Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1519931

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1519931

GCC Structural Steel Fabrication - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

PUBLISHED:

PAGES: 150 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

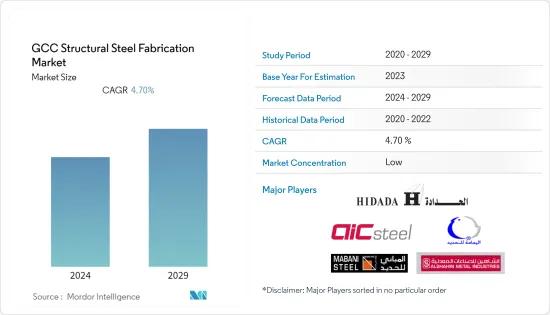

The GCC Structural Steel Fabrication Market is expected to register a CAGR of greater than 4% during the forecast period.

Key Highlights

- With Saudi Arabia leading the way, followed by the United Arab Emirates, the market for structural steel production in the Gulf Cooperation Council is expected to grow strongly. Significant investments in infrastructure development, construction projects, and the development of waterfront cities have contributed to this growth. Moreover, the growing population of the Gulf Cooperation Council region has led to an increased focus on green building practices.

- Over the years, several factors have contributed to the growth of the Gulf Cooperation Council's iron and steel market, including increased infrastructure development, an increase in population, and urbanization.

- Annual demand for flat and long steel in GCC countries is expected to reach 38 million tonnes by 2030. There has been a significant increase in population and urbanization in GCC countries. The demand for structural steel is driven by a growing population and urbanization, which has increased housing demand.

- In the United Arab Emirates, the demand for structural steel has seen substantial growth, particularly in the realms of residential housing, commercial establishments, and infrastructure development projects. The use of structural steel enables rapid construction, a crucial factor in meeting the country's accelerated urbanization and infrastructure needs.

- Supported by the country's strong development agenda, including the Projects of the 50 initiative and a subsequent focus on industrial, transportation, and energy infrastructure with the aim of attracting nearly USD 150 billion in foreign direct investment by 2030, the UAE construction sector is expected to thrive at an encouraging pace.

GCC Structural Steel Fabrication Market Trends

Construction Industry is Dominating the Market

- The booming construction sector in the Gulf Cooperation Council, which is undoubtedly driven by an increase in the total value of contracts awarded in the Kingdom of Saudi Arabia and the United Arab Emirates over the past few years, has and continues to offer a wide range of opportunities for stakeholders at all levels.

- In the Digital Construction Hub Projects Awards Tracker, the value of construction projects awarded in the Gulf Cooperation Council, including buildings, infrastructure, and industry, increased in the second quarter of 2023.

- The Omani projects market recorded USD 20 billion in awarded construction contracts, overtaking the United Arab Emirates (USD 9.8 billion) and Saudi Arabia (USD 8.9 billion). Although higher oil prices contributed to the overall growth in this segment of the Gulf Cooperation Council projects market during the second quarter of 2023, Oman's clean energy plans have significantly increased project award rates.

- In absolute terms, in the next two and five years, the United Arab Emirates is expected to have a project pipeline of USD 29 billion and USD 199 billion, respectively. Compared to Saudi Arabia's USD 521 billion and Qatar's USD 53 billion in the same period, these figures are significant.

UAE is Dominating the Market

- In 2023, steel demand in the United Arab Emirates was expected to increase by almost 15% due to strong oil prices and a recovery in construction. The demand for steel increased from approximately 2.13 million tonnes in 2022 to about 2.5 million by 2023 as the Middle East's second-biggest economy grew. The increase is mainly driven by high oil prices, an upswing in the country's construction sector, and increased trade with the United Arab Emirates.

- Most of its steel and steel products are imported from the United Arab Emirates. The country is constrained by its steel production and uses imports to meet demand for a large part. China, India, South Korea, and Ukraine are the primary sources of steel imports. Hot-rolled coils, rebars, steel rods, and plates are the most common steel imports.

- The United Arab Emirates intends to increase its steel production capacity by more than 60% to 15 million tonnes per year by 2030 to meet rising demand. New mills and production methods will increase supply, such as directly reducing iron DRI. To build a sustainable and competitive steel industry, the United Arab Emirates aims to be one of the world's foremost trade centers for steel.

- An increase in the construction sector leads to an increase in the structural steel fabrication market. Examples of new construction include Etihad Rail, which is a 1,200-km network that will extend across the United Arab Emirates from the Saudi border to Oman. With a cost of Dh 40 billion (USD 10.89 billion), the project benefits will be visible over the longer term. Annually, the project is expected to serve 16 million passengers and 50 million tonnes of freight.

- Abu Dhabi Midfield Terminal- The trial operations at the much-awaited facility have started. Once open, the terminal buildings are expected to accommodate up to 11,000 passengers per hour or around 45 million passengers annually. The country's latest tourism numbers suggest a massive uptick in foreign visitor arrivals.

GCC Structural Steel Fabrication Industry Overview

The report covers the major players operating in the GCC structural steel fabrication market. The companies in the region compete heavily with no major share as the market is occupied by small and medium-sized players; hence, the market is highly competitive and fragmented.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 66674

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 MARKET INSIGHTS AND DYNAMICS

- 3.1 Market Overview

- 3.2 Market Drivers

- 3.2.1 Increasing Construction Spending in Emerging Economies

- 3.3 Market Challenges

- 3.3.1 Demand of Skilled Professional in Steel Fabrication Process

- 3.4 Market Opportunities

- 3.4.1 Rising Demand for Prefabricated Buildings

- 3.5 Value Chain / Supply Chain Analysis

- 3.6 Industry Attractiveness - Porter's Five Force Analysis

- 3.6.1 Threat of New Entrants

- 3.6.2 Bargaining Power of Buyers/Consumers

- 3.6.3 Bargaining Power of Suppliers

- 3.6.4 Threat of Substitute Products

- 3.6.5 Intensity of Competitive Rivalry

- 3.7 Technological Snapshot

- 3.8 Government Regulations and Key Initiatives

- 3.9 Impact of COVID-19 on the Market

4 MARKET SEGMENTATION

- 4.1 By End-user Industry

- 4.1.1 Manufacturing

- 4.1.2 Power and Energy

- 4.1.3 Construction

- 4.1.4 Oil and Gas

- 4.1.5 Other End-user Industries

- 4.2 By Product Type

- 4.2.1 Heavy Sectional Steel

- 4.2.2 Light Sectional Steel

- 4.2.3 Other Product Types

- 4.3 By Country

- 4.3.1 Saudi Arabia

- 4.3.2 United Arab Emirates

- 4.3.3 Qatar

- 4.3.4 Rest of GCC

5 COMPETITVE LANDSCAPE

- 5.1 Market Competition Overview

- 5.2 Key Company Profiles

- 5.2.1 Hidada Ltd Company

- 5.2.2 Arabian International Company For Steel Structures

- 5.2.3 Al Yamamah Steel Industries Co.

- 5.2.4 Mabani Steel LLC

- 5.2.5 Al Shahin Company For Metal Industries

- 5.2.6 IMCC

- 5.2.7 Standard Steel Fabrication Co. LLC

- 5.2.8 Techno Steel

- 5.2.9 Aarya Engineering

- 5.2.10 Vogue Steel LLC*

- 5.3 Other Companies

6 FUTURE MARKET OUTLOOK

7 APPENDIX

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.