PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521428

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521428

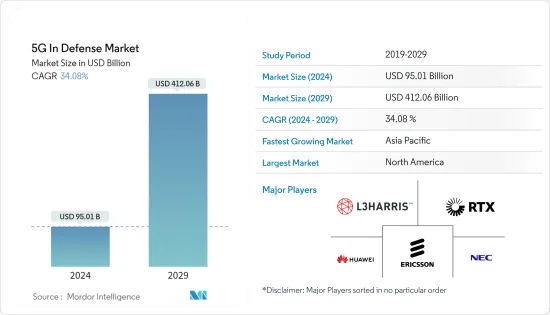

5G In Defense - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The 5G In Defense Market size is estimated at USD 95.01 billion in 2024, and is expected to reach USD 412.06 billion by 2029, growing at a CAGR of 34.08% during the forecast period (2024-2029).

Key Highlights

- The growing dependence on big data is projected to drive the increased need for 5G networks of defense equipment. The increased use of real-time data for decisive decision-making has raised substantial data collections. With faster and more thorough communication, the 5G network will establish the capacity to take huge amounts of data more swiftly. Through its 5G network, this new wireless network would allow for real-time data transfer from unmanned aerial vehicles and surveillance drones to command centers, boosting situational awareness and tactical reconnaissance.

- Defense program demand will propel interoperability forward in the defense market. End-to-end slicing for unique end users can be carried out via 5G networks. Slices can be tailor-made to offer system performance needed by programs such as autonomous cars and trucks and automated process technology.

- However, the high costs involved in setting up 5G infrastructure might hinder the market growth during the forecast period.

5G In Defense Market Trends

Airborne Segment to Register the Highest CAGR During the Forecast Period

- The airborne segment is expected to grow with the highest CAGR owing to the rising procurement of unmanned aerial vehicles (UAVs) and military aircraft. 5G integration with airborne in the defense market has the potential to significantly enhance capabilities and transform military aerial operations.

- Incorporating 5G can greatly enhance UAV and drone operations. High-speed data transmission will allow real-time video and sensor data streaming, crucial for surveillance, reconnaissance, and combat operations. In December 2023, the National Defense Authorization Act (NDAA) announced that it would allocate USD 886 billion in defense spending. It also asked the US Defense Department to deploy 5G open RAN private wireless networks on military bases.

- The ultra-low latency of 5G can also support better remote control of UAVs in environments where every millisecond counts. 5G can ensure seamless data integration between airborne assets and ground or naval forces, creating a unified combat picture and improving joint operations' efficiency. 5G can facilitate communication between multiple drones, enabling swarm drone operations. Such drone swarms can collaboratively undertake tasks, be it for surveillance, electronic warfare, or even offensive operations.

Asia-Pacific to Witness the Highest Growth During the Forecast Period

- 5G technology in the Asia-Pacific region is experiencing significant growth due to countries such as China, South Korea, and Japan, which have advanced considerably in rolling out 5G networks, leading to a surge in demand for 5G technology solutions. China is outcompeting the US in the wireless network market, specifically with 5G technology. The widespread establishment of 5G networks in these and other countries in the area has propelled the expansion of the 5G testing market.

- For instance, the Indian Army wants to establish a 5G network along the border to improve communication and get a high-speed data network for operational requirements. China has already begun the operation of setting up a 5G network along the Line of Actual Control (LAC) for better communication.

- The Indian Army has been endeavoring to exploit 5G for supporting operations in the tactical battlefield area. In this context, in April 2022, a Memorandum of Understanding (MoU) for the establishment of a 5G testbed was signed between the Military College of Telecommunication Engineering and IIT Madras. Such developments will ensure speedy growth of the 5G defense market in Asia Pacific.

5G In Defense Industry Overview

The 5G in Defense Market is semi-consolidated, with the market players vying for a dominant market share through attractive offerings and competitive pricing strategies. Some of the key market participants in the 5G defense market include Telefonaktiebolaget LM Ericsson, Huawei Technologies Co., Ltd., NEC Corporation, L3Harris Technologies, Inc., and RTX Corporation. These major players operating in this market have adopted various strategies comprising M&A, investment in R&D, collaborations, partnerships, regional business expansion, and new product launches.

For instance, in April 2022, Lockheed Martin and Intel Corporation signed a memorandum of understanding to leverage their expertise in technology and communications to bring together innovative 5G-capable solutions. The memorandum of understanding (MoU) will expand the strategic relationship between the two companies to align 5G-enabled hardware and software solutions for the US Department of Defense.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Communication Infrastructure

- 5.1.1 Small Cell

- 5.1.2 Macro Cell

- 5.1.3 Radio Access Network

- 5.2 By Core Network Technology

- 5.2.1 Software-Defined Networking (SDN)

- 5.2.2 Fog Computing (FC)

- 5.2.3 Mobile Edge Computing (MEC)

- 5.2.4 Network Functions virtualization (NFV)

- 5.3 By Platform

- 5.3.1 Land

- 5.3.2 Naval

- 5.3.3 Airborne

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.4.1 Brazil

- 5.4.4.2 Rest of Latin America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Israel

- 5.4.5.4 Rest of Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Huawei Technologies Co., Ltd.

- 6.2.2 L3Harris Technologies, Inc.

- 6.2.3 NEC Corporation

- 6.2.4 Nokia Networks (Nokia Corporation)

- 6.2.5 Qualcomm Technologies, Inc.

- 6.2.6 RTX Corporation

- 6.2.7 Samsung Electronics Co., Ltd.

- 6.2.8 Telefonaktiebolaget LM Ericsson

- 6.2.9 THALES

- 6.2.10 Wind River Systems, Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS