PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851036

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851036

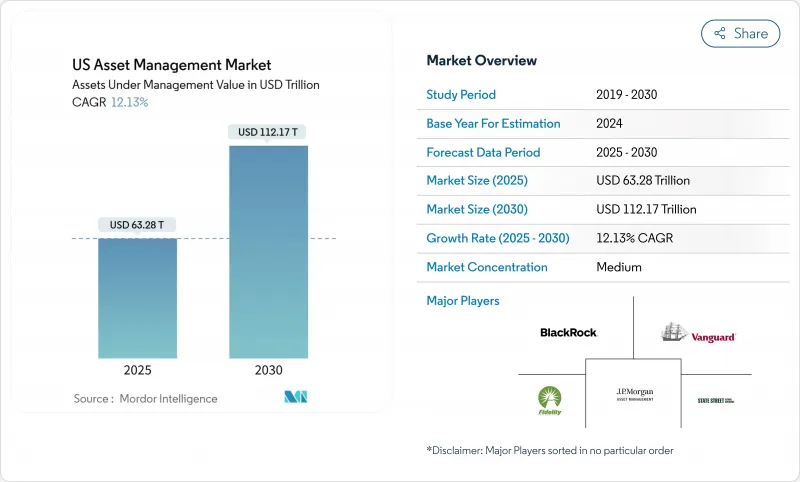

US Asset Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The US asset management market is valued at USD 63.28 trillion in 2025 and is forecast to expand to USD 112.17 trillion by 2030, reflecting a 12.13% CAGR.

Growth is rooted in rapid adoption of AI-driven portfolio automation, the rising influence of tokenized private assets, and the redeployment of excess defined-benefit pension capital into outsourced CIO mandates. Established firms confront pressure from fintech entrants that promise granular personalization at scale, while the ongoing migration from mutual funds to exchange-traded funds reshape fee dynamics. Corporate surpluses, booming high-net-worth liquid balances, and regulatory nudges toward emergency-savings vehicles collectively widen the US asset management market opportunity set.

US Asset Management Market Trends and Insights

AI-driven portfolio automation & real-time analytics adoption

Artificial intelligence has transitioned from being an experimental pilot to becoming an operational core, with a significant majority of asset managers either deploying or planning AI tools in portfolio construction in the near future. Predictive analytics, sentiment scraping, and alternative data ingestion sharpen trade timing and risk control, while firms such as JPMorgan and Goldman Sachs report measurable revenue gains from AI-enabled cross-selling. Hyper-personalized model portfolios that adjust in real time have raised client retention metrics and freed advisers to handle larger books. The competitive moat now rests on algorithm transparency and proprietary data pipelines rather than simple scale. As natural-language interfaces mature, the US asset management market expects client-facing tools to offer conversational explanations of strategy shifts in plain English, narrowing the perception gap between human and machine advice.

Democratization of private markets via tokenized/interval funds

Tokenization shrinks minimum tickets and adds programmable liquidity, allowing retail investors to access private equity, real estate, and credit strategies once restricted to institutions. Major sponsors tout blockchain's immutable audit trail as a compliance aid, while distributors view fractional shares as an education bridge for newer investors. For the US asset management market, this driver opens fee-resilient revenue streams uncorrelated with headline equity benchmarks.

Rising regulatory & cybersecurity compliance costs

A shifting SEC agenda now centers on custody safeguards, AI governance, and outsourcing oversight, adding specialist staff and technology outlays that weigh most heavily on mid-size advisers. The formation of a dedicated crypto-asset task force foreshadows new rules that will raise onboarding and transaction-monitoring complexity for tokenization initiatives. At the same time, cyber-threat vectors multiply as advisers integrate third-party data feeds and remote-work endpoints, forcing multi-factor authentication upgrades and red-team testing.

Other drivers and restraints analyzed in the detailed report include:

- Corporate-pension surplus redeployment to OCIO mandates

- Workplace emergency-savings programs boosting cash AUM

- Ongoing fee compression from passive & robo propositions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Equity retained a 44.5% US asset management market share in 2024 on the strength of AI-centric mega-caps, while fixed income regained relevance as yields reset upward. Alternative assets are forecasted to grow at a 14.67% CAGR between 2025 and 2030, faster than any core class in the US asset management market. Private-equity allocations targeting technology, healthcare, and renewables averaged 10.5% annualized returns through 2024, drawing incremental pension and family-office flows.

Tokenization lowers barriers for individual investors to participate in private credit and real estate investments, making alternatives a major on-ramp for retail diversification. Infrastructure deals tied to energy transition and digitization themes supply duration-matched cash flows for insurers managing long-dated liabilities.

Wealth advisory firms controlled 33.5% of the US asset management market in 2024 and benefit from a 13.83% CAGR outlook. Broker-dealers respond by shifting from commission to advisory pricing while banks cross-sell managed portfolios through digital branches.

Fiduciary duty underpins the RIA value proposition, and around 79% of wealth managers expect AI to lift earnings by enriching client engagement. Expanded menus include private credit and direct indexing, enabling differentiated tax outcomes. Should advisor headcount fall by up to 110,000 over the next decade, firms that automate plan diagnostics and account aggregation will widen their share within the US asset management market.

The US Asset Management Market is Segmented by Asset Class (Equity, Fixed Income, Alternative Assets, and Other Asset Classes), by Firm Type (Broker-Dealers, Banks, Wealth Advisory Firms, and Other Firm Types), by Mode of Advisory (Human Advisory and Robo-Advisory), by Client Type (Retail and Institutional), and by Management Source (Offshore and Onshore). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Vanguard Group

- BlackRock Inc.

- Fidelity Investments

- State Street Global Advisors

- J.P. Morgan Asset Management

- Goldman Sachs Asset Management

- Charles Schwab Asset Management

- Invesco Ltd.

- T. Rowe Price

- Capital Group

- BNY Mellon Investment Management

- Franklin Templeton

- Dimensional Fund Advisors

- Northern Trust Asset Management

- Wellington Management

- PIMCO

- Nuveen (TIAA)

- Brookfield Asset Management

- AllianceBernstein

- Apollo Global Management

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 AI-driven portfolio automation & real-time analytics adoption

- 4.2.2 Expansion of HNW & mass-affluent investable assets

- 4.2.3 Democratisation of private markets via tokenised/interval funds

- 4.2.4 Corporate?pension surplus redeployment to OCIO mandates

- 4.2.5 Active-ETF wrapper migration unlocking tax-efficient flows

- 4.2.6 Workplace emergency-savings programmes boosting cash AUM

- 4.3 Market Restraints

- 4.3.1 Rising regulatory & cyber-security compliance costs

- 4.3.2 Ongoing fee compression from passive & robo propositions

- 4.3.3 Distribution-platform concentration squeezing mid-size firms

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Asset Class

- 5.1.1 Equity

- 5.1.2 Fixed Income

- 5.1.3 Alternative Assets

- 5.1.4 Other Asset Classes

- 5.2 By Firm Type

- 5.2.1 Broker-Dealers

- 5.2.2 Banks

- 5.2.3 Wealth Advisory Firms

- 5.2.4 Other Firm Types

- 5.3 By Mode of Advisory

- 5.3.1 Human Advisory

- 5.3.2 Robo-Advisory

- 5.4 By Client Type

- 5.4.1 Retail

- 5.4.2 Institutional

- 5.5 By Management Source

- 5.5.1 Offshore

- 5.5.2 Onshore

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for Key Companies, Products & Services, and Recent Developments)

- 6.4.1 Vanguard Group

- 6.4.2 BlackRock Inc.

- 6.4.3 Fidelity Investments

- 6.4.4 State Street Global Advisors

- 6.4.5 J.P. Morgan Asset Management

- 6.4.6 Goldman Sachs Asset Management

- 6.4.7 Charles Schwab Asset Management

- 6.4.8 Invesco Ltd.

- 6.4.9 T. Rowe Price

- 6.4.10 Capital Group

- 6.4.11 BNY Mellon Investment Management

- 6.4.12 Franklin Templeton

- 6.4.13 Dimensional Fund Advisors

- 6.4.14 Northern Trust Asset Management

- 6.4.15 Wellington Management

- 6.4.16 PIMCO

- 6.4.17 Nuveen (TIAA)

- 6.4.18 Brookfield Asset Management

- 6.4.19 AllianceBernstein

- 6.4.20 Apollo Global Management

7 Market Opportunities & Future Outlook

- 7.1 White-space & unmet-need assessment