PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521638

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521638

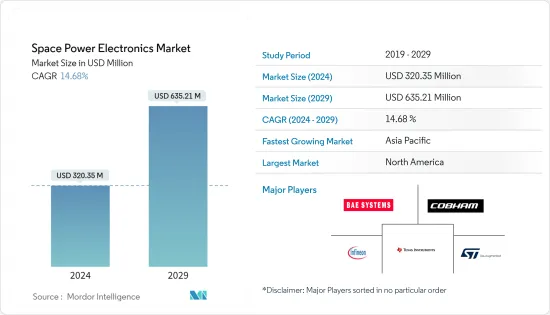

Space Power Electronics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Space Power Electronics Market size is estimated at USD 320.35 million in 2024, and is expected to reach USD 635.21 million by 2029, growing at a CAGR of 14.68% during the forecast period (2024-2029).

The development of power electronics for space applications has been driven by advancements in semiconductor technologies and the need for efficient power management systems. Wide bandgap semiconductors, for instance, have emerged as a significant innovation, offering improved performance over traditional materials. Power electronics systems in space also include modular power electronic subsystems (PESS) that connect to a source and load at their input and output power ports. These systems are integral to operating satellites, spacecraft, launch vehicles, and rovers, ensuring they have the necessary power to perform their functions.

The space power electronics market is experiencing growth due to the increasing development of low-Earth orbit (LEO) satellites and reusable launch vehicles. These advancements drive the demand for more sophisticated power management devices, batteries, and power converters, which are essential for the long-term sustainability and efficiency of space missions.

However, the market faces significant challenges, such as the high costs associated with designing and developing these complex systems and the rigorous integration and quality inspection process required for space applications. Despite these challenges, the industry's commitment to research and development is expected to overcome these restraining factors, leading to considerable growth over the forecast period.

Space Power Electronics Market Trends

Satellites are Expected to Dominate the Market During the Forecast Period

The satellite segment is expected to dominate the market during the forecast period owing to the increasing demand for satellites for various applications such as communication, navigation, earth observation, and others. A surge in the small satellite sector was witnessed in the last decade, fueled by significant technological advancements, the commercialization of the industry, and an influx of private capital. This momentum was propelled by increased interest in space exploration and the need for small satellites to perform complex tasks such as attitude and orbit control, orbital transfers, and responsible end-of-life deorbiting strategies.

The miniaturization of power electronics has been particularly beneficial for CubeSats, enhancing their performance and reliability. Concurrently, the burgeoning NewSpace industry is embracing modularization, with components like miniaturized radiation-hardened MOSFETs, gate drivers, DC-DC converters, and solid-state relays becoming standard, reflecting a trend toward more efficient, scalable, and cost-effective satellite designs.

For instance, in January 2023, Airbus signed a contract with the Belgian Ministry of Defense to provide tactical satellite communications services to the armed forces for 15 years. Airbus plans to launch a new ultra-high frequency (UHF) communications service by 2024 for the armed forces of other European nations and NATO allies. Developments such as these are driving the growth of the market.

Asia-Pacific is Expected to Register the Highest CAGR During the Forecast Period

The Asia-Pacific region is witnessing a significant evolution in the space industry, particularly in space power electronics. Key trends include the increasing recognition of space as a vital part of national security, the rise of small private commercial space startups, and a shift in focus toward exploiting space resources. Countries like China, India, and Japan are leading the way with ambitious space programs to establish their presence in space by developing technologies for lunar exploration and asteroid mining.

The satellite communication equipment market in the region is experiencing growth due to the rising demand for high-speed internet connectivity. This growth is supported by major satellite operators such as Singtel and Thaicom, which contribute to the more than 100 million active pay satellite TV subscribers in Asia. For instance, in December 2023, China announced that it would be building its version of StarLink, a satellite internet constellation using low-Earth orbit, with plans to launch around 26,000 satellites to cover the entire world, led by state-run companies.

Thus, the advancements in space power electronics are crucial for these developments, as they enable the creation of more efficient and reliable systems for power management in satellites, which is essential for long-term missions and deep space exploration.

Space Power Electronics Industry Overview

The space power electronics market is consolidated, with key players occupying a significant market share. The major players in this market are BAE Systems PLC, Cobham Limited, Infineon Technologies AG, Texas Instruments Incorporated, and STMicroelectronics NV. These companies are at the forefront of developing powerful electronic devices that can withstand harsh conditions in space, such as extreme temperatures and radiation.

The leading market players are focusing more on acquiring contracts to maintain their market position. This approach is often complemented by introducing innovative products featuring cutting-edge technologies. For instance, in April 2023, ZF signed a multi-year supply agreement with STMicroelectronics for silicon carbide devices. Collaborations have become instrumental in establishing specialized research and development centers dedicated to advancing space power electronics equipment, signifying a robust commitment to innovation and growth in this high-tech field.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Platform

- 5.1.1 Satellites

- 5.1.2 Spacecraft and Launch Vehicles

- 5.1.3 Others

- 5.2 Type

- 5.2.1 Radiation-Hardened

- 5.2.2 Radiation-Tolerant

- 5.3 Application

- 5.3.1 Communication

- 5.3.2 Earth Observation

- 5.3.3 Navigation, Global Positioning System (GPS) and Surveillance

- 5.3.4 Technology Development and Education

- 5.3.5 Others

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 France

- 5.4.2.3 Germany

- 5.4.2.4 Russia

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.4.1 Brazil

- 5.4.4.2 Rest of Latin America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 BAE Systems PLC

- 6.2.2 Cobham Limited

- 6.2.3 Microchip Technology Inc.

- 6.2.4 RUAG Group

- 6.2.5 STMicroelectronics NV

- 6.2.6 Teledyne Technologies Incorporated

- 6.2.7 Texas Instruments Incorporated

- 6.2.8 Honeywell International Inc.

- 6.2.9 Microsemi Conduction

- 6.2.10 ON Semiconductor

- 6.2.11 Analog Devices Inc.

- 6.2.12 Renesas Electronics Corporation

- 6.2.13 Infineon Technologies AG