apprehend and describe the different realities of the countryside. This includes crop types, cultivated and fallow land areas, boundaries between properties, climatological aspects, irrigation, etc. It also makes it feasible to know in more significant detail the types of soil, the nutrients available in them, the amount of water, temperature, etc. All of this is essential information for making critical decisions for farm management.

- For instance, according to the Australian Bureau of Statistics, in FY2023, the land area utilized for wheat production in Australia amounted to just over 13 million hectares. Wheat production holds the largest land area used for crop production in Australia. Such a vast availability of farmland could create an opportunity for the market to grow.

- Governments use GIS technology to enhance data collection, planning, and service delivery at all levels of government (local, state, and federal). Different levels of government have different responsibilities in other countries, so it isn't easy to define this definitively. State governments use GIS for things like significant road planning and management, construction of assets, health administration, and various types of taxation collection.

- GIS provides spatial solutions to many fields of civil engineering, such as transportation, water resources, facilities management, urban planning, construction, and e-business. GIS is an effective tool for visualizing the topographical conditions of construction sites. The modeling of the construction site facilitates the construction controlling and planning process.

Asia Pacific GIS Industry Overview

The Asia-Pacific GIS market is fragmented due to major players like Autodesk Inc., Mappointasia (Thailand) Public Company Limited, Bentley Systems Incorporated, Trimble Inc., and Google LLC (Alphabet Inc.). Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In February 2024, Hexagon's group part, Leica Geosystems, unveiled the new Leica TerrainMeasuring and Recording Airborne LiDAR (TerrainMapper)-3 airborne sensor. This sensor offers new scan pattern configurations to support the broadest range of applications and needs in a single solution. The higher scan rate enables customers to fly their aircraft more quickly while maintaining the best data quality. The 60-degree customizable field of view optimizes data collection by reducing the number of flight lines. In addition to the TerrainMeasuring-3, the company announced the addition of a 4-band Leica Microfocal Camera (MFC150). The MFC150 has the same 60-degree field of view as the TerraMeasuring-3 LiDAR, ensuring accurate data consistency.

In January 2024, Maxar Technologies announced that it was awarded a contract by the NGA to provide high-resolution satellite images and data to produce 3D maps and model data. The Indo-Pacific (USSPA) region comprises South Asia, Southeast Asia, Oceania, and the Pacific islands. The US Indo-Pacific command is responsible for all US military operations in this region.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 GEOGRAPHIC INFORMATION SYSTEMS (GIS) - MARKET INSIGHTS

- 4.1 Australia

- 4.2 Singapore

- 4.3 Indonesia

- 4.4 Malaysia

- 4.5 Bangladesh

- 4.6 Rest of Asia-Pacific

5 COMPETITIVE LANDSCAPE

- 5.1 Company Profiles*

- 5.1.1 Autodesk Inc.

- 5.1.2 Mappointasia (Thailand) Public Company Limited

- 5.1.3 Bentley Systems Incorporated

- 5.1.4 Trimble Inc.

- 5.1.5 Google LLC (Alphabet Inc.)

- 5.1.6 Environmental Systems Research Institute Inc.

- 5.1.7 Hexagon AB

- 5.1.8 Blacksky Technology Inc.

- 5.1.9 Intermap Technologies Corporation

- 5.1.10 MAPBOX

- 5.1.11 Maxar Technologies Inc.

- 5.1.12 Precisely Holdings LLC

6 VENDOR MARKET SHARE ANALYSIS