PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521577

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521577

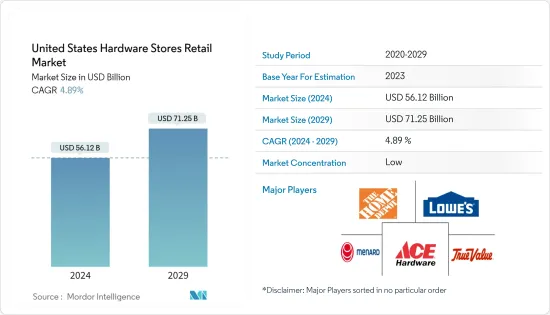

United States Hardware Stores Retail - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The United States Hardware Stores Retail Market size is estimated at USD 56.12 billion in 2024, and is expected to reach USD 71.25 billion by 2029, growing at a CAGR of 4.89% during the forecast period (2024-2029).

The hardware store retail market in the United States is a significant part of the broader home improvement industry. The primary reason behind the surge in demand for hardware retailers is the growing embrace of home appliances in renovation projects. This is driven by an increased need for effective storage cabinetry, evolving appliance preferences, trends in hardwood flooring and backsplashes, and a desire for more efficient connections with outdoor spaces. Additionally, the expanding presence of the e-commerce sector and the notable rise in online sales contribute significantly to the heightened demand for products.

With homeowners dedicating more time to their homes, the ability to work remotely allowed for a migration of focus. This trend and the constrained housing market led many families to choose renovation over new construction. This shift has proven advantageous for the home improvement retail industry.

United States Hardware Stores Retail Market Trends

Increased Focus on Home Improvement and Renovation Projects

The rise in renovation activities and home improvement can contribute to growth in the hardware market. As more people upgrade or renovate their homes, there is typically a higher demand for various hardware products such as tools, fasteners, building materials, and other related supplies. This increased demand can positively impact the hardware market by leading to higher sales and potentially driving growth for businesses within the industry.

Factors such as changing trends in home design, the increase in do-it-yourself (DIY) projects, and the growing awareness of sustainable and energy-efficient home solutions can contribute to the overall growth of the hardware market. Additionally, economic factors like low interest rates and a strong housing market can encourage homeowners to invest in home improvement projects, further boosting the hardware market.

Rise of the Digital Hardware Store

Entrepreneurs running hardware stores can unlock a pathway to connect with customers beyond their local community by venturing into the digital landscape. This broader reach opens up possibilities for increased revenue. Online hardware retail establishments have existed for many years, and their longevity in the market is expected to continue. These digital stores offer diverse products, including tools, equipment, electrical supplies, furniture, woodworking, and interior items, for residential and commercial spaces. Despite the enduring nature of the market, businesses in this niche have gradually embraced digital transformation.

Ace Hardware, the world's largest retailer-owned hardware cooperative with around 5,600 locally owned and operated stores, concluded the year on a high note with unprecedented online sales in December.

United States Hardware Stores Retail Industry Overview

The US hardware stores retail market is fragmented with the presence of many players. Hardware stores sell various items such as tools, building materials, paint, and home improvement supplies. They typically prioritize high-quality products from reputable brands. The key players in the market include Home Depot Inc., Lowe's Companies Inc., Menard Inc., Ace Hardware, and True Value Hardware.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in Home Improvement and Renovation Projects

- 4.3 Market Restraints

- 4.3.1 Hardware Stores Often Experience Seasonal Demand Variations

- 4.4 Market Opportunities

- 4.4.1 Hardware Stores Thrive as Innovation Drives Customer Engagement and Efficiency

- 4.5 Value Chain Analysis

- 4.6 Industry Attractiveness: Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights into Technological Advancements in the Industry

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Door Hardware

- 5.1.2 Building Materials

- 5.1.3 Kitchen and Toilet Products

- 5.1.4 Other Product Types

- 5.2 By Distribution Channel

- 5.2.1 Offline

- 5.2.2 Online

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.3 Home Depot Inc.

- 6.4 Lowe's Companies Inc.

- 6.5 Menard Inc.

- 6.6 Ace Hardware

- 6.7 True Value Hardware

- 6.8 84 Lumber

- 6.9 Handy Andy Home Improvement Centers Inc.

- 6.10 Hippo Hardware and Trading Company

- 6.11 Orchard Supply Hardware

- 6.12 Harbor Freight Tools*

7 MARKET FUTURE TRENDS

8 DISCLAIMER AND ABOUT US