Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1645074

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1645074

South-East Asia Oil And Gas Pipeline - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 110 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

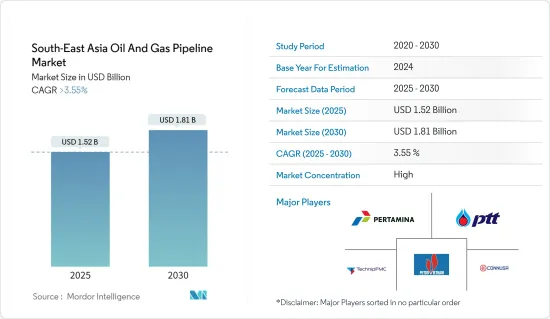

The South-East Asia Oil And Gas Pipeline Market size is estimated at USD 1.52 billion in 2025, and is expected to reach USD 1.81 billion by 2030, at a CAGR of greater than 3.55% during the forecast period (2025-2030).

Key Highlights

- In the medium term, the increasing energy demand in the region and emerging export opportunities in the area are expected to drive the Southeast Asian oil and gas pipeline market.

- However, the volatility in energy prices is expected to hinder the growth of the market studied in Southeast Asia.

- The increasing deployment of smart pipeline systems, such as monitoring systems, is expected to provide growth opportunities in the forecast period.

- Indonesia is expected to dominate the Southeast Asian oil and gas pipeline market due to the country being the largest energy consumer and the increasing demand for oil and gas in the region during the forecast period.

South-East Asia Oil And Gas Pipeline Market Trends

Gas Pipeline Segment to Dominate the Market

- With the region's burgeoning population and economic expansion, the need for cleaner and more efficient energy sources has intensified. Natural gas, as a relatively cleaner-burning fossil fuel, aligns with environmental concerns and economic growth aspirations. This shift in energy preference toward natural gas drives the development and expansion of gas pipeline infrastructure.

- According to the Energy Institute Statistical Review of World Energy, in 2022, natural gas consumption reached an all-time low in the past decade due to the industrial slowdown in the region. However, consumption is expected to increase in the coming years as most countries in the area focus on reducing fossil fuel consumption and rising natural gas consumption.

- Furthermore, Southeast Asia's geographical characteristics favor the dominance of gas pipelines. The region comprises numerous archipelagos and islands, and maritime transport of oil can be logistically challenging and costly. In contrast, gas pipelines provide a cost-effective and efficient solution for transporting natural gas across these difficult terrains. This geographic advantage contributes to the inclination toward gas pipelines as the preferred mode of energy transportation.

- Southeast Asia is witnessing increased investments in gas infrastructure, including the development of liquefied natural gas (LNG) terminals and associated pipelines. These investments facilitate the import and distribution of LNG, offering a cleaner energy alternative. As natural gas gains prominence as a primary energy source, channels play a pivotal role in transporting LNG from terminals to consumption centers, thereby bolstering the significance of the gas pipeline segment.

- For instance, in September 2023, Malaysia's Bumi Armada made an agreement with a subsidiary of the Indonesian energy company Pertamina and natural gas trading firm PT Davenergy Mulia Perkasa. The agreement pertains to the development and commercialization of liquefied natural gas (LNG). As part of this arrangement, the companies would establish fundamental principles for the development and commercialization of LNG extracted from the Madura Gas Field and the adjacent fields in Indonesia.

- Therefore, according to the points discussed above, the gas pipeline segment is expected to dominate the market studied during the forecast period.

Indonesia expected to be the Largest Geographic Segment

- Indonesia has abundant natural resources, notably its extensive reserves of oil and natural gas. The country is a significant oil and gas producer, and the need to efficiently transport these resources to refineries, distribution points, and export terminals is paramount. The vast reserves and the continuous exploration for new sources create a compelling case for the expansion of oil and gas pipeline infrastructure in Indonesia.

- According to the Energy Institute Statistical Review of World Energy, oil consumption in the country increased by 8.5% between 2021 and 2022. In 2022, oil consumption was 1,585 thousand barrels per day compared to 1,461 thousand barrels per day in 2021.

- Indonesia's strategic geographic location plays a crucial role in its expected dominance in the oil and gas pipeline market. The nation consists of numerous islands and archipelagos, necessitating the construction of pipelines for efficient energy transportation. Gas pipelines, in particular, offer a cost-effective and reliable means of transporting natural gas across challenging terrain, connecting production sites to urban centers and industrial zones.

- In January 2023, Casakha announced that the commencement of design, engineering, and project management activities would take place promptly at its Jakarta offices. The offshore installation is scheduled for 2023, as outlined by the Indonesian subsea and offshore consultancy. The defined scope of work encompasses detailed engineering design, installation, transportation, and engineering tasks related to a 16-inch (40.6 centimeters) offshore pipeline connecting the LPRO and EPRO platforms.

- The growing demand for energy in Indonesia is a driving force behind the expansion of the oil and gas pipeline sector. The country's expanding population, coupled with economic development, fuels the need for energy resources. To meet this demand, investments in pipeline projects are imperative, and these pipelines serve as the primary mode of transporting oil and gas to meet the energy requirements of households, businesses, and industries.

- Indonesia's regulatory framework and government support are instrumental in its dominance in the oil and gas pipeline market. The government actively promotes the development of energy infrastructure and encourages investment in pipeline projects. Favorable regulations and incentives provided by regulatory bodies create an environment conducive to the growth of the pipeline sector, both for domestic use and export.

- Therefore, according to the points discussed above, Indonesia is expected to dominate the market studied during the forecast period.

South-East Asia Oil And Gas Pipeline Industry Overview

The Southeast Asian oil and gas pipeline market is moderately fragmented. Some of the major players in the market (in no particular order) include PT Pertamina, PTT Public Company Limited, TechnipFMC PLC, PetroVietnam, and PT. Connusa Energindo, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50002037

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 List of Major Upcoming and in Pipeline Projects, Southeast Asia (Length of Pipeline, Transportation Fuel, Operator, Total CAPEX, Year of Start of Construction, and Commissioning Year)

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.1.1 Increasing Energy Demand

- 4.6.1.2 Increasing Export Opportunities

- 4.6.2 Restraints

- 4.6.2.1 Volatility in Energy Prices

- 4.6.1 Drivers

- 4.7 Supply Chain Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGEMENTATION

- 5.1 Location of Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Type

- 5.2.1 Crude Oil

- 5.2.2 Natural Gas

- 5.3 Country

- 5.3.1 Indonesia

- 5.3.2 Malaysia

- 5.3.3 Thailand

- 5.3.4 Vietnam

- 5.3.5 Rest of Southeast Asia

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Companies Profiles

- 6.3.1 PT Pertamina

- 6.3.2 PTT Public Company Limited

- 6.3.3 TechnipFMC PLC

- 6.3.4 PetroVietnam

- 6.3.5 PT. Connusa Energindo

- 6.4 Market Share

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Deployment of Smart Pipeline Systems

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.