PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1694010

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1694010

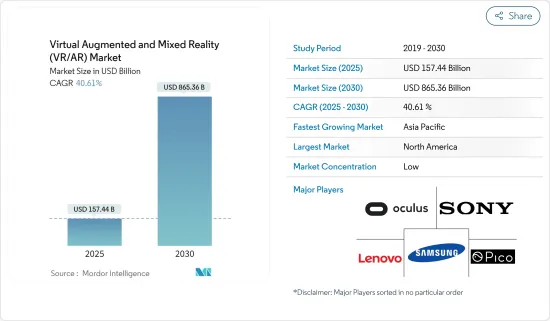

Virtual Augmented and Mixed Reality (VR/AR) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Virtual Augmented and Mixed Reality Market size is estimated at USD 157.44 billion in 2025, and is expected to reach USD 865.36 billion by 2030, at a CAGR of 40.61% during the forecast period (2025-2030).

Key Highlights

- Virtual reality is the utilization of computer technology primarily aimed at generating a simulated environment. In contrast to the conventional user interface, VR enables users to fully engage in an immersive experience rather than merely observing a monitor screen. This technology has undoubtedly revolutionized various aspects globally by providing a multi-sensory simulation encompassing aspects like vision, touch, hearing, and smell.

- In contrast, augmented reality is a captivating experience that enriches the real world by incorporating computer-generated perceptual information. Augmented reality seamlessly incorporates digital content into our surroundings and objects by utilizing software, apps, and hardware like AR glasses.

- Augmented reality (AR) has experienced remarkable growth due to the widespread utilization of this technology in commercial settings. It is anticipated to hold significant importance in the upcoming years, considering the substantial investments made in innovation and adoption by prominent technology market leaders like Apple, Google, Facebook, Microsoft, and Amazon. The expanding presence of smartphones and the increasing integration of AR in mobile gaming are key drivers of this market, leading to the development of more solutions by major vendors in this segment.

- Using mixed reality may enhance the interactivity of classroom education, as it empowers teachers to present virtual examples of concepts and incorporate gaming elements to supplement textbooks. Consequently, this innovative approach facilitates accelerated learning and improved retention of information for students.

- It is worth acknowledging that an increasing number of students face challenges in maintaining focus and concentration during their educational journey, particularly at universities and colleges. They may also encounter various mental health issues, such as depression and anxiety.

- Virtual reality is emerging as a revolutionary technology that may notably impact various end-user industries. The acceptance of the technology is witnessing continuous growth, leading to significant expansion in the number of use cases. Virtual reality technology also offers several advantages that are changing the dynamics of businesses and commercial enterprises used to operate earlier.

- For instance, the technology is being used in the retail industry to enhance consumer experience. Before purchasing, they may use it to check the product in a virtual environment. By using the technology, businesses across various end-user industries may develop robust marketing campaigns to attract the attention of more customers. It also helps them offer remote maintenance and support by providing the procedures in a virtual environment.

- Training and skill development are among the major sectors wherein the demand for virtual reality technology is anticipated to witness substantial growth primarily due to factors such as the convenience the technology adds to the process. Furthermore, it also helps minimize the overall training cost while making the process safer than traditional methods. For instance, to train employees to work in hazardous environments, organizations may use a simulated virtual environment rather than sending the employee to the actual site.

- Although the AR/VR/MR market is finding an enhanced footprint across various industries, the technological and cost limitations remain relevant in the market as these are emerging technologies and are yet to achieve standardization and mass acceptance. Furthermore, these technologies are complex and require a skilled workforce for further development. Hence, the lack of sufficient availability of a skilled workforce is another major factor challenging the market's growth.

Virtual Augmented and Mixed Reality (VR/AR) Market Trends

Gaming to be the Fastest Growing End-user for VR

- Virtual reality (VR) has become widely used in the gaming sector because of its ability to deliver an immersive and dynamic experience. By sending players directly into the virtual environment, VR creates a sense of presence and immersion. Virtual reality headsets allow players to experience games from a first-person perspective. This heightened immersion enhances the gaming experience and makes players feel more connected to the virtual world and its characters.

- R&D of new technologies, such as Full High-Definition (FHD), Ultra-High Definition (UHD), and 4K displays, has boosted the adoption of TVs for playing games. The growth of virtual reality in the gaming industry has also been stimulated by increasing investments in new technologies. The future of the VR gaming industry is projected to be driven by continued improvement in graphics performance. Gaming companies use potent graphics processors to provide the best VR games to integrate physical and fantasy environments. Graphics play an essential role in providing a realistic gaming experience. Real-time expertise is offered to users by technologies such as 3D effects and interactive graphics while playing games or walking on virtual reality platforms.

- Rapid growth in AR and VR gamers worldwide has expanded the market's horizon. According to NewGenApps, a provider of Artificial Intelligence, Machine Learning, Big Data Analytics, and AR/VR solutions, the global user base of AR and VR games will increase to 216 million users by 2025.

- The increasing demand for video games creates an opportunity for vendors to offer VR headsets. According to the Entertainment Retailers Association, in 2022, British consumers spent approximately GBP 4.66 billion (USD 5.95 billion) on video games. This represents a 2.3% increase from the previous year. By 2028, the market volume of VR headsets is expected to be over 27 million.

- The gaming industry recognizes the market potential of VR. As the technology becomes more accessible and affordable, the demand for VR gaming experiences is increasing. Game developers and publishers see VR as an opportunity to reach new audiences and create exciting, immersive experiences that stand out in a crowded market.

North America to Hold Major Market Share in the Virtual, Augmented, and Mixed Reality Market

- The demand for virtual reality (VR) in North America has experienced rapid growth owing to the significant shift in individuals across various sectors engaging with technology. This increasing demand is fueled by the various applications of VR technology, from entertainment and gaming to education, healthcare, enterprise solutions, and others.

- The demand for VR is further propelled by technological advancements, making VR devices more accessible and user-friendly. The affordability and improved performance of VR headsets have contributed to broader adoption across North America, from tech enthusiasts to casual users seeking novel and engaging experiences. Hence, many companies are launching new products to increase their market share.

- As VR becomes more accessible and easier to use, it offers a lot of great possibilities for the government to explore innovative approaches. Hence, the US government uses VR as a valuable tool across multiple sectors. For instance, in September 2023, the US Food and Drug Administration announced that VR could deliver some clinical services, normally delivered only in clinics and hospitals, to patients in their homes or other non-clinical settings, and in the coming year, this will increase, which will boost the demand of VR.

- Due to several vendors making significant investments in market innovation and the US's dominant position in the global software market, the augmented reality market in North America is expected to grow significantly during the forecast period.

- Increased mobile penetration and the availability of new consoles in the North American market have contributed to tremendous growth in the gaming sector over the last few years. The US is one of the world's biggest gaming markets and offers many games for its citizens. In the United States, video gamers reported an increase of 45% in the time spent playing video games during the quarantine period of the COVID-19 pandemic compared to previous weeks.

- The demand for mixed reality (MR) in North America has experienced rapid growth owing to the significant shift in individuals across various sectors engaging with technology. Due to several vendors making substantial investments in market innovation and the US's dominant position in the global market, the mixed reality market in North America is expected to grow significantly during the forecast period.

Virtual Augmented and Mixed Reality (VR/AR) Market Overview

The virtual, augmented, and mixed reality market is highly fragmented with the presence of major players like Oculus VR LLC (Meta Platform Technologies), Sony Corporation, Samsung Electronics Co. Ltd, Lenovo Group Ltd, and Pico Interactive Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- November 2023 - Samsung Electronics Co. Ltd announced plans to launch its upcoming mixed-reality headset in the second half of 2024 alongside the Galaxy Z Flip6 and the Galaxy Z Fold6. According to the company, Samsung is working on a mixed-reality headset in partnership with Google and Qualcomm.

- September 2023 - Oculus VR LLC announced a new partnership program with 15 US universities teaching immersive technology. Every university is hosting virtual reality classrooms and exercises to explore how immersive technology may advance the future of education.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

- 4.3.1 Sharp Decline in Demand Observed in the Enterprise Segment

- 4.3.2 The Gaming Segment to be at the Forefront of Growth in the Upcoming Months

- 4.3.3 Rise in Telehealth-based Implementation to Drive Growth in the Healthcare Segment

- 4.3.4 How Does VR Stack Up Against AR in Terms of the Relative Impact

- 4.4 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of AR/VR in Commercial Application

- 5.1.2 Increasing Demand for VR Setup for Training Across Various End-user Segments

- 5.1.3 Technological Advancements, Networking, and Connectivity Improvements

- 5.2 Market Challenges/Restraints

- 5.2.1 Health Risks from Using AR/VR Headsets in the Longer Run

- 5.2.2 Development Complexity and High Cost of AR/VR Devices

- 5.2.3 Cybersecurity and Data Privacy Issues

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Hardware

- 6.1.1.1 Tethered HMD

- 6.1.1.2 Standalone HMD

- 6.1.1.3 Screenless Viewer

- 6.1.2 Software

- 6.1.1 Hardware

- 6.2 By End-user Vertical

- 6.2.1 Gaming

- 6.2.2 Media and Entertainment

- 6.2.3 Retail

- 6.2.4 Healthcare

- 6.2.5 Military and Defense

- 6.2.6 Real Estate

- 6.2.7 Education

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 AUGMENTED REALITY (AR) MARKET SEGMENTATION

- 7.1 By Type

- 7.1.1 Hardware

- 7.1.2 Software

- 7.2 By End-user Vertical

- 7.2.1 Gaming

- 7.2.2 Media and Entertainment

- 7.2.3 Retail

- 7.2.4 Healthcare

- 7.2.5 Military and Defense

- 7.2.6 Real Estate

- 7.2.7 Education

- 7.3 By Geography

- 7.3.1 North America

- 7.3.2 Europe

- 7.3.3 Asia

- 7.3.4 Australia and New Zealand

- 7.3.5 Latin America

- 7.3.6 Middle East and Africa

8 MIXED REALITY (MR) MARKET SEGMENTATION

- 8.1 By End-user Vertical

- 8.1.1 Gaming

- 8.1.2 Media and Entertainment

- 8.1.3 Retail

- 8.1.4 Healthcare

- 8.1.5 Military and Defense

- 8.1.6 Real Estate

- 8.1.7 Education

- 8.2 By Geography

- 8.2.1 North America

- 8.2.2 Europe

- 8.2.3 Asia

- 8.2.4 Australia and New Zealand

- 8.2.5 Latin America

- 8.2.6 Middle East and Africa

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles

- 9.1.1 Oculus VR LLC

- 9.1.2 Sony Corporation

- 9.1.3 Samsung Electronics Co. Ltd

- 9.1.4 Lenovo Group Ltd

- 9.1.5 Pico Interactive Inc.

- 9.1.6 Qualcomm Technologies Inc.

- 9.1.7 FOVE Inc.

- 9.1.8 Unity Technologies Inc

- 9.1.9 Unreal Engine (Epic Games Inc.)

- 9.1.10 DPVR (Lexiang Technology Co. Ltd)

- 9.1.11 Autodesk Inc.

- 9.1.12 Eon Reality Inc.

- 9.1.13 3D Systems Corporation

- 9.1.14 Dassault Systemes SE

- 9.1.15 HTC Vive (HTC Corporation)

- 9.1.16 Google LLC (Alphabet Inc.)

- 9.1.17 Seiko Epson Corporation

- 9.1.18 Vuzix Corporation

- 9.1.19 Realwear Inc.

- 9.1.20 Dynabook Americas Inc. (Sharp Corporation)

- 9.1.21 Niantic Inc.

- 9.1.22 Optinvent

- 9.1.23 Atheer Inc.

- 9.1.24 Blippar.com Ltd

- 9.1.25 PTC Inc.

- 9.1.26 Ultraleap Limited

- 9.1.27 Wikitude GmbH

- 9.1.28 TechSee Augmented Vision Ltd

- 9.1.29 Microsoft Corporation

- 9.1.30 HP Development Company LP

- 9.1.31 Dell Technologies Inc.

- 9.1.32 AsusTek Computer Inc.

- 9.1.33 Acer Inc.

- 9.1.34 Magic Leap Inc.

- 9.1.35 Amber Garage (Holokit)

- 9.1.36 Barco

10 VENDOR MARKET SHARE

11 INVESTMENT ANALYSIS

12 FUTURE OF THE MARKET