PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521651

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521651

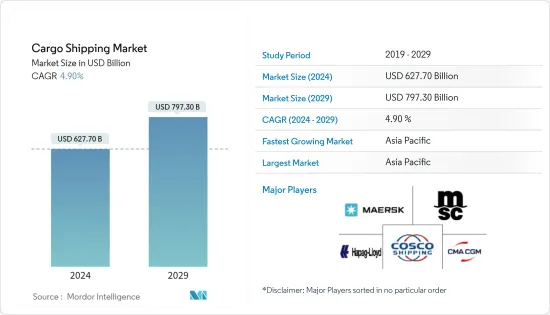

Cargo Shipping - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Cargo Shipping Market size is estimated at USD 627.70 billion in 2024, and is expected to reach USD 797.30 billion by 2029, growing at a CAGR of 4.90% during the forecast period (2024-2029).

The rising demand for cargo vessels such as container ships, bulk carriers, and others due to the growth in sea freight activity is driving the cargo shipping market.

Factors such as the increasing demand for cargo transportation through ships and the surge in trade-related agreements supplement the growth of the cargo shipping market. Fluctuations in transportation and inventory costs hamper the growth of the cargo shipping market. However, factors such as the anticipated trend of automation in marine transportation and an increase in marine safety norms are expected to provide opportunities for the growth of the cargo shipping market during the forecast period.

Key Highlights

- In 2022, the freight volume transported domestically via coastwise vessels in Japan stood at 320.93 million metric ton, compared to 324.66 million metric ton in 2021.

- According to the Indian Ministry of Ports, Shipping, and Waterways, the total volume of cargo handled at seaports across India touched 1,323 million metric ton in FY 2022, witnessing a Y-o-Y increase of 6.0% compared to FY 2021.

Cargo Shipping Market Trends

Increasing Cross-border Trading to Support Market Expansion

The increasing cross-border trading activity via sea, rising sea freight volumes due to the growth of the e-commerce industry, and the implementation of various free-trade agreements across nations are contributing to expanding sea trade activity, which, in turn, is positively contributing to the growth of the cargo shipping market.

- The number of general cargo ships in the global merchant fleet stood at 17,784 units as of 2022, while the number of bulk cargo carriers reached 12,941 units.

The capacity of the global merchant fleet has increased steadily in recent decades, attributed to the rising demand for more seaborne trade, which calls for larger vessels to transport more volume in one trip.

- In 2022, the capacity of container ships touched 293 million dwt, registering a CAGR of 3.1% between 2018 and 2022.

With the rising seaborne trade activity, there exists a greater demand for these cargo carriers as these ships transport various goods, thereby positively impacting the surging growth of the market.

Leading ocean freight forwarders across the world are witnessing a rapid surge in the volume of freight they are transporting in recent years, owing to the growth in cross-border e-commerce activity. Since sea freight remains the dominant transportation medium to ship goods across long distances, the demand for cargo carriers shoots up extensively.

- In 2022, the United States was the leading market among Indian consumers who shop online, capturing 21% of the cross-border e-commerce market out of the overall cross-border e-commerce share, followed by Australia.

Thus, the rapid advancement in e-commerce, coupled with rising sea freight activity, may contribute to the surging growth of the cargo shipping market in the coming years.

Europe Holds a Significant Share in the Market

With the increasing seaborne trade and economic growth, the demand for cargo shipping is anticipated to witness evident growth in the European market.

The marine sector is one of the most important sectors of the German economy. The annual turnover is up to EUR 50 billion (USD 53.22 billion), and the number of jobs directly or indirectly dependent on the maritime industry was up to 400,000 in 2022.

In Germany, more than 360 shipping companies operate around 2,700 seagoing vessels. According to owner nationality, Germany is the largest shipping nation after Greece, Japan, and China (ranked 4th) with its merchant fleet.

- Germany holds around 29% of all container-carrying capacities worldwide in container shipping and is still positioned as an international leader according to owner nationality.

About nine shipyards support the German naval shipbuilding industry, and about 2,800 companies are active in the shipbuilding and ocean industries. The companies generate a domestic value added of approximately 85% on deliveries from German shipyards.

Likewise, almost 95% of all UK imports and exports move by sea through over 400 British ports.

- In 2022, Spain was the world's fourth largest importer of fish and seafood after the United States, China, and Japan.

- In 2022, Spain's seafood imports from all origins were USD 9.6 billion, up 7.6% from 2021. Total Spanish exports in 2022 reached USD 5.9 billion, up 3.4% compared to the previous year.

Spain is vital to the shipping and logistics in Europe. Spain's shipping industry is supported by its network of maintained infrastructure across all sectors (road, rail, and air), allowing it to boast efficient and capable supply routes through Europe and beyond. Over a hundred different shipping companies in Spain make up its massive fleet. Spain is covered by water on three sides, making it ideal for establishing ports and other shipping hubs. Well-connected facilities are linked to several international airports in the region.

Owing to the abovementioned factors, the European segment of the market is expected to grow during the forecast period.

Cargo Shipping Industry Overview

The cargo shipping market is fragmented in nature, with the presence of many international companies in the market. The top players in the segment include Maersk, MSC, CMA, COSCO, and Hapag Lloyd. High barriers to entry restrain the market due to the high cost of vehicles and increasing economies of scale, which affect competition in the industry. However, key players are involved in strategic partnerships and acquisitions to capture market share in the coming years.

- In January 2023, A.P. Moller-Maersk (Maersk) announced the completion of its acquisition of Martin Bencher Group, a Danish project logistics expert with premium capabilities within non-containerized project logistics and global operations. With the addition of Martin Bencher, these companies are strengthening their ability to offer project logistics services to their global clients while providing a more comprehensive offering to a wide array of industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 The Rise of Trade Agreements Between Nations

- 4.2.2 Increasing Volume of International Trade

- 4.3 Market Restraints

- 4.3.1 Surge in Fuel Costs Affecting the Market

- 4.4 Value Chain/Supply Chain Analysis

- 4.5 Industry Policies and Regulations

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Ship Type

- 5.1.1 Bulk Carriers

- 5.1.2 General Cargo Ships

- 5.1.3 Container Ships

- 5.1.4 Tankers

- 5.1.5 Reefer Ships

- 5.2 Industry Type

- 5.2.1 Food and Beverages

- 5.2.2 Manufacturing

- 5.2.3 Oil and Gas

- 5.2.4 Pharmaceutical

- 5.2.5 Electrical and Electronics

- 5.2.6 Others

- 5.3 Cargo Type

- 5.3.1 Liquid Cargo

- 5.3.2 Dry Cargo

- 5.3.3 General Cargo

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South Ameria

- 5.4.4.2 Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 A. P. Moller-Maersk AS

- 6.2.2 MSC Mediterranean Shipping Company SA

- 6.2.3 CMA CGM

- 6.2.4 China COSCO Holdings Company Limited

- 6.2.5 Hapag-Lloyd

- 6.2.6 ONE (Ocean Network Express)

- 6.2.7 Evergreen Line

- 6.2.8 Wan Hai Lines

- 6.2.9 Zim

- 6.2.10 SITC

- 6.2.11 Zhonggu Logistics Corp.

- 6.2.12 Antong Holdings (QASC)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Developments in the Logistics Sector