PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521643

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521643

Europe Luxury Yacht - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

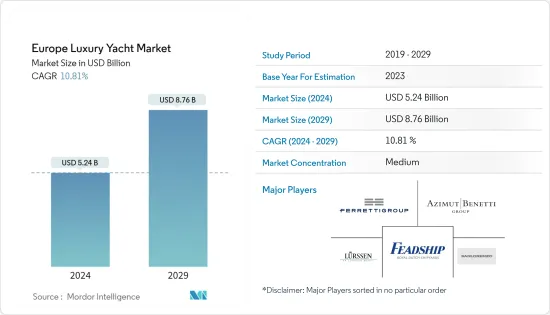

The Europe Luxury Yacht Market size is estimated at USD 5.24 billion in 2024, and is expected to reach USD 8.76 billion by 2029, growing at a CAGR of 10.81% during the forecast period (2024-2029).

The European recreational boating industry continues to attract large volumes of participants who are strongly competing with rival luxury leisure pursuits. It has been estimated that European recreational boating involves the use of luxury yachts for leisure and recreation purposes. The increasing disposable income of consumers and growing inclination toward marine tourism and leisure activities, such as sailing, power boating, water sports, yachting, and others, have experienced significant growth in recent years.

The boating industry is expected to develop due to factors such as rising interest in recreational water sports and rising water-based tourism. Furthermore, the advancements in telematics and IoT platforms are expected to improve the luxury yacht industry's potential over the coming years. However, the market is projected to be hampered by the high initial and ownership costs of luxury yachts and environmental problems related to recreational boating.

The growing interest in water adventure sports is helping the water adventure tourist business and positively impacts the luxury yacht market growth. Water adventure sports are performed in bodies of water such as lakes, canals, the sea, streams, the ocean, and coastal locations. Water sports enthusiasts go to specific regions to participate in soft and hard water-based experiences and activities such as fishing, Fast tenders, sea kayaks, paddleboards, sailing, and jet skis. These factors are expected to drive market growth during the forecast period.

Europe Luxury Yacht Market Trends

Motorized Luxury Yacht Type Segment to Fuel the Market Demand -

Motorized luxury yachts are gaining popularity among consumers in the region due to their numerous benefits. These include high speed, greater privacy in each room, easier handling without requiring sailing knowledge, an attractive appearance on the water, and the added convenience of usually coming with a crew (for boats 50 feet and longer) so that users do not have to worry about the boat at all.

Motor yachts are popular for their speed and power. These yachts are designed to be sleek and stylish, without the restrictions of sails and rigging that come with other types of boats. As a result, they offer more space and comfort. Depending on their size, motor yachts can also provide a wide array of amenities, such as beach clubs, gyms, elevators, saunas, and hammams, making them the ultimate luxury for ocean travel.

Manufacturers are developing sustainable and environment-friendly innovations, such as solar electric yachts, which are expected to contribute to the growth of this segment in the coming years. For instance,

* In May 2023, TYDE, a German luxury yacht manufacturer in partnership with BMW, introduced THE OPEN, setting a new benchmark as the world's largest foiling motor yacht during a prestigious unveiling event in Dubai. This announcement follows the introduction of THE ICON electric watercraft in May 2023. THE OPEN has dimensions of 14.8 meters in length and 4.5 meters in width. Moreover, by incorporating hydrofoil technology, THE OPEN achieves an impressive 80% reduction in energy consumption, significantly outperforming traditional day yachts that typically use over 150 liters of fossil fuel per hour.

The luxury yacht market is expected to grow due to increasing demand for competitive and recreational boating activities, a rise in purchasing power, becoming a preferred destination for luxury yachts, and the development of tourist attractions and luxurious hotels. For instance,

* In 2022, Participation in boating activities in the United Kingdom increased from 2020 to 2022. As of 2022, 18.5 percent of the British population participated in boating activities. This figure showed a slight increase compared to the previous year.

Owing to these factors, the adoption of motorized luxury yachts is increasing in the region. Such positive trends are expected to enhance the growth of the European luxury yacht market over the forecast period.

Italy is Anticipated to Hold a Significant Market Share -

The luxury yacht market in Italy is experiencing a significant phase of growth, buoyed by the country's rich maritime heritage and its status as a global center for yacht design and manufacturing. The luxury yacht industry in Italy is also witnessing a trend towards customization and personalization, with buyers seeking unique, tailor-made vessels that reflect their personal style and meet their specific needs.

This trend is contributing to the overall expansion of the market, making luxury yachting accessible to a wider audience and encouraging a culture of yachting across different consumer segments. A blend of rich maritime heritage, advanced technological capabilities, and a strong culture of innovation and design underpin this expansion. For instance,

* In September 2023, accommodation establishments in Italy recorded approximately 14 million tourist arrivals, including international and domestic travelers.

Italy, with its extensive 4,723 miles of coastline and strategic location in the Mediterranean basin, stands as a testament to its maritime vocation. The country's deep-seated connection to the sea has fostered a thriving yacht industry, renowned worldwide for its exquisite craftsmanship, elegant designs, and pioneering technology. Owing to this, several players in the country are introducing various business strategies to enhance their market offerings in the yacht industry. For instance,

* In January 2024, The Italy-based yacht manufacturer Benetti unveiled the 40.8-metre Benetti Oasis 40M superyacht, BO116, at its Livorno shipyard in Italy.

Hence, owing to these aforementioned factors, Italy is expected to see significant market growth and is likely to create opportunities for the luxury yacht market over the forecast period.

Europe Luxury Yacht Industry Overview

The European luxury yacht market is fragmented. A few prominent companies include Fr. Lurssen Werft GmbH & Co.KG, Ferretti S.p.A., Sanlorenzo, Azimut Benetti, and Feadship. A few companies in the market are focusing on improving their product portfolios to widen their customer base. Some other key players aim to expand their presence in the market through product launches, offerings expansion, manufacturing expansion, and collaborations with other companies. For instance,

* In January 2024, Sanlorenzo announced a partnership with Volvo Penta, a collaboration that aims to pool efforts to reduce the environmental impact of the marine industry through the continuous drive for innovation.

* In November 2023, Benetti S.p.A recently launched AMANTIS, a superyacht that measures 49.9 m, is the eighth vessel in the popular B. Now 50 range. The yacht's design features a steel hull and aluminum superstructure with a nearly vertical bow. In contrast to other yachts in the series, the AMANTIS has a traditional aft deck and beach area.

* In November 2023, Azimut unveiled the Grande 30m and Seadeck 9 in its first collaboration with the shipyard Matteo Thun, Antonio Rodriguez, and Alberto Mancini.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing Tourism Industry is Expected to Boost the Luxury Yacht Market

- 4.2 Market Restraints

- 4.2.1 Luxury Yacht Charter and Used Yacht to Hamper Market Growth

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers/Consumers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in USD)

- 5.1 By Yacht Type

- 5.1.1 Sailing Luxury Yacht

- 5.1.2 Motorized Luxury Yacht

- 5.1.3 Other Types

- 5.2 By Size

- 5.2.1 Up to 20 Meters

- 5.2.2 20 to 50 Meters

- 5.2.3 Above 50 Meters

- 5.3 By Application

- 5.3.1 Commercial

- 5.3.2 Private

- 5.4 By Country

- 5.4.1 Germany

- 5.4.2 United Kingdom

- 5.4.3 France

- 5.4.4 Italy

- 5.4.5 Spain

- 5.4.6 Denmark

- 5.4.7 Netherlands

- 5.4.8 Greece

- 5.4.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 ISA Yachts

- 6.2.2 Sinot Yacht Architecture and Design

- 6.2.3 Fr. Lurssen Werft GmbH & Co.KG

- 6.2.4 Hatteras Yachts

- 6.2.5 Sunseeker

- 6.2.6 Ferretti S.p.A.

- 6.2.7 Fincantieri Yachts

- 6.2.8 Oceanco Yacht

- 6.2.9 Lazzara Yachts

- 6.2.10 Azimut Benetti

- 6.2.11 Nobiskrug Yacht GmBH

- 6.2.12 Sanlorenzo

- 6.2.13 Princess Yachts

- 6.2.14 IYC Yacht

- 6.2.15 Hargrave Custom Yachts

- 6.2.16 Burger Boat Company

- 6.2.17 Delta Marine Industries Inc

- 6.2.18 Feadship

- 6.2.19 Kadey-Krogen Yachts

7 MARKET OPPORTUNITIES AND FUTURE TRENDS