PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687897

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687897

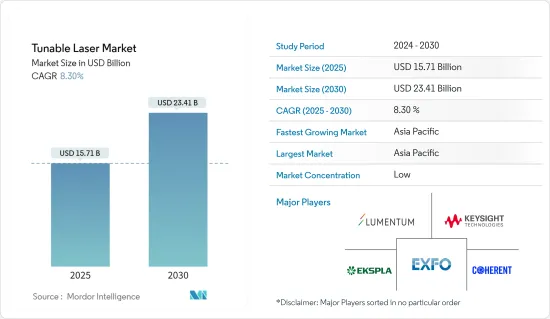

Tunable Laser - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Tunable Laser Market size is estimated at USD 15.71 billion in 2025, and is expected to reach USD 23.41 billion by 2030, at a CAGR of 8.3% during the forecast period (2025-2030).

Tunable lasers possess the ability to emit light at different wavelengths, making them very versatile. This flexibility enables them to adapt to various applications like spectroscopy, material processing, optical communications, etc. These lasers can be fine-tuned to match the specific requirements, providing robust control and precision. The lasers can emit a broad spectrum, from ultraviolet to infrared, allowing for a multitude of applications.

Key Highlights

- Tunable lasers offer high resolution, allowing researchers to precisely study minute details. This level of resolution is crucial in fields like microscopy, where the ability to focus on specific structures or cells is paramount. By adjusting the laser's wavelength, efficient detail and clarity can be achieved.

- Tunable lasers offer cost-effective solutions in various industries. Compared to traditional fixed-wavelength lasers, tunable lasers eliminate the need for multiple lasers to cover a wide range of wavelengths. This consolidation reduces costs associated with maintenance, calibration, and power consumption.

- Additionally, the ability to reconfigure the laser's output wavelength eliminates the need for expensive hardware upgrades, making these lasers a more economical choice in the long run. They also offer high energy efficiency by converting the input energy into useful output light. This efficiency reduces power consumption, making tunable lasers an environmentally friendly choice.

- Tunable lasers are also being integrated with other technologies, such as optical fibers and integrated photonics. Combining these technologies allows tunable lasers to enable more complex and integrated systems. Further, the integration of tunable lasers with artificial intelligence (AI) holds great potential for optimizing laser performance. AI can be employed to automate the tuning process, enhance stability, and optimize laser parameters based on specific applications. This integration could enable more efficient and intelligent control of tunable lasers.

- However, the high initial cost associated with tunable lasers is one of the primary market restraints. The extensive R&D required to manufacture these lasers results in expensive production processes, making them unaffordable for many potential buyers. The high cost restricts the market to a niche customer base and limits the adoption of tunable lasers in various industries.

- Moreover, it presented new opportunities for growing data generation due to the increase in remote working environments. The remote working environment is leading to the growth in hyper-scale data centers, creating a need for efficient networking. Tunable lasers are essential for precise wavelength control in WDM systems. As the number of optical channels increases and smaller channel spacing is required, highly accurate tuning and filtering become necessary. Tunable lasers are also used in multiplexing and capacity expansions, as well as parallel single-mode architectures, coherent systems, dense wavelength division multiplexing (DWDM), etc.

- Various data center vendors are consistently investing in new data centers in line with the insatiable need for data. According to the National Association of Software and Service Companies (NASSCOM), India's data center market investment is expected to reach USD 4.6 billion in 2025. India's higher cost efficiency in both development and operation is its most significant advantage compared to more mature markets. Currently, India's data centers are mostly located in Mumbai, Bengaluru, Chennai, Delhi (NCR), Hyderabad and Pune. Calcutta, Kerala, and Ahmedabad are the upcoming data center hubs. These growing data center market investments drive the demand for data center infrastructure, including IT, electrical, mechanical, and general construction services in India.

Tunable Laser Market Trends

Healthcare Sector to Witness Significant Growth

- The tunable lasers in the healthcare sector will witness high growth as they are used in various applications such as cancer treatment, acne treatment, cardiology, inflammatory skin disease, human papilloma, hemangiomas, dermatology, etc. In healthcare, tunable lasers enable non-invasive imaging modalities like optical coherence tomography for detailed tissue imaging.

- The tunable lasers uniquely adjust the output wavelength, enabling precise targeting of various medical procedures. The ability to customize these lasers plays an important role in applications such as dermatology, ophthalmology, and surgical procedures, allowing healthcare professionals to target specific tissue types with optimal precision.

- As technology advances, the tunable laser in the healthcare sector is witnessing significant growth, driven by increasing demand for minimally invasive procedures, improved diagnostic capabilities, and improved therapeutic outcomes. These lasers also find application in areas such as tattoo removal and retinal surgery, where their flexibility in wavelength selection is critical to achieving optimal clinical results.

- The expanding scope of medical applications and the continual refinement of laser technologies will drive the market's growth. Moreover, through ongoing research and development, there is potential to incorporate advanced features such as real-time image control and automatic wavelength selection, further improving the efficiency and safety of medical procedures.

- The increasing prevalence of chronic diseases and the aging of the global population are leading to increased demand for innovative medical technologies, thus propelling the market's growth during the projected timeline. As per the report published by the National Center for Biotechnology Information, 1,958,310 new cancer cases and 609,820 cancer deaths are predicted in the United States in fiscal year 2023. The rising number of cancer patients increases the demand for medical imaging, thus driving the market's growth.

- Moreover, increasing healthcare expenditure and investments across various regions to improve healthcare infrastructure may create demand in the market studied. For instance, according to CMS, projected U.S. personal healthcare expenditure, both in total and per capita, is set to see significant growth from 2000 to 2031. By 2031, the nation's total healthcare spending is forecasted to hit a staggering USD six trillion, with per capita expenditure anticipated to increase to USD 17,178.

- In May 2023, the government of the United Kingdom announced the building of five more significant hospitals in the country as a part of the new hospital program. Through this initiative, the government aims to protect patients' and staff safety, and it is expected to be backed by over EUR 20 billion (USD 21.45 billion) of investments in hospital infrastructure. These five hospitals urgently need refurbishment and will be prioritized so patients and staff can benefit from sizeable new hospital buildings equipped with the latest technology.

Asia-Pacific to Hold Major Share

- Asia-Pacific is a major consumer and producer of laser technologies, including tunable lasers. In some major countries, such as China, South Korea, Taiwan, Japan, etc., raw materials are highly available for manufacturing laser solutions, especially tunable lasers highly dependent on semiconductors and electronic components (such as solid-state lasers.). Asia-Pacific is a major importer for many companies manufacturing tunable laser solutions abroad.

- NTT India has allocated around USD 2 billion to improve the nation's information and communications technology infrastructure over the next three to four years to capitalize on the surge in data usage. The main areas where NTT India's capex is planned include new data centers, cloud computing, submarine cable landing stations, and solar parks.

- Moreover, the increasing government initiatives and companies' investment in data centers further boost market growth. Tunable lasers are critical enablers of modern data centers, supporting the rapid and efficient flow of data that powers the digital world. As data center demand continues to grow, the role of these miniature light sources is only expected to become more prominent, driving further innovation and advancements in high-speed data communication.

- These lasers are increasingly used in material processing applications such as drilling, welding, and cutting various materials with high precision. The increasing government initiatives to boost the manufacturing sector further boost the market growth.

Tunable Laser Market Overview

As there are many global and regional players in the industry, the global market for the tunable laser is expected to be fragmented. Lumentum Operations LLC (Lumentum Holdings Inc.), Coherent, Inc., EKSPLA (EKSMA Group), EXFO Inc., and Keysight Technologies Inc. are some of the major players in the market. All these players are involved in competitive strategic developments such as partnerships, new product innovation, and market expansion to gain leadership positions in the global tunable laser market.

- In January 2024, EKSPLA strengthened its global network of over 25 distributors to fortify its market presence worldwide. Its electronic products have been popular amongst the United States laser manufacturers for 20+ years straight, and they are currently seeking more partners to represent and distribute its OEM laser electronics in the United States and Canada.

- In January 2024, TOPTICA Photonics AG announced that its French subsidiary TOPTICA Photonics SAS would take over the sales of TOPTICA products in France to strengthen the collaboration between French scientific or industrial customers and TOPTICA by offering a direct link between the partners. TOPTICA Photonics SAS would also distribute products from HighFinesse GmbH, a valued partner of TOPTICA, and complement the TOPTICA lasers with wavelength meters and other optical analyzers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 Technology Snapshot

- 5.1 By Type

- 5.1.1 C-wave

- 5.1.2 Other Types

6 MARKET DYNAMICS

- 6.1 Market Drivers

- 6.1.1 Increased Demand for Tunable Diode Laser Gas Analyzer

- 6.1.2 Demand for Spectroscopy Equipment in Life Science Study

- 6.2 Market Restraints

- 6.2.1 Complexity in System Design and Function

7 MARKET SEGMENTATION

- 7.1 By End-User Industry

- 7.1.1 Manufacturing and Industrial Sector

- 7.1.2 Telecommunication and Networking Devices Sector

- 7.1.3 Healthcare Sector

- 7.1.4 Other End-user Industries

- 7.2 By Geography

- 7.2.1 North America

- 7.2.2 Europe

- 7.2.3 Asia

- 7.2.4 Australia and New Zealand

- 7.2.5 Latin America

- 7.2.6 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Lumentum Operations LLC (Lumentum Holdings Inc.)

- 8.1.2 Coherent Inc.

- 8.1.3 EKSPLA (EKSMA Group)

- 8.1.4 EXFO Inc.

- 8.1.5 Keysight Technologies Inc.

- 8.1.6 HBNER GmbH & Co. KG

- 8.1.7 Sacher Lasertechnik

- 8.1.8 Newport Corporation (MKS Instruments Inc.)

- 8.1.9 Santec Corporation

- 8.1.10 Thorlabs Inc.

- 8.1.11 TOPTICA Photonics AG

9 INVESTMENT ANALYSIS

10 MARKET OPPORTUNITIES AND FUTURE TRENDS