PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521493

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521493

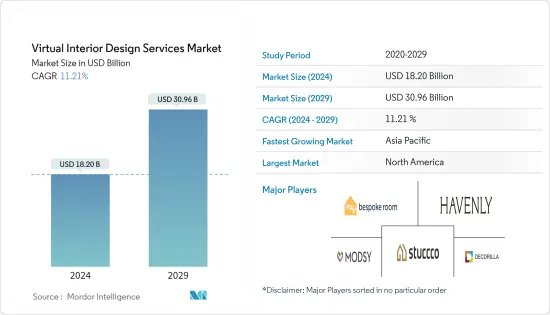

Virtual Interior Design Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Virtual Interior Design Services Market size is estimated at USD 18.20 billion in 2024, and is expected to reach USD 30.96 billion by 2029, growing at a CAGR of 11.21% during the forecast period (2024-2029).

The demand for virtual interior design services increased during the COVID-19 pandemic and has not slowed down. The idea of bringing a custom, in-person service online on a more standardized digital platform gave rise to e-design. Virtual packages give customers the pleasure of working with a professional interior designer, along with increased flexibility, accessibility, and convenience. An e-design trend that has gained traction in recent times is app-based matchmaking, in which an organization pairs an interior designer with a prospective client based on data it gathers digitally, for instance, through a style survey. While some e-design businesses concentrate mostly on the matching aspect, others adopt a more comprehensive strategy and de-identify the interior designer responsible for the project.

E-design services are expanding due to several variables. The consequences of the COVID-19 pandemic compelled interior designers to rapidly gain confidence in providing virtual services. E-design is frequently far less expensive than hiring a conventional interior design company. Although the degree of service provided may not be as extensive or thorough, it does fill the gap between a buyer's vision for their property and their capacity to make it a reality.

Virtual Interior Design Services Market Trends

The Commercial Segment is the Fastest-Growing Segment

Due to increased commercial construction projects, the commercial segment has dominated the market, observing a high market share over the study period. For financial advantage, commercial interior designers conceptualize places for businesses to improve functionality and raise style. Compared to residential houses, commercial buildings undergo renovations more regularly. This is expected to further affect the growth of the commercial category. The expanding retail sector offers even more potential for the commercial segment's growth. Many international suppliers are increasing their footprint in developing nations. Urban specialty stores are also likely to help spur expansion.

It is anticipated that as several government initiatives to create smart cities increase, so will the demand for commercial interior design services. In office construction, non-traditional structures like data centers are leading the way. Businesses involved in technology and life sciences are also creating new structures with personalized interior designs. Throughout the projected period, the market for interior design services in the commercial segment is anticipated to expand due to all these factors.

Asia-Pacific is the Fastest-Growing Region in the Virtual Interior Design Services Market

In Asia-Pacific, the market for interior design services has been growing gradually because of the increasing need for construction projects in developing countries like China, Japan, and India. China is Asia-Pacific's most significant revenue-generating country for virtual interior design services. China and Japan have sizable construction sectors, contributing significantly to the growing use of interior design solutions.

Japan is one of the biggest importers of home decor items in the world. Hotels and resorts renovated their aging structures before the Olympic Games, hoping to welcome millions of foreign guests. Interior design-related furniture and other products are in high demand in Japan. Finnish firms specializing in these products see Japan as one of their largest and fastest-growing markets. However, North America owns the majority of the shares of the sector because of its cosmopolitan population, high standard of life, and rising disposable income. The region's immigrant population and expanding nuclear families are additional market drivers.

Virtual Interior Design Services Industry Overview

The virtual interior design services market is partially fragmented due to the numerous competitors vying for market share. The disparity in service prices in the market has increased competition in the industry. The competitive landscape of the market and some of the significant players are included in the report. The major players are Decorist, Modsy, Havenly, Stucco, and My Bespoke Room.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Urbanization and High Demand for Personalized Interior

- 4.2.2 Rapid Expansion in the Real Estate and Construction Sectors

- 4.3 Market Restraints

- 4.3.1 High Cost of Interior Design Services

- 4.3.2 Economic Downturns and Fluctuations

- 4.4 Market Opportunities

- 4.4.1 Smart Homes and Technology Integration

- 4.4.2 Collaborations with Architects and Builders

- 4.5 Value Chain Analysis

- 4.6 Industry Attractiveness: Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights into Technological Advancements in the Industry

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 New Construction

- 5.1.2 Renovation

- 5.2 By Application

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Italy

- 5.3.2.6 Spain

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Modsy

- 6.2.2 Havenly

- 6.2.3 Stucco

- 6.2.4 My Bespoke Room

- 6.2.5 Decorilla

- 6.2.6 AECOM

- 6.2.7 Spacejoy

- 6.2.8 roomLift

- 6.2.9 Laurel & Wolf

- 6.2.10 AMA Designs & Interiors*

7 FUTURE MARKET TRENDS

8 DISCLAIMER AND ABOUT US