PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1645071

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1645071

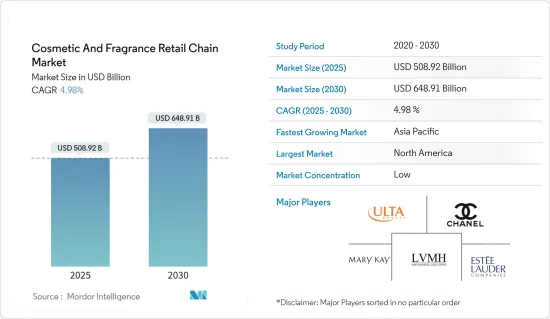

Cosmetic And Fragrance Retail Chain - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Cosmetic And Fragrance Retail Chain Market size is estimated at USD 508.92 billion in 2025, and is expected to reach USD 648.91 billion by 2030, at a CAGR of 4.98% during the forecast period (2025-2030).

The cosmetic and fragrance retail chain market encompasses businesses that specialize in selling cosmetic products, skincare items, haircare products, and fragrances through retail outlets, both offline and online. These retail chains typically offer various beauty and personal care products from various brands, catering to diverse consumer preferences and needs.

Key characteristics of the cosmetic and fragrance retail chain include offering a broad assortment of beauty products, such as makeup, skincare, haircare, fragrances, and bath items from various brands, spanning mass-market to luxury. These chains cater to diverse consumer preferences by curating product selections for different demographics, tastes, and budgets. The market boasts a plethora of brands, ranging from global powerhouses to niche and indie labels, providing consumers with a rich array of choices. Moreover, the market is heavily influenced by evolving trends and innovations in product formulations, packaging, and technology, necessitating retail chains to continually update their offerings to align with changing consumer demands.

Cosmetic And Fragrance Retail Chain Market Trends

The Skincare Sector Holds a Predominant Position Within the Cosmetic Market

Skincare routines can differ based on skin type, age, and lifestyle. Recently, there's been more focus on skincare for self-care, with people preferring products that use natural ingredients and are eco-friendly. This has led to constant improvements and new skincare product technologies to meet consumers' changing demands.

The beauty industry is characterized by many trends, with new products, formulations, and companies emerging regularly. Skincare has emerged as the focal point for beauty enthusiasts in recent years, exemplified by the "skinification" trend. This trend involves integrating skincare into other beauty routines, such as hair care and makeup. As a result, it's anticipated that skin benefits will become a staple in nearly every cosmetic product on the market in the near future.

North America's Holds Largest Shares in Cosmetic Fragrance Retail Chain Market

North America is the largest cosmetic and fragrance retail market. It includes well-known chains, such as Sephora, Ulta Beauty, Bath & Body Works, and Perfumania. These retailers offer various cosmetic and fragrance products, catering to various preferences and budgets. The market is competitive, with companies constantly innovating to attract customers and expand their market share. The market benefits from the widespread availability of renowned global brands like L'Oreal, Estee Lauder, Clinique, Chanel, and Mary Kay. Furthermore, the well-established presence of offline retail chains specializing in prestige cosmetics and fragrances in the United States adds to the market's momentum.

Cosmetic And Fragrance Retail Chain Industry Overview

The cosmetic and fragrance retail chain market is fragmented with many players. These companies increasingly prioritize developing organic and natural products, driving market growth. In the competitive landscape, players implement strategies such as acquisitions and mergers and forming strategic partnerships with leading cosmetic and fragrance manufacturers to ensure exclusive product launches. The key players include Ulta Beauty Inc., Chanel Inc., LVMH Moet Hennessy Louis Vuitton, and Mary Kay Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Consumers Heighten Focus on Appearance and Personal Grooming

- 4.3 Market Restraints

- 4.3.1 Regulatory Compliance and Safety Standards

- 4.3.2 Rising Awareness of Health Risks and Allergies

- 4.4 Market Opportunties

- 4.4.1 Digital Transformation and E-commerce

- 4.4.2 Offering Personalized and Customizable Beauty Solutions

- 4.5 Value Chain Analysis

- 4.6 Industry Attractiveness: Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights into Technological Advancements in the Industry

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Hair Care

- 5.1.2 Skin Care

- 5.1.3 Make-Up Products

- 5.1.4 Deodorants

- 5.1.5 Fragrances

- 5.2 By Category

- 5.2.1 Mass

- 5.2.2 Premium

- 5.3 By End User

- 5.3.1 Men

- 5.3.2 Women

- 5.3.3 Unisex

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 India

- 5.4.1.2 China

- 5.4.1.3 Japan

- 5.4.1.4 Australia

- 5.4.1.5 Rest of Asia- Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Rest of North America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Russia

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East & Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East & Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.3 Ulta Beauty

- 6.4 Chanel Inc.

- 6.5 LVMH Moet Hennessy Louis Vuitton

- 6.6 Mary Kay Inc.

- 6.7 Estee Lauder Companies

- 6.8 Shiseido Company, Limited

- 6.9 Christian Dior SE

- 6.10 Lush Retail Ltd.

- 6.11 Jumei International Holding Ltd

- 6.12 Avon Justine (Pty)

7 MARKET FUTURE TRENDS

8 DISCLAIMER AND ABOUT US