PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521644

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521644

Asia Pacific Luxury Yacht - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

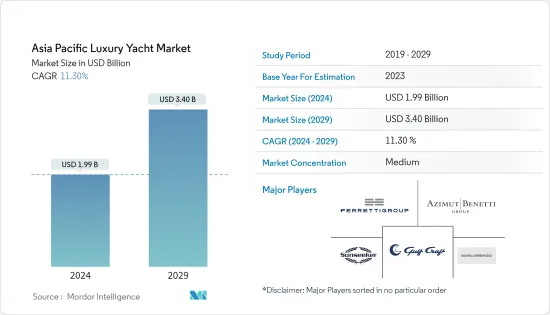

The Asia Pacific Luxury Yacht Market size is estimated at USD 1.99 billion in 2024, and is expected to reach USD 3.40 billion by 2029, growing at a CAGR of 11.30% during the forecast period (2024-2029).

The luxury yacht industry in Asia-Pacific has experienced steady growth, driven by the increasing number of ultra-high-net-worth individuals (UHNWIs). These HNWI clients seek unique and personalized experiences, making luxury yacht ownership the ultimate symbol of wealth and prestige. The increasing disposable income of consumers and growing inclination toward marine tourism and leisure activities, such as sailing, power boating, water sports, yachting, and others, have experienced significant growth in recent years.

Notably, sustainability and ecological consciousness have emerged as significant influences within the Asia-Pacific luxury yacht industry. With an increasing focus on environmental preservation, manufacturers and consumers actively emphasize developing and utilizing energy-efficient technologies, sustainable materials, and environmentally friendly propulsion systems. Moreover, various key rental companies are also implementing cost-cutting strategies to offer cost-efficient yacht services, which is anticipated to hamper the new sales of luxury yachts.

The growing interest in water adventure sports is helping the water adventure tourist business and positively impacts the luxury yacht market growth. Water adventure sports are performed in bodies of water such as lakes, canals, the sea, streams, the ocean, and coastal locations. Water sports enthusiasts go to specific regions to participate in soft and hard water-based experiences and activities such as fishing, fast tenders, sea kayaks, paddleboards, sailing, and jet skis. These factors are expected to drive market growth during the forecast period.

Asia Pacific Luxury Yacht Market Trends

Motorized Luxury Yacht Type Segment to Fuel the Market Demand -

Motorized luxury yachts are high-end watercraft equipped with powerful engines for propulsion, offering lavish amenities and comfort for leisure cruising. The rising disposable incomes across the region enable more individuals to afford to be part of motorized luxury yachts. Its numerous benefits are gaining popularity among consumers in the region. These include high speed, greater privacy in each room, easier handling without requiring sailing knowledge, an attractive appearance on the water, and the added convenience of usually coming with a crew so that users do not have to worry about the boat.

The growing tourism industry across the Asia-Pacific region also attracts a steady stream of high-net-worth travelers seeking unique and extravagant experiences. Motor luxury yachts are popular for their speed and power. These yachts are designed to be sleek and stylish, without the restrictions of sails and rigging that come with other types of boats.

In 2023, The growth in international visitor arrivals that started in early 2022 gained momentum in early 2023, with over 93.3 million foreign arrivals added, marking a substantial increase compared to the previous period. This boosted the tourism rate for early 2023 to more than 68 percent of the early 2019 international visitor arrival levels. Furthermore, numerous manufacturers are developing and launching new motorized yachts, which are expected to contribute to the growth of this segment in the coming years. For instance,

In December 2022, Riviera Australia Pty. Ltd launched a new 46 Sports Motor Yacht in Australia. The new 46 Sports Motor Yacht comes with a capacity for six adults sleeping on board. The designers have provided a 500-liter water tank and 151-liter holding tank with luxurious amenities.

Owing to these factors, the adoption of motorized luxury yachts is increasing in the region. Such positive trends are expected to enhance the growth of the Asia-Pacific luxury yacht market over the forecast period.

China is Anticipated to Hold a Significant Market Share -

The luxury yacht market in China is experiencing a significant upswing driven by the burgeoning wealth of the country's elite and a growing interest in maritime leisure activities. Moreover, the luxury yacht industry in China is witnessing a shift in consumer preferences with a notable inclination towards customization and exclusivity. Chinese yacht buyers strongly prefer tailor-made solutions that reflect their personal style and status, pushing manufacturers to offer bespoke design options.

The rise of yacht clubs and marinas in coastal cities such as Shanghai, Qingdao, and Sanya is emblematic of the growing yachting culture in China. These hubs provide the necessary infrastructure for yacht mooring and maintenance and serve as social venues where the elite can congregate, further embedding yachting within the luxury lifestyle narrative. The development of these facilities is instrumental in fostering a yachting community that offers networking opportunities and promotes nautical sports and leisure activities among the affluent Chinese population.

China's prime natural geographical location, a series of tourist attractions, and tourist sites have been formed in coastal areas. The length of China's coastline is about 32,000 km, of which 18,400 km are on the mainland, extending from the Yalu River at the China-Korea border to the China-Vietnam border. The country's deep-seated connection to the sea has fostered a thriving yacht industry, renowned worldwide for its exquisite craftsmanship, elegant designs, and pioneering technology.

In the fourth quarter of 2023, approximately 1.22 billion domestic tourist trips were made in China, significantly exceeding the figure for the same period in 2022. Hence, owing to these factors, the China country segment is expected to see significant market growth and will likely create opportunities for the luxury yacht market over the forecast period.

Asia Pacific Luxury Yacht Industry Overview

The Asia-Pacific luxury yacht market is fragmented. A few prominent players include Sunseeker, Azimut Benetti, Ferretti S.p.A., Gulf Craft Inc., and Sanlorenzo Asia. A few companies in the market are focusing on improving their product portfolios to widen their customer base. Some other key players aim to expand their presence in the market through product launches, offerings expansion, manufacturing expansion, and collaborations with other companies. For instance,

In January 2024, Sanlorenzo Asia announced a partnership with Volvo Penta, a collaboration that aims to pool efforts to reduce the environmental impact of the marine industry through the continuous drive for innovation.

In December 2023, Japan's cruise ship industry announced a new megayacht ship order. This development underscores a broader trend of expansion within the Japanese yacht market, which has traditionally catered to domestic travelers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing Tourism Industry is Expected to Boost the Luxury Yacht Market

- 4.2 Market Restraints

- 4.2.1 Luxury Yacht Charter and Used Yacht to Hamper Market Growth

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers/Consumers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in USD)

- 5.1 By Yacht Type

- 5.1.1 Sailing Luxury Yacht

- 5.1.2 Motorized Luxury Yacht

- 5.1.3 Other Types

- 5.2 By Size

- 5.2.1 Up to 20 Meters

- 5.2.2 20 to 50 Meters

- 5.2.3 Above 50 Meters

- 5.3 By Application

- 5.3.1 Commercial

- 5.3.2 Private

- 5.4 By Country

- 5.4.1 China

- 5.4.2 India

- 5.4.3 Japan

- 5.4.4 South Korea

- 5.4.5 Singapore

- 5.4.6 Australia

- 5.4.7 Rest of Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Horizon Yacht

- 6.2.2 Johnson Yacht

- 6.2.3 Azimut Benetti

- 6.2.4 Ferretti S.p.A.

- 6.2.5 Sunseeker

- 6.2.6 Fincantieri Yachts

- 6.2.7 Oceanco Yacht

- 6.2.8 Ocean Alexander

- 6.2.9 Heysea Yachts Company Limited

- 6.2.10 Gulf Craft Inc.

- 6.2.11 Sanlorenzo Asia

- 6.2.12 PALM BEACH MOTOR YACHTS

- 6.2.13 Grand Banks Yachts

- 6.2.14 Riviera Australia Pty. Ltd.

- 6.2.15 Superyacht Australia

7 MARKET OPPORTUNITIES AND FUTURE TRENDS