PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1645093

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1645093

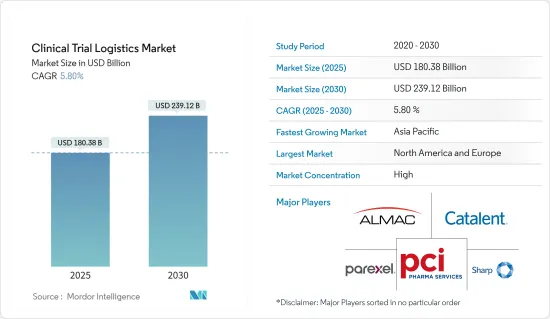

Clinical Trial Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Clinical Trial Logistics Market size is estimated at USD 180.38 billion in 2025, and is expected to reach USD 239.12 billion by 2030, at a CAGR of 5.8% during the forecast period (2025-2030).

The increasing number of clinical trial procedures conducted by pharmaceutical companies is expected to significantly impact the clinical trial logistics market. According to data from ClinicalTrials.gov, the United States leads in the number of clinical trials conducted annually. Factors such as the growing presence of contract research organizations (CROs) and healthcare providers are contributing to the market's expansion.

Additionally, the market's growth is driven by the rising demand for Over The Counter (OTC) medications such as Vitamins, Minerals, and Supplements (VMS), common cold remedies, gastrointestinal drugs, and dermatology products.

The growing importance of expedited healthcare assistance is fueling the demand for clinical trial logistics. Furthermore, reducing distribution costs through a centralized distribution channel is boosting the need for these services. Moreover, advancements in pharmaceuticals and biologics, particularly in the testing and development of new products, drugs, and experiments, are major drivers of the global clinical trial logistics market.

The COVID-19 pandemic had a widespread effect on all industries. Clinical trial diagnostic labs were under increased scrutiny as they faced growing pressure to effectively carry out stages of clinical trials for vaccines and treatments to reduce the global health impact of COVID-19.

Clinical Trial Logistics Market Trends

Increasing Specimen Collection From Homes

The evolution of the pharmaceutical industry has led to changes in the nature of clinical trials. The focus is now on evidence-based medicine, patient-centered care, and the development of orphan drugs and personalized cell and gene therapies. This shift has driven the growth of direct-to-patient sample delivery and collection services.

Clinical trials are no longer limited to investigator sites but are now conducted in patients' homes, where they receive treatment and have blood samples taken for shipping. This approach requires drug delivery and sample collection services to be provided at the patient's doorstep.

To meet these demands, sponsor firms are outsourcing clinical trial activities to specialized providers to improve efficiency and reduce costs.

The increasing prevalence of chronic diseases, an aging population, and the emergence of Asian countries as key players in home healthcare are expected to drive further market expansion.

Asia-Pacific is experiencing significant growth

Asia-Pacific, particularly East and South Asia, is experiencing significant growth due to increasing healthcare needs and government funding for research. The demand for medications is rising due to the growing elderly population, which is also driving the clinical trial logistics market in the region. Major pharmaceutical companies are outsourcing their drug development services to countries like India, Malaysia, China, and Singapore, further fueling this market growth.

Patients are now comparing home care services to those offered by other industries like entertainment, banking, and retail.

While samples for pathological tests can be collected at home, physical visits to testing centers are still preferred for X-rays and ultrasounds. Although the trend of home sample collection is welcomed, service providers need to be adaptable to meet customer needs.

Clinical Trial Logistics Industry Overview

The clinical trials logistics market is fairly fragmented, with companies like Alamc Group, Catalent Inc., PCI Services, Parexel International Corporation, and Sharp Packaging Services are some of the major players in the market. The globalization of clinical trials, rising investments in R&D for clinical trials in the North American region, and rising strategic choices such as partnerships and collaboration for clinical trial services are some of the major factors contributing to the growth of the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS & DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Ageing Population

- 4.2.2 Expanding Number of Medical Care Suppliers

- 4.3 Market Restraints

- 4.3.1 High Cost in Managing Logistics

- 4.4 Market Opportunities

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Technological Snapshot

- 4.8 Government Regulations & Key Initiatives

- 4.9 Impact of Covid-19 on the Market

5 MARKET SEGMENTATION

- 5.1 Type Of Services

- 5.1.1 Delivery Of Medication

- 5.1.2 Pickup Of Specimens

- 5.1.3 Drug/Ancillary Supply Returns

- 5.2 By Region

- 5.2.1 North America

- 5.2.2 Asia-Pacific

- 5.2.3 Europe

- 5.2.4 South America

- 5.2.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Competition Overview

- 6.2 Company Profiles

- 6.2.1 Alamc Group

- 6.2.2 Catalent Inc.

- 6.2.3 PCI Services

- 6.2.4 Parexel International Corporation

- 6.2.5 Sharp Packaging Services

- 6.2.6 Biocair

- 6.2.7 O&M Movianto

- 6.2.8 Klifo A/S

- 6.2.9 Thermo Fisher Scientific Inc.

- 6.2.10 Capsugel

- 6.2.11 UDG Healthcare Plc.

- 6.2.12 DHL

- 6.2.13 Bilcare Limited

- 6.2.14 PRA Health Sciences Inc.

- 6.2.15 Eurofins Scientific*

- 6.3 Other Companies

7 FUTURE OF THE MARKET

8 APPENDIX