PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521504

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521504

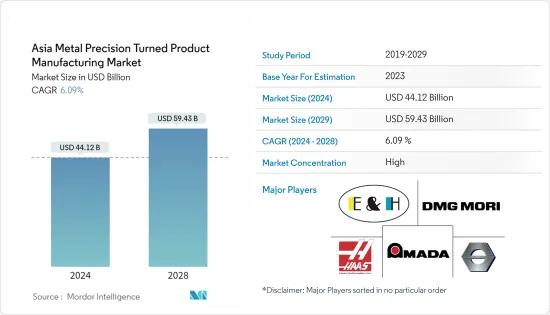

Asia Metal Precision Turned Product Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Asia Metal Precision Turned Product Manufacturing Market size is estimated at USD 44.12 billion in 2024, and is expected to reach USD 59.43 billion by 2029, growing at a CAGR of 6.09% during the forecast period (2024-2029).

Key Highlights

- The metal precision turned product manufacturing market in Asia is quite extensive and diverse. As a region, Asia is known for its strong manufacturing capabilities and technological advancements. Several countries in Asia play a significant role in this market, including China, Japan, South Korea, and Taiwan.

- China, being the largest manufacturing hub in the world, has a substantial presence in the metal precision turned product manufacturing market. The country's manufacturing sector is known for its scale, efficiency, and cost-effectiveness. Chinese manufacturers produce a wide range of metal precision turned products, catering to both domestic and international demand.

- Japan has a long-standing reputation for precision engineering and high-quality manufacturing. Japanese companies are known for their advanced technologies, precision machining capabilities, and attention to detail. The metal precision turned product manufacturing market in Japan is driven by industries such as automotive, electronics, and machinery.

- South Korea is another key player in the metal precision turned product manufacturing market in Asia. The country has a strong focus on technological innovation and has developed advanced manufacturing capabilities. South Korean manufacturers produce a wide range of metal precision-turned products, including components for the automotive, electronics, and aerospace industries.

- Taiwan is known for its expertise in precision engineering and manufacturing. Taiwanese manufacturers have a strong presence in the metal precision turned product market, offering high-quality products and competitive pricing. The country's manufacturing sector is known for its efficiency, reliability, and ability to meet customer demands.

- Other countries in Asia, such as India, Singapore, and Malaysia, also have a significant presence in the metal precision turned product manufacturing market. These countries offer a mix of manufacturing capabilities, technological expertise, and cost competitiveness.

- The demand for metal precision-turned products in Asia is driven by various industries. The automotive industry is a major consumer of these components, requiring precision parts for engines, transmissions, suspension systems, and more. The electronics industry, including consumer electronics and telecommunications, also relies on metal precision turned products for connectors, switches, and other components.

- The aerospace industry in Asia is growing rapidly, contributing to the demand for metal precision-turned products. As countries in the region invest in aerospace manufacturing and research, the need for high-quality, precise components is increasing.

- In recent years, there has been a growing emphasis on sustainability and environmental responsibility in the manufacturing sector.

Asia Metal Precision Turned Product Manufacturing Market Trends

Demand from automotive sector boosting the market

Asia-Pacific region is the largest region in the world, covering an area of 29.3m sq. km. It is home to 60% of the world's population. China and India are two of the fastest-growing countries in the world. With its growing population, Asia's economy and industries are constantly changing.

The automotive industry is one such industry that is a key industry for many Asian-Pacific economies. As the region's population grows, so does the demand for efficient mobility. It is no surprise that the region is home to many of the world's most valuable automobile manufacturers.

The automotive industry includes the production of motor vehicles and their aftermarket parts. With its high level of production, the automotive industry in Asia-Pacific generates huge sales of passenger cars and commercial vehicles.

In terms of light commercial vehicle production volume, China was the largest producer in 2022, with around 1.85m vehicles produced. Thailand was the second largest producer, with 1.29m light commercial vehicles produced in 2022. Myanmar was the third largest producer, with 695 LCA produced in 2022.

The automotive sector in Asia has experienced significant growth over the years, and with it, the demand for metal precision-turned products has also increased. These products play a crucial role in the manufacturing of automobiles, ensuring the smooth functioning and efficiency of various components.

Asia, particularly countries like China, Japan, South Korea, and India, has emerged as a major hub for automotive production.

As the world's largest automotive market, China has a massive demand for metal precision-turned products. The country's automotive industry is driven by both domestic consumption and export. Chinese manufacturers require precision-turned components for engines, transmissions, steering systems, suspension systems, and more. The demand is fueled by the growing middle class and their increasing purchasing power.

Japan has a long-standing reputation for its automotive industry, known for its high-quality and technologically advanced vehicles. Japanese automakers have stringent quality standards, which require precision-turned products to ensure optimal performance and reliability. These components are used in engines, drivetrains, fuel systems, braking systems, and other critical parts.

The automotive industry in South Korea has witnessed remarkable growth, with companies like Hyundai and Kia gaining global recognition. The demand for metal precision-turned products in South Korea is driven by the production of vehicles, including passenger cars, commercial vehicles, and electric vehicles. These components are used in powertrains, chassis, steering systems, and more.

China Holds a Prominent Share in The Market

China has emerged as a global leader in manufacturing, including the production of metal precision-turned products. The country's manufacturing sector has experienced significant growth over the years, fueled by factors such as a large labor force, technological advancements, and favorable government policies.

In 2022, China's automotive industry produced approximately 23.8 million passenger cars. In 2021, not only did China produce the highest number of passenger cars in the APAC region, but it was also predicted to produce the highest total number of passenger cars worldwide in 2021. In the electric car segment, Chinese manufacturing companies, including BYD Auto Co., Ltd., are expected to catch up with US-based manufacturer Tesla.

China's metal precision-turned-product manufacturing market is vast and has been growing steadily. The demand for precision-turned components in various industries, including automotive, aerospace, electronics, and machinery, has contributed to the market's expansion. The market size is influenced by both domestic consumption and exports to global markets.

China has developed advanced manufacturing capabilities, including state-of-the-art machinery, skilled labor, and efficient production processes. These capabilities enable manufacturers to produce high-quality metal precision-turned products with tight tolerances and complex geometries. Chinese manufacturers often leverage advanced technologies such as CNC machining, automatic lathes, and computer-aided design (CAD) to meet customer requirements.

The metal precision turned product manufacturing market in China is highly competitive, with numerous manufacturers competing for customers domestically and internationally. Manufacturers range from large-scale enterprises to small and medium-sized enterprises (SMEs). Some companies specialize in specific industries or product categories, while others offer a wide range of precision-turned components.

The demand for metal precision-turned products in China is driven by various industries. In the automotive sector, these components are used in engines, transmissions, steering systems, and other critical parts. In the aerospace industry, precision-turned products are utilized in aircraft engines, landing gear systems, and avionics. The electronics industry requires precision components for devices such as smartphones, computers, and consumer electronics.

Chinese manufacturers are increasingly focusing on quality control and adhering to international standards. Many companies have obtained certifications such as ISO 9001 to demonstrate their commitment to quality management systems. This emphasis on quality has helped Chinese manufacturers gain recognition in global markets.

Asia Metal Precision Turned Product Manufacturing Industry Overview

In the competitive landscape of Asia's metal precision turned product manufacturing market, several key players dominate the industry. The companies are competing based on factors such as product quality, precision, cost-effectiveness, innovation, and customer service. The market is highly competitive, driving companies to continuously improve their processes and stay at the forefront of technological advancements.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Dynamics

- 4.2.1 Market Drivers

- 4.2.1.1 Increasing demand from automobile industry

- 4.2.1.2 Increased focus on precision products

- 4.2.2 Market Restraints

- 4.2.2.1 The cost of production and transportation

- 4.2.2.2 Regulations and quality standards

- 4.2.3 Market Opportunities

- 4.2.3.1 Technological advancements driving the market

- 4.2.3.2 Increasing focus on sustainable manufacturing

- 4.2.1 Market Drivers

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Operation

- 5.1.1 Manual Operation

- 5.1.2 CNC Operation

- 5.2 By Machine Types

- 5.2.1 Automatic Screw Machines

- 5.2.2 Rotary Transfer Machines

- 5.2.3 Computer Numerically Controlled(CNC)

- 5.2.4 Lathes or Turning Center

- 5.2.5 Other Machine Types

- 5.3 By End-User

- 5.3.1 Industries

- 5.3.2 Automobile

- 5.3.3 Electronics

- 5.3.4 Defense and Healthcare

- 5.3.5 Other End-Users

- 5.4 By Geography

- 5.4.1 China

- 5.4.2 India

- 5.4.3 Japan

- 5.4.4 South Korea

- 5.4.5 Rest Of Asia

6 COMPETITIVE LANDSCAPE

- 6.1 E&H Precision

- 6.2 DMG MORI

- 6.3 Ningbo Sinster Machine Co. Ltd.

- 6.4 AMADA

- 6.5 HAAS

- 6.6 MAZAK

- 6.7 Ningbo Sinster Machine Co. Ltd.

- 6.8 Star Rapid

- 6.9 3E Rapid Prototyping (3ERP)

- 6.10 Junying Metal Manufacturing Co. Limited*

7 FUTURE OF THE MARKET

8 APPENDIX