PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521639

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521639

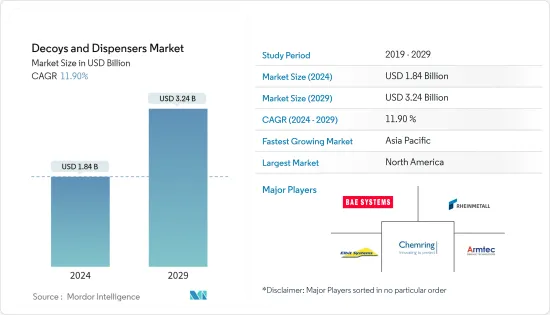

Decoys And Dispensers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Decoys And Dispensers Market size is estimated at USD 1.84 billion in 2024, and is expected to reach USD 3.24 billion by 2029, growing at a CAGR of 11.90% during the forecast period (2024-2029).

The increasing sophistication of threats, which necessitates advanced countermeasures, and nations' ongoing modernization of military equipment are driving the market's growth. The market is also driven by technological advancements that improve the effectiveness and reliability of these systems. Additionally, integrating decoys and dispensers into unmanned systems and developing new platforms capable of deploying them contribute to market growth. Strategic partnerships and mergers & acquisitions are also providing growth opportunities, allowing companies to expand their capabilities.

However, the market faces several challenges, such as the rapid advancement of threat detection technologies, which can compromise the effectiveness of decoys. Adversaries continuously improve their capabilities to detect and counteract decoys, necessitating constant innovation in decoy technology, and the integration of these systems into existing military platforms may require substantial modification or upgrades.

The physical limitations of decoys, such as size and weight, can restrict their deployment on smaller or unmanned platforms. Electromagnetic spectrum management is also a critical issue, as the effective use of decoys often depends on precise emissions control to avoid detection by enemy sensors.

Decoys And Dispensers Market Trends

Fixed Wing Aircraft is Expected to Dominate the Market During the Forecast Period

Fighter jets, bombers, transport planes, and UAVs are integral to national security and equipped with sophisticated avionics and weapon systems to maintain a strategic edge. However, this advanced technology also makes them susceptible to modern threats like heat-seeking missiles, driving the need for innovative countermeasures to protect these assets.

Rising warfare situations, political disputes among neighboring countries, and a growing number of cross-border conflicts lead to growing spending on the defense sector. For instance, in January 2024, the US Department of Defense (DoD) awarded a USD 31 million contract modification to Chemring Australia, a global supplier of aerial countermeasures to support various F-35 Joint Strike Fighter nations with 19,570 MJU-68/B flare infrared (IR) decoys. Thus, increasing procurement of fighter jets and rising expenditure on military aircraft modernization programs are expected to drive the market's growth during the forecast period.

Asia-Pacific is Expected to Witness Significant Growth During the Forecast Period

Asia-Pacific is expected to witness significant growth during the forecast period. By the end of 2023, there were 15,653 active aircraft in the Asia-Pacific region, of which fixed-wing aircraft accounted for 60% while rotorcraft accounted for the remaining fleet. China, India, Japan, and South Korea together accounted for 55% of the total active fleet in the region.

The modernization of military forces is a significant aspect of national security for many countries in this region. For instance, in November 2023, the Indian MoD contracted Hindustan Aeronautics Limited to deliver 97 Tejas Light Combat Aircraft (Mark 1A) for the Indian Air Force (IAF). The Tejas Mk-1A Light Combat Aircraft is an indigenously designed and manufactured fourth-generation fighter equipped with AESA Radar, EW suite consisting of radar warning and self-protection jamming, Digital Map Generator (DMG), Smart Multi-function Displays (SMFD), Combined Interrogator and Transponder (CIT), advanced radio altimeter, and other advances features.

In October 2023, Japan signed a defense agreement with Britain and Italy to jointly develop a sixth-generation fighter jet. Developments such as these are expected to drive the market's growth during the forecast period.

Decoys And Dispensers Industry Overview

The decoy and dispensers market is fragmented and marked by the presence of several local and international players. The key market players include BAE Systems PLC, Chemring Group PLC, Elbit Systems Ltd, Rheinmetall AG, and Armtec Defense Technologies.

Most market players are focusing on collaborations, product development partnerships, and mergers to expand their product portfolio and market presence. For instance, in June 2023, Elbit Systems Ltd unveiled Nano SPEAR, an expendable active RF decoy to protect aircrews and platforms from anti-aircraft threats. The Nano SPEAR is an advanced, expendable RF decoy that uses the existing dispensing system of the aircraft and, once launched, acts independently to lure away hostile radar-guided missiles.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Pyrotechnic

- 5.1.2 Pyrophoric

- 5.1.3 Others

- 5.2 Application

- 5.2.1 Fixed-wing Aircraft

- 5.2.2 Rotary-wing Aircraft

- 5.2.3 Unmanned Aircraft Vehicles

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 France

- 5.3.2.3 Germany

- 5.3.2.4 Russia

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 BAE Systems PLC

- 6.2.2 Chemring Group PLC

- 6.2.3 Elbit Systems Ltd

- 6.2.4 Rheinmetall AG

- 6.2.5 Armtech Defense Technologies

- 6.2.6 Leonardo SpA

- 6.2.7 Lacroic Defense

- 6.2.8 TARA Aerospace RD

- 6.2.9 ROSOBORONEXPORT

- 6.2.10 Mil-Spec Industries Corporation