PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521334

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521334

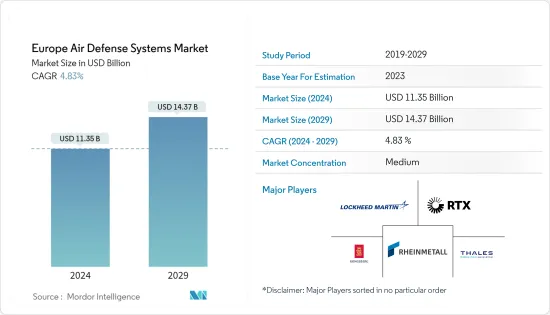

Europe Air Defense Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Europe Air Defense Systems Market size is estimated at USD 11.35 billion in 2024, and is expected to reach USD 14.37 billion by 2029, growing at a CAGR of 4.83% during the forecast period (2024-2029).

Key Highlights

- The geopolitical landscape influences the European air defense systems market, and rising security concerns drive the demand for advanced air defense capabilities. Technological advancements in radar systems, missile technologies, and C2 systems push the market in Europe. The need to counter aerial threats, including drones and hypersonic missiles, further stimulates investment in modern air defense systems across European nations.

- The ongoing Russia-Ukraine war has significantly impacted the Europe air defense systems market, restructured priorities, and accelerated defense expenditures. In 2024, there is a heightened awareness of the vulnerability of neighboring nations to sophisticated aerial threats. Countries affected by the war are expediting the deployment of modern radar technologies, missile defense systems, and integrated air defense solutions to enhance their ability to counter evolving threats. Countries like Poland, Finland, etc. have increased the budget for the procurement of air defense systems from foreign countries.

- The market is also witnessing collaborations between various countries in Europe for the development of new and technologically advanced air defense systems. This is also expected to help the market growth during the forecast period. However, the growth of the market in Europe is subjective to several associative factors, such as the allocation of funds, which can be adversely affected due to the projected onset of an economic turndown.

- Collaborative projects among European Union member countries and North Atlantic Treaty Organization (NATO) countries improve interoperability and resource sharing. The growing importance of multi-layered defense systems, including integrated air and missile defense, opens opportunities for industry players.

Europe Air Defense Systems Market Trends

Land-based Segment to Dominate Market Share During the Forecast Period

- Integrated air and missile defense systems deployed on land platforms play a critical role in safeguarding territorial boundaries. Countries are investing in radar systems, missile launchers, and C2 centers to establish a robust land-based air defense infrastructure. Land-based air defense is an important and effective means for neutralizing incoming aerial threats and plays a key role in any integrated air defense system.

- In this regard, several countries are procuring various types of threat detection and countermeasure systems for their armies. Moreover, several countries are developing or ordering advanced ground-launched lasers to neutralize aerial threats, which are scheduled to enter service during the forecast period.

- In January 2024, during a trial, a UK team led by MBDA achieved a groundbreaking milestone by successfully destroying an aerial target for the first time using a high-power shot with its DragonFire laser. This trial, utilizing a direct-energy weapon, marks a significant step forward in the deployment of the system, scheduled to be operational by 2029. Both the UK Royal Army and the Royal Navy have expressed interest in incorporating laser technology for air defense. The UK Ministry of Defence (MoD) plans to finalize the retrofit of a 150-kilowatt-class laser directed-energy weapon for the new Type 26 frigates, with the process set to commence in the early 2030s.

Russia to Dominate Market Share During the Forecast Period

- Russia is one of the top five defense spenders in the world. The country's massive investments in the defense sector are propelling the indigenous air defense system development programs. The ongoing war with Ukraine has had a profound impact on the Russian air defense systems market. Russia has intensified its focus on bolstering its air defense capabilities. The country has accelerated the deployment of advanced missile systems, radar technologies, and anti-aircraft missiles to enhance its defensive posture.

- Russia with its vast territory and geopolitical influence, Russia invests heavily in modernizing its defense capabilities. The deployment of advanced missile systems, radars, and anti-aircraft weaponry contributes to the overall growth of the European air defense market.

- However, the war has strained Russia's resources, as the increased demand for defense capabilities requires substantial financial investments. Economic pressures from the war, coupled with potential sanctions, may affect the sustained growth of Russia's air defense market for the long term. Additionally, geopolitical tensions have impacted collaborative opportunities with other European nations, leading to a more competitive landscape.

- As of January 2024, Russia began installing S-300 air defense systems around St. Petersburg after Ukrainian drones struck military targets in the surrounding Leningrad Oblast. Russian experts claim that the S-500 can even target satellites in low-earth orbit and fifth-generation stealth aircraft, in addition to its primary targets of cruise and ballistic missiles.

Europe Air Defense Systems Industry Overview

The Europe air defense systems market is semi-consolidated and marked by the presence of prominent players such as RTX Corporation, Rheinmetall AG, THALES, Lockheed Martin Corporation, and Kongsberg Gruppen ASA, among others.

The market is witnessing a significant investment in research and development of advanced air-defense systems from several countries across Europe. The air-defense systems manufacturers are collaborating, forming joint ventures for the sharing of technology and expertise, which will help them develop sophisticated systems in the future, which, in turn, will help them attract new customers and increase their market presence and share in the region during the forecast period.

For instance, in January 2024, Germany sanctioned USD 1.33 billion for the development of prototypes of an air defense system designed for close and immediate area protection, utilizing the Boxer IFV as its foundation. The envisioned air defense system includes essential components such as a command post, fire control tanks, radar devices, and anti-aircraft missile tanks.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Platform

- 5.1.1 Air-based

- 5.1.2 Sea-based

- 5.1.3 Land-based

- 5.2 Geography

- 5.2.1 United Kingdom

- 5.2.2 France

- 5.2.3 Germany

- 5.2.4 Italy

- 5.2.5 Russia

- 5.2.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 RTX Corporation

- 6.1.2 Rheinmetall AG

- 6.1.3 MBDA

- 6.1.4 THALES

- 6.1.5 Lockheed Martin Corporation

- 6.1.6 Saab AB

- 6.1.7 Kongsberg Gruppen ASA

- 6.1.8 Leonardo S.p.A.

- 6.1.9 Northrop Grumman Corporation

- 6.1.10 Almaz - Antey Air and Space Defence Corporation

- 6.1.11 The Boeing Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS