Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1639512

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1639512

Middle East And Africa Combined Heat And Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 110 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

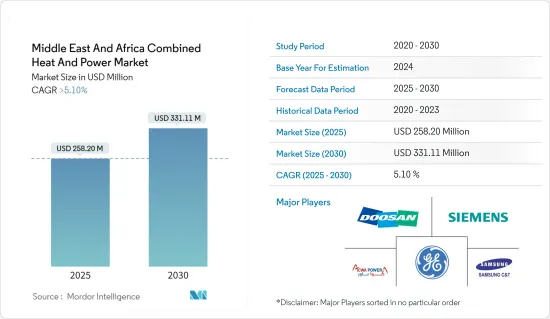

The Middle East And Africa Combined Heat And Power Market size is estimated at USD 258.20 million in 2025, and is expected to reach USD 331.11 million by 2030, at a CAGR of greater than 5.1% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the increasing industrial development coupled with demand for energy efficiency is expected to drive the market during the forecast period.

- On the other hand, increasing penetration of renewable energy sources such as solar energy is expected to hinder the growth of the market during the forecasted period.

- Nevertheless, the ability of combined heat and power systems to be integrated with renewable energy sources is expected to create huge opportunities for the Middle-East and Africa Combined Heat and Power Market.

- Saudi Arabia is expected to be a dominant region for the market due to the increasing demand for energy in the region.

MEA Combined Heat & Power Market Trends

Biomass Expected to See Significant Market Growth

- The Middle-East and Africa's diverse biomass speed stock, including agricultural residues and organic waste, offers a locally sourced and renewable energy supply. This strategic alignment between regional resources and biomass fuel production bolsters its prominence as an optimal fuel option for combined heat and power systems.

- Moreover, the region's quest for energy security and reduced dependence on fossil fuels resonates profoundly with the attributes of biomass. The utilization of biomass addresses two critical imperatives: the efficient generation of electricity in heat and the mitigation of waste through organic waste to energy conversions.

- Biomass combined heat and power systems alliance seamlessly with the region's strategic goal of reducing carbon emissions and offering an avenue to diversify the energy mix and enhance energy to self-reliance.

- For instance, according to the Energy Institute Statistical Review Of World Energy 2023, biofuel consumption in the region increased by 9.3% between 2021 and 2022, while an annual average growth rate of 11.3% was recorded between 2012 and 2022. This signifies an increase in the consumption of biofuels in the region, which can be extrapolated to the increasing use of biofuels in the aviation industry.

- Furthermore, the societal and environmental benefits of biomass fuel underscore its dominance. Using biomass reduces greenhouse gas emissions and landfill waste, contributing to local and global sustainability objectives. As environmental consciousness gains traction, biomass emerges as a viable solution, elevating its appeal within the combined heat and power market.

- The dominance of biomass within the Middle East and Africa region is firmly rooted in regional resource availability, energy security imperatives, and sustainability aspirations. As the region embarks on a trajectory towards cleaner and more efficient energy systems, the integration of biomass as a primary fuel source for combined heat and power emerges as a transformative force poised to redefine energy generation, enhance environmental stewardship, and contribute significantly to the region's journey toward a more sustainable future.

- Therefore, as per the above points, the biomass fuel type is expected to dominate the combined heat and power market in Middle-East and Africa during the forecast period.

Saudi Arabia to Dominate the Market

- Saudi Arabia's approach to energy diversification and its commitment to reducing carbon emissions, enhancing energy security, and optimizing resource utilization aligns harmoniously with the attributes of combined heat and power systems. Saudi Arabia's expansive infrastructure, coupled with its ambition to maximize the value extracted from energy sources, establishes a favorable environment for the widespread adoption of combined heat and power solutions.

- According to the Energy Institute Statistical Review Of World Energy, the electricity generation in Saudi Arabia increased by 2.2% between 2021 and 2022, while an average annual growth rate of 3.6% was recorded between 2012 and 2022, signifying the increasing consumption of electricity in the country due to expanding infrastructure activities.

- Moreover, Saudi Arabia's robust industrial base fuels the demand for efficient energy solutions. The nation's burgeoning industries, from petrochemicals to manufacturing, necessitate electricity and thermal energy. Combined heat and power systems that capture and repurpose waste generated during electricity production offer a pragmatic approach to fulfill the dual energy requirements of industries, thereby enhancing operational efficiency and competitiveness.

- Furthermore, it moves the country's investment in innovation and technology to cement its dominance. Saudi Arabia's commitment to research and development, particularly in energy efficiency and sustainability, resonance with the innovation-driven attributes of combined heat and power systems. Integrating advanced technologies within combined heat and power solutions aligns seamlessly with Saudi Arabia's modernization and technological leadership pursuit.

- For instance, in September 2022, Doosan Energy, one of the central power generation EPC companies in South Korea, announced that it had been awarded a contract to develop a combined heat and power system project in Saudi Arabia. The USD 385 Million project is located in the Al Hofuf region in eastern Saudi Arabia. The project is expected to be completed in the fourth quarter of 2024.

- Therefore, per the above points, Saudi Arabia is expected to dominate the combined heat and power market of the Middle East and Africa during the forecasted period.

MEA Combined Heat & Power Industry Overview

The Middle-East and African combined heat and power market is moderately fragmented. Some of the key players in this market (in no particular order) include General Electric Company, Siemens AG, Samsung C&T Corp., ACWA POWER, and Doosan Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50873

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Industrial Growth

- 4.5.1.2 Energy Efficiency

- 4.5.2 Restraints

- 4.5.2.1 Penetration of Alternative Energy Sources

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGEMENTATION

- 5.1 Fuel Type

- 5.1.1 Natural Gas

- 5.1.2 Coal

- 5.1.3 Oil

- 5.1.4 Biomass

- 5.1.5 Other Fuel Types

- 5.2 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)})

- 5.2.1 Saudi Arabia

- 5.2.2 South Africa

- 5.2.3 United Arab Emirates

- 5.2.4 Rest of the Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration, and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Key Companies Profiles

- 6.3.1 General Electric Company

- 6.3.2 Siemens AG

- 6.3.3 Samsung C&T Corp.

- 6.3.4 Doosan Corp.

- 6.3.5 Engie SA

- 6.3.6 ABB Ltd

- 6.3.7 Saudi Electricity Company

- 6.3.8 Saudi Arabian Oil Co.

- 6.4 Market Ranking

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Integration with Other Renewable Energy Sources

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.