PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521543

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521543

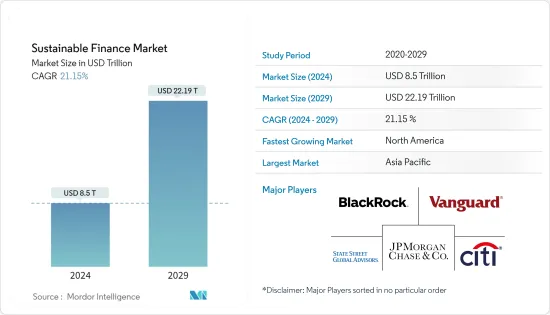

Sustainable Finance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Sustainable Finance Market size is estimated at USD 8.5 trillion in 2024, and is expected to reach USD 22.19 trillion by 2029, growing at a CAGR of 21.15% during the forecast period (2024-2029).

In recent years, sustainable financing has grown significantly. The demand has risen as more and more investors understand the effectiveness of sustainability and ESG elements in their investment plans. Many institutional investors have incorporated ESG criteria into their investment frameworks. They consider environmental and social aspects and corporate governance practices to assess investments' long-term sustainability and risk profile. Green bonds have become a popular instrument in sustainable finance. Socially Responsible Investing (SRI) focuses on investments aligning with ethical or social values. It involves screening companies involved in controversial activities and investing in businesses with a positive social impact. The availability and quality of ESG data have improved, enabling investors to make more informed decisions. Companies increasingly report on their ESG performance and disclose relevant information to meet investor demands.

Sustainable Finance Market Trends

Rise in the Issuance of Green Bonds

Green bonds offer a specialized funding source for initiatives that benefit the environment, like energy efficiency, renewable energy, sustainable infrastructure, and climate change adaptation. The proceeds from green bond issuances are specifically allocated to these projects, enabling investors to support and participate in the transition to a more sustainable economy. The increased issuance of green bonds reflects the growing demand from investors for sustainable investment opportunities. Investors are increasingly seeking investments that align with their ESG principles and contribute to positive environmental outcomes. Green bonds offer a transparent and credible investment option, allowing investors to direct their capital toward environment-friendly projects. Investing in green bonds may add a new asset class to their portfolios and reduce exposure to sectors more vulnerable to climate-related risks or other ESG concerns. Long-term gains from this diversification may be possible in addition to risk management.

Increasing Sustainable Finance Market Value in North America

The value of sustainable bonds issued in the region has been increasing, reflecting the growing demand for sustainable finance. Investors in North America have been increasingly interested in sustainable investments. They understand the importance of including environmental, social, and governance (ESG) considerations in their investment plans. This demand has led to a surge in sustainable bond issuances as companies and governments seek to attract capital from ESG-conscious investors. Governments and regulatory bodies in North America have been supportive of sustainable finance. They have implemented policies and regulations that encourage the issuance of sustainable bonds. In North America, investments in green infrastructure, such as climate resilience programs, sustainable transportation schemes, and renewable energy projects, have gained prominence. Since these initiatives frequently need significant capital outlays, the issue of sustainable bonds has been a crucial source of funding for their advancement.

Sustainable Finance Industry Overview

The sustainable finance market is moderately consolidated with many players in the market. Some major global market players include BlackRock, Vanguard Group, State Street Global Advisors, JPMorgan Chase, and Citigroup. In the study period, market players are also involved in mergers and acquisitions, and partnerships are focused on expanding their market presence. During the forecast period, the market offers growth prospects, which are anticipated to intensify competition. However, mid-size to smaller businesses are expanding their market presence by landing new contracts and breaking into untapped sectors due to product innovation and technological improvement.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise of Corporate Social Responsibility Initiatives

- 4.2.2 Recognition of the Long-term Financial Benefits of Sustainable Investments

- 4.3 Market Restraints

- 4.3.1 High Initial Costs Restraining the Market

- 4.3.2 Lack of Standardized Definitions and Metrics for Measuring Sustainability

- 4.4 Market Opportunities

- 4.4.1 Sustainable Infrastructure Development Creating an Opportunity

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Insights on Technological Innovations in the Market

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Investment Type

- 5.1.1 Equity

- 5.1.2 Fixed Income

- 5.1.3 Mixed Allocation

- 5.2 By Transaction Type

- 5.2.1 Green Bond

- 5.2.2 Social Bond

- 5.2.3 Mixed-sustainability Bond

- 5.3 By Industry

- 5.3.1 Utilities

- 5.3.2 Transport and Logistics

- 5.3.3 Chemicals

- 5.3.4 Food and Beverage

- 5.3.5 Government

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of Middle East

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Company Profiles

- 6.2.1 BlackRock

- 6.2.2 Vanguard Group

- 6.2.3 State Street Global Advisors

- 6.2.4 JPMorgan Chase

- 6.2.5 Citigroup

- 6.2.6 Goldman Sachs

- 6.2.7 UBS

- 6.2.8 Bank of America

- 6.2.9 Amundi

- 6.2.10 Allianz*

7 MARKET FUTURE TRENDS

8 DISCLAIMER AND ABOUT US