PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521630

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521630

Italy Chemical Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

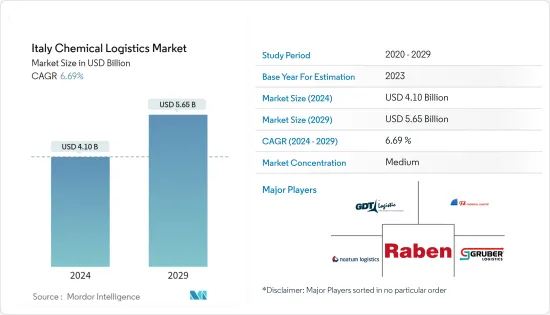

The Italy Chemical Logistics Market size is estimated at USD 4.10 billion in 2024, and is expected to reach USD 5.65 billion by 2029, growing at a CAGR of 6.69% during the forecast period (2024-2029).

Key Highlights

- In recent years, the chemical manufacturing sector has witnessed a significant uptick in demand. This surge is primarily driven by the escalating need for chemicals, especially shale gas, as a feedstock in the energy sector. Given the potential environmental ramifications of mishandling chemical transportation, ensuring safe logistics has become paramount. Against this backdrop, the confluence of rising chemical demand and the imperative for secure transportation is poised to propel the chemical logistics market forward.

- Notably, the upswing in chemical production is anticipated to be a key catalyst for the chemical logistics sector. As chemical output expands to cater to diverse industries like food, pharmaceuticals, automobiles, and engineering, the demand for reliable transportation and distribution services surges. In 2022, Versalis, a subsidiary of Eni, an Italian oil and gas company, emerged as the top Italian chemical manufacturer, boasting sales worth EUR 6.2 billion (USD 6.70 billion).

- The Italian chemical industry's production value in 2022 reached a pinnacle of EUR 66 billion (USD 77.37 billion) during the 2013-2022 study period. While the import value of chemicals into Italy fluctuated over the years, it peaked at EUR 61.5 billion (USD 66.49 billion) in 2022. Conversely, the export value of the Italian chemical industry stood at EUR 43 billion (USD 46.49 billion) in the same year.

- With a rising appetite for chemicals across sectors like pharmaceuticals, cosmetics, oil and gas, specialty chemicals, and food, the market for chemical logistics is set for expansion. The meticulousness with which manufacturers navigate the intricate supply chains, be it through roads, railways, or sea, underscores the industry's commitment to safety. Governments worldwide are investing significantly in modernizing their chemical logistics systems, underscoring the global emphasis on averting potential catastrophes. Collectively, these factors paint a positive growth trajectory for the chemical logistics industry.

Italy Chemical Logistics Market Trends

Growth in the Pharmaceutical Industry is Driving the Market

- An aging population and a surge in chronic diseases are driving up the demand for medications, particularly specialty drugs and biologics. These drugs often come with intricate logistics requirements, given their temperature sensitivity and specific handling needs. The growing emphasis on personalized medicine and targeted therapies further underscores the need for streamlined and dependable logistics to ensure the timely delivery of tailored treatments.

- As an illustration, in 2022, Italy had 37 individuals aged 65 or above for every 100 working-age individuals (aged 15-64). Projections suggest this ratio will climb to 65 by 2050. The Italian Statistics Institute estimates that the population aged 80 and above will witness a 35% surge from 2021, surpassing 6 million by 2041.

- Industry sources indicate that the revenue of the Italian pharmaceuticals market is poised for steady growth from 2024 to 2028, with a cumulative increase of EUR 4 billion (USD 4.34 billion)(+24.81%). After marking its sixth consecutive year of growth, the market's revenue is projected to hit EUR 20.13 billion, setting a new milestone in 2028.

- Pharmaceutical companies are increasingly adopting a global approach, sourcing materials and manufacturing drugs from various corners of the world. This shift necessitates robust international logistics solutions to ensure seamless movement of goods. Leveraging its strategic position in Europe, Italy has emerged as a pivotal hub for pharmaceutical logistics, catering to both domestic and international markets.

Expansion of Warehousing and Distribution in the Country is Boosting the Market

- Strategic placement of warehouses near key transportation hubs and production centers in Italy is optimizing delivery times and curtailing transportation expenses. For instance, DISTA SpA, a prominent player in chemical logistics, has established warehouses in both Northern and Southern Italy, efficiently catering to distinct regions.

- Employing advanced warehouse management systems (WMS), such as cloud-based solutions, logistics firms like Sealog Logistics are bolstering inventory control, streamlining picking and packing, and enhancing order fulfillment. These measures not only boost efficiency but also lead to cost reductions.

- Seamlessly integrated with multiple transportation modes-road, rail, and sea-warehouses are enabling multimodal transport solutions. This integration facilitates cost-effective options, tailored to both distance and urgency. Notably, CMA CGM Air Cargo and CEF Storage & Logistic Services have joined forces to offer integrated airfreight and warehousing solutions, catering specifically to the chemical sector in Italy.

- Warehouses dedicated to handling chemicals adhere to stringent safety regulations. These facilities boast temperature-controlled environments, designated explosion-proof zones, and robust ventilation systems. Logistics giants like Gefco are going the extra mile, providing dedicated teams and comprehensive training programs to ensure safe handling, storage, and meticulous documentation of hazardous materials in Italy.

Italy Chemical Logistics Industry Overview

The Italian chemical logistics market is fragmented, with a mix of global and regional players. Due to e-commerce, technology integration, and growing economies, the market is anticipated to grow during the forecast period. The major companies in the country have adopted various modern technologies, such as warehousing management systems, automation, drone delivery, and the transportation management system, which enabled better planning and tracking facilities and resulted in increased productivity and value proposition. The major players in this market are GDT Logistics, FA Chemical Logistics S.R.L, Raben Group, Gruber Logistics, and Noatum Logistics.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Insights

- 4.1 Current Market Scenario

- 4.2 Industry Value Chain Analysis

- 4.3 Government Initiatives to Attract Investments in the Industry

- 4.4 Insights into 3PL Industry

- 4.5 Impact of COVID-19 on the Market

5 Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Growing demand for Perishable Goods

- 5.1.2 Expanding E-commerce Market

- 5.2 Market Restraints

- 5.2.1 Infrastructure Limitations

- 5.2.2 Skilled Labor Shortage

- 5.3 Market Opportunities

- 5.3.1 Investing in Infrastructure Facilities

- 5.3.2 Digitalization and Technology Advancements

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Buyers/consumers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitutes

- 5.4.5 intensity of Competitive Rivalry

6 Market Segmentation

- 6.1 By Service

- 6.1.1 Transportation

- 6.1.2 Warehousing and Distribution

- 6.1.3 Consultant & Managemenr Services

- 6.1.4 Customs & Security

- 6.1.5 Green Logistics

- 6.1.6 Others

- 6.2 By Mode of Transportation

- 6.2.1 Roadways

- 6.2.2 Railways

- 6.2.3 Airways

- 6.2.4 Waterways

- 6.2.5 Pipelines

- 6.3 By End-User

- 6.3.1 Pharmaceutical Industry

- 6.3.2 Cosmetic Industry

- 6.3.3 Oil and Gas Industry

- 6.3.4 Specialty Chemical Industry

- 6.3.5 Others

7 Competitive Landscape

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 GDT Logistic

- 7.2.2 FA Chemical Logistics S.R.L

- 7.2.3 Raben Group

- 7.2.4 Dachser Logistics

- 7.2.5 GEODIS

- 7.2.6 DHL

- 7.2.7 Gruber Logistics

- 7.2.8 Rhenus Logistics

- 7.2.9 TRANSALPI Transporti

- 7.2.10 Noatum Logistics

- 7.2.11 MOL Logistics*

- 7.3 Other Companies

8 Future Outlook Of The Market

9 Appendix