PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521657

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521657

United Kingdom Car Insurance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

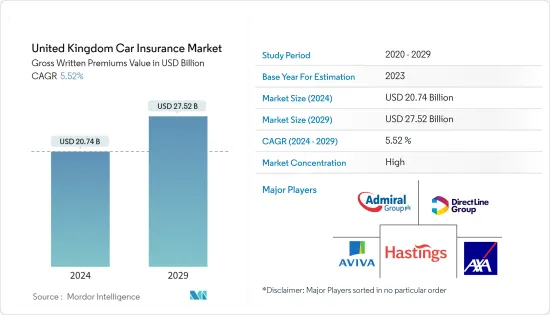

The United Kingdom Car Insurance Market size in terms of gross written premiums value is expected to grow from USD 20.74 billion in 2024 to USD 27.52 billion by 2029, at a CAGR of 5.52% during the forecast period (2024-2029).

The Financial Conduct Authority (FCA) regulates the United Kingdom insurance market to ensure fair practices and consumer protection. The FCA introduced regulations to improve transparency and fairness in the market. The cost of car insurance premiums in the United Kingdom can vary widely depending on factors such as the driver's age, location, type of vehicle, and driving history. Young and inexperienced drivers often face higher premiums. Telematics or black box insurance, which monitors driving behavior, became increasingly popular to offer personalized premiums.

The UK government mandates that all drivers must include at least third-party insurance to legally operate a vehicle on public roads. This requirement helps ensure that all drivers are financially responsible for potential accidents.

Many insurers offer no claims discounts to policyholders who never claimed during a policy year. These discounts can significantly reduce premiums. The United Kingdom car insurance market faces challenges such as fraudulent claims, uninsured drivers, and rising repair costs. These factors can put pressure on premiums.

United Kingdom Car Insurance Market Trends

Growth of Car Sales as Demand for Electric Car in United Kingdom

The United Kingdom government is promoting the adoption of electric vehicles as part of its efforts to reduce greenhouse gas emissions and combat climate change. It led to a significant increase in EV sales, with various incentives and grants available to consumers who opt for electric cars. These incentives played a significant role in the increasing trend of EV sales. The United Kingdom set ambitious targets to phase out the sale of new petrol and diesel cars over the next six years. These regulatory changes encouraged consumers to consider cleaner and more sustainable transportation options, further boosting EV sales. Growing awareness of environmental concerns and the benefits of electric vehicles influenced consumer behavior and people are considering EVs as a responsible and sustainable choice. The sales volume of EV cars in the country is observing an increase as well, increasing the number of car insurance policies purchased.

Growth of Insurance Premiums Through Online in United Kingdom

Many insurance providers in the United Kingdom offer online platforms and services for purchasing car insurance. It allows consumers to compare quotes, select coverage options, and complete the purchase process from the comfort of their own homes. Price comparison websites are prevalent in the United Kingdom insurance market. They allow consumers to enter their details and receive quotes from multiple insurance companies, making it easier to find competitive premiums. Some insurers offer discounts specifically for policies purchased online. It is because online transactions can reduce administrative costs for insurers, and these savings may be passed on to customers. Many online insurance platforms offer automated renewal reminders to help policyholders avoid coverage lapses. Online platforms are expected to hold robust security measures in place to protect customers' personal and financial information. All these factors are helping in the growth of online distribution channels.

United Kingdom Car Insurance Industry Overview

The United Kingdom car insurance market is highly concentrated, with a few large players dominating the space. While there are over 195 different car insurance providers in the United Kingdom, the top 10 make up over 70% of the country's market share. Technological and product innovation in the market are leading to a wide range of car insurance products being offered to car owners, consisting of personal and third-party liability insurance. Some of the existing players in the United Kingdom Car Insurance Market are Admiral Group, Direct Line Group, Aviva, Hastings, and AXA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Adoption of Innovative Tracking Technologies

- 4.3 Market Restraints

- 4.3.1 Rising Competition of Banks with Fintech and Financial Services

- 4.4 Market Opportunities

- 4.4.1 Emerging Market of Electric Vehicles Expanding the Car Insurance Market

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Insights on impact of technology in the Market

- 4.7 Insights on Regulatory Trends Shaping the Market

- 4.8 Insights on Consumer Behaviour Analysis

- 4.9 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Coverage

- 5.1.1 Third-Party Liability Coverage

- 5.1.2 Collision/Comprehensive/Other Optional Coverage

- 5.2 By Application

- 5.2.1 Personal Vehicles

- 5.2.2 Commercial Vehicles

- 5.3 By Distribution Channel

- 5.3.1 Direct Sales

- 5.3.2 Individual Agents

- 5.3.3 Brokers

- 5.3.4 Banks

- 5.3.5 Online

- 5.3.6 Other Distribution Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concetration Overview

- 6.2 Company Profiles

- 6.2.1 Admiral Group

- 6.2.2 Direct Line Group

- 6.2.3 Aviva

- 6.2.4 Hastings

- 6.2.5 Axa

- 6.2.6 LV= General Insurance

- 6.2.7 Esure

- 6.2.8 RSA

- 6.2.9 Ageas

- 6.2.10 NFU Mutual*

7 MARKET FUTURE TRENDS

8 DISCLAIMER AND ABOUT US