PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521708

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521708

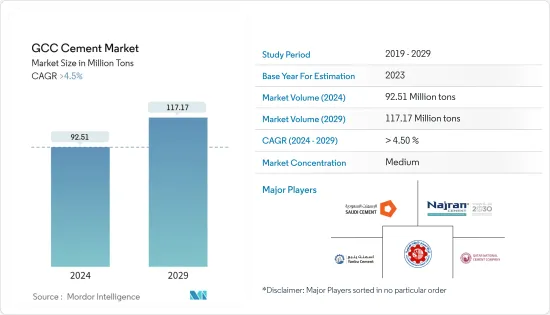

GCC Cement - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The GCC Cement Market size is estimated at 92.51 Million tons in 2024, and is expected to reach 117.17 Million tons by 2029, growing at a CAGR of greater than 4.5% during the forecast period (2024-2029).

The GCC cement market was negatively impacted by the COVID-19 pandemic as the nationwide lockdowns in the region resulted in decreasing demand across the construction industry and the closing of various manufacturing facilities. However, post-pandemic, the market is recovering gradually.

Key Highlights

- Over the medium term, the increase in regional residential constructions and growing infrastructural activities drive the market's growth.

- On the flip side, government regulations on carbon emissions from cement manufacturing plants are expected to hinder the market's growth.

- However, shifting preference toward green construction will likely act as an opportunity for the market.

- Saudi Arabia dominates the market across the region, with the most substantial consumption from the country's construction industry.

GCC Cement Market Trends

Residential Construction Application to Dominate the Market

- The residential sector is one of the most significant cement demand sectors. The market studied will likely be driven by increased construction of new residential buildings as middle-class disposable income rises.

- Cement is becoming more popular in the residential sector due to increased building standards and legislation regulating energy-efficient structures.

- Residential construction accounts for a significant share of the overall construction sector in the region. Saudi Arabia and the United Arab Emirates are the leading residential construction markets in the area, with significant ongoing residential construction projects.

- In Saudi Arabia, the USD 8,000 million worth of Kind Salman Park In Riyadh includes 12,000 units of residential facilities along with hotels, commercial complexes, and others.

- Amaala: The Riviera Of The Middle East project worth USD 6 billion is another ongoing construction project in Saudi Arabia that includes the construction of 943 residential villas and is expected to be completed by 2027.

- Qiddiya City In Riyadh is a USD 5 billion project that includes constructing 11,000 residential units and is expected to be fully completed by 2030.

- Owing to all these factors, the cement market will likely grow during the forecast period.

Saudi Arabia to Dominate the Market

- Saudi Arabia is the region's largest country and construction market.

- The country is the largest cement producer in the region. The country is home to some of the largest cement manufacturing companies in the region.

- The construction industry contributes nearly 6-7% of the country's GDP. Saudi Arabia's Vision 2030 aims to bring change by focusing on sustainability commitments, improving the quality of life for citizens, and building a thriving economy in the country. The announcement of Vision 2030 and the associated National Transformation Plan (NTP) have increased investments in various sectors, such as healthcare, education, and infrastructure.

- Under its Budget 2023, the Saudi government announced a SAR 34 billion (~USD 9.06 billion) expenditure for its infrastructure and transportation sector. The country has also launched various Giga project programs, the most extensive civil infrastructure engineering program in the world, covering industrial, residential, and tourism development development.

- The investments in Saudi Arabia's real estate and infrastructure projects crossed the USD 1 trillion mark in 2023. In 2016, they reached USD 1.1 trillion since the 'National Transformation Plan' launch.

- In June 2022, the country launched 93 projects to upgrade its utility infrastructure. These projects, which will cost SAR 8.5 billion, will support water and environmental sustainability and improve the operational efficiency of waterway transportation and distribution.

- The Saudi government works on various mega projects to boost infrastructure. This, in turn, would positively impact the cement market during the forecast period. For instance, the government is building a prime tourist destination named Amaala, which involves the construction of airports to cater to luxury travelers. The project's first phase is projected to be completed by the end of 2024 and consists of an investment of about USD 15 billion.

- Thus, all these factors are expected to propel the growth of the cement market during the forecast period.

GCC Cement Industry Overview

The GCC cement market is partially fragmented. The major players (not in any particular order) include Southern Region Cement Company, Saudi Cement, Najran Cement Company, Yanbu Cement Company (YCC), and Qatar National Cement Company.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increase in Residential Constructions Across the Region

- 4.1.2 Growing Infrastructural Activities In The Region

- 4.1.3 Other Drivers

- 4.2 Market Restraints

- 4.2.1 Government Regulations On Carbon Emissions From Cement Manufacturing Plants

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Supplier

- 4.4.2 Bargaining Power of Buyer

- 4.4.3 Threat of New Entrant

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competitive

5 MARKET SEGMENTATION (Market Size In Volume)

- 5.1 Type

- 5.1.1 Portland

- 5.1.2 Blended

- 5.1.3 Other Types (Rapid Hardening Cement, Quick Setting Cement, Expansive Cement, Hydrographic Cement, and Colored Cement)

- 5.2 Application

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Infrastructure

- 5.2.4 Industrial and Institutional

- 5.3 Geography

- 5.3.1 Saudi Arabia

- 5.3.2 United Arab Emirates

- 5.3.3 Qatar

- 5.3.4 Oman

- 5.3.5 Kuwait

- 5.3.6 Bahrain

6 COMPETITIVE LANDSCAPE

- 6.1 Merger and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Cemex, S.A.B. de C.V.

- 6.4.2 Emirates Steel Arkan

- 6.4.3 Hoffmann Green Cement Technologies

- 6.4.4 HOLCIM

- 6.4.5 Kuwait Cement Company

- 6.4.6 Najran Cement Company

- 6.4.7 Qassim Cement

- 6.4.8 Qatar National Cement Company

- 6.4.9 Raysut Cement Company

- 6.4.10 Saudi Cement

- 6.4.11 Southern Region Cement Company

- 6.4.12 Yamana Cement

- 6.4.13 Yanbu Cement Company (YCC)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Shifting Preference Toward Green Construction

- 7.2 Other Opportunities