PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521315

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1521315

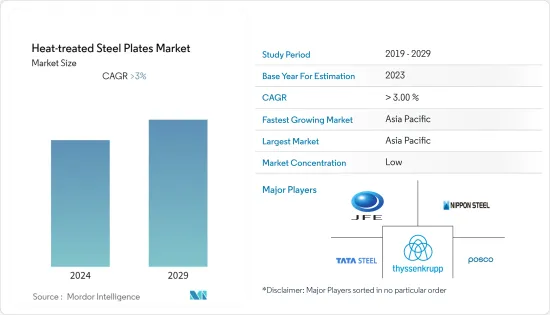

Heat-treated Steel Plates - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Heat-treated Steel Plates Market size is estimated at USD 7.33 billion in 2024, and is expected to reach USD 9.02 billion by 2029, growing at a CAGR of greater than 4% during the forecast period (2024-2029).

The market was significantly impacted by COVID-19 in 2020. Several countries were forced to go in lockdown owing to the pandemic scenario, which led to a shutdown of manufacturing facilities of almost every industry worldwide for a specified time. Disruption of industrial production impacted metals production, especially steel production. Furthermore, the building and construction industry experienced a temporary slowdown during the period. Currently, the market has recovered from the pandemic and is growing at a significant rate. COVID-19 negatively impacted the market in 2020. However, the market reached pre-pandemic levels in 2022 and is expected to grow steadily in the future.

Key Highlights

- The increasing applications in the production of heavy machinery and growing demand from the construction industry in developing countries are driving the market growth.

- Fluctuating raw material prices is expected to hinder the market growth for heat-treated steel plates.

- Increasing application in the energy and power sector is expected to act as an opportunity in the future.

- Due to rapid industrialization and the growing construction sector, the Asia-Pacific region is expected to dominate the heat-treated steel plates market, globally.

Heat-Treated Steel Plates Market Trends

Growing Applications for Machinery Production

- Heat-treated steel plates are used to improve the mechanical and chemical properties of steel without changing any original characteristics. Hence, they are being used by various end-user industries.

- The demand from the automobile and industrial machinery has been growing because of heat-treated steel plate properties. Among all the types of steel, carbon steel has a major share and is used in different applications.

- Heat-treated steel plates are employed to produce machinery equipment, such as gear teeth profile, crane cable drum, gear wheel, brake drum, machines worm steel, flywheel, railway wheels, crankshaft, hydraulic clutches, electric transmission lines, boiler mountings, etc.

- The Department for Promotion of Industry and Internal Trade in India proposed investment value of nearly INR 25 billion (~ USD 320 million) in 2022 towards the industrial machinery sector, a significant increase of nearly 29% compared to previous year.

- Further, in China, several investment and expansion have been made to meet the developing need of speacialist machinery. For example, Naipu Mining Machinery, a Chinese manufacturer of mining equipment in October 2022, announced the investment of USD 25 million to set up a wholly owned subsidiary in Serbia and build a production base in the country.

- Overall, increasing applications for industrial machinery and a decrease in demand in developing regions are expected to impact the demand for heat-treated steel plates through the years to come.

Asia-Pacific to Dominate the Market

- Asia-Pacific region is expected to dominate the global market owing to the highly developed manufacturing sector in China, Japan, and India, coupled with the continuous investments done in the region to advance the automotive, construction, energy, and power sector through the years.

- The demand from the energy and power sector has been growing significantly in recent years. Heat-treated steel plates are being used for boilers, storage tanks, pressure vessels, and other structural parts most commonly used in hydropower stations, nuclear, and other energy generation plants.

- The Asia-Pacific thermal sector is registering growth, with China primarily driving the growth of the sector. China has the most coal-fired power plants of any country or territory in the world. On the Chinese Mainland as of July 2022, there were 1,118 operational coal power plants. This is approximately four times the number of such power plants in India, which came in second place. China accounts for more than half of worldwide coal electricity generation.

- China, under its 14th Five-Year Plan (2021-2025), has set the target for coal-power capacity to about 1,100 GW. Thus, the network operator, State Grid, and the China Electricity Council have been targeting to develop hundreds of new coal-fired power stations in the country. The country has been looking forward to developing power plants despite overcapacity in the sector, where more than half of the coal-power plants have been witnessing loss, and few plants have been running at less than 50% of their capacity.

- Moreover, the construction industry in Asia-Pacific has constantly been growing. India, Japan, and China have witnessed decent growth in recent years.

- In Japan, according to the Ministry of Land, Infrastructure, Transport, and Tourism (MLIT) Japan, in 2022, approximately 859.5 thousand housing developments were initiated in Japan, which represented an increase of 0.4% compared to the previous year.

- Redevelopment projects in the country have been one of the prominent contributors to the growth of the market. For instance, the Yaesu redevelopment project, which includes office, hotel, residential, retail, and educational facilities, is due to be completed by 2023. Other projects include the Shibaura chrome redevelopment and the new Shimbashi building redevelopment with office, retail, and residential spaces.

- With the rapid growth of industrialization, increasing usage of machinery equipment, and construction industries in developing countries, the rising power generation plants are expected to drive the market for heat-treated steel plates in Asia-Pacific through the years to come.

Heat-Treated Steel Plates Industry Overview

The heat-treated steel plates market is partly fragmented in nature. The major players in the studied market (not in any particular order) include POSCO, NIPPON STEEL CORPORATION, TATA STEEL LIMITED, JFE Mineral & Alloy Company,Ltd., and thyssenKrupp Steel Europe, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Applications in Machinery Production

- 4.1.2 Growing Demand from Construction Industry in Developing Countries

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Fluctuating Raw Material Prices

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Steel Type

- 5.1.1 Carbon Steel

- 5.1.2 Stainless Steel

- 5.1.3 Alloy Steel

- 5.2 By Heat Treatment Type

- 5.2.1 Annealing

- 5.2.2 Tempering

- 5.2.3 Normalizing

- 5.2.4 Quenching

- 5.3 By End-user Industry

- 5.3.1 Automotive and Heavy Machinery

- 5.3.2 Building and Construction

- 5.3.3 Ship Building and Off-Shore Structures

- 5.3.4 Energy and Power

- 5.3.5 Others (Metalworking, Transportation, etc.)

- 5.4 By Geography

- 5.4.1 Asia Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 NORDIC

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Nigeria

- 5.4.5.4 Qatar

- 5.4.5.5 Egypt

- 5.4.5.6 UAE

- 5.4.5.7 Rest of Middle-East and Africa

- 5.4.1 Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ArcelorMittal

- 6.4.2 Baosteel Group

- 6.4.3 HYUNDAI STEEL

- 6.4.4 JFE Mineral & Alloy Company,Ltd.

- 6.4.5 NIPPON STEEL CORPORATION

- 6.4.6 NUCOR

- 6.4.7 Outokumpu

- 6.4.8 POSCO

- 6.4.9 TATA STEEL LIMITED

- 6.4.10 thyssenKrupp Steel Europe

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Applications in Energy and Power

- 7.2 Other Opportunities