PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686214

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686214

Automotive Adhesive Tape - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

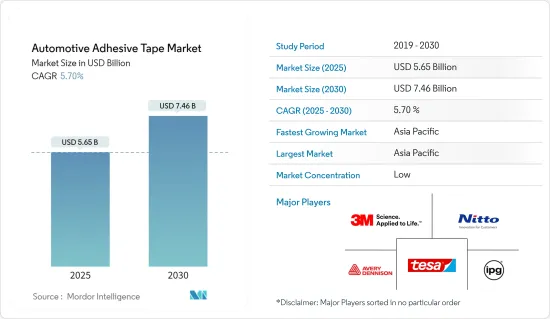

The Automotive Adhesive Tape Market size is estimated at USD 5.65 billion in 2025, and is expected to reach USD 7.46 billion by 2030, at a CAGR of 5.7% during the forecast period (2025-2030).

The COVID-19 pandemic significantly impacted the automotive adhesive tape market by disrupting the supply chain, causing production to slow and shut down and an economic downturn. While the initial impact of COVID-19 was negative, the market is on a recovery path during the forecast period.

Key Highlights

- The adhesive tapes are anticipated to witness growth due to the rising demand for a lightweight sealing solution in electric vehicles over the forecast period. In addition, adhesive tapes offer an attractive alternative to traditional mechanical fastening methods and play a vital role in the EV manufacturing sector.

- Growing trends of electrification and automation are resulting in rising challenges for automotive manufacturers. The high cost of electric vehicles is a challenge that is likely to restrict the growing demand.

- Demand for heat-resistant and low VOC automotive adhesive tapes creates lucrative opportunities to improve heat management efficiency. It is associated with IC engine cars and electric vehicles, as well as increasing the degree of freedom in vehicle interior design.

- The Asia-Pacific region accounted for the most significant global automotive adhesive tape market share, considering the increasing production and sales of electric vehicles and conventional automobiles.

Automotive Adhesive Tape Market Trends

Rising Use of Adhesive Tapes in Electric and Hybrid Vehicles

- The adhesive tapes are increasingly used in electric vehicle batteries to increase safety and reduce the vehicle's overall weight. The growing replacement of fasteners with adhesive tapes to improve the vehicle's aesthetics is anticipated to drive the market over the forecast period.

- Adhesive tapes are used in the automotive industry to attach parts onto the outer surfaces of a car's body, offering protection against abrasion during varnishing and providing support during assembly. Adhesive tapes also serve a variety of purposes specific to automotive interiors.

- Electric vehicles are gaining popularity across the globe owing to their benefits, such as being cheap to run and smooth to drive. Automotive manufacturers are investing in improving the power-to-weight ratio using lightweight materials, including composites and weight-saving bonding, joining, and fixing solutions.

- Electric vehicles (EVs) are one of the important steps towards zero carbon emission initiatives globally. Many governments are supporting electric production and helping investors set up the necessary infrastructure. Moreover, the governments are also helping consumers through various subsidies to promote the use of electric vehicles.

- Several automotive manufacturers across the globe are investing in electric vehicles. Nissan Motors, Toyota Motor Corporation, Mercedes-Benz, Tesla, Hyundai Motors, etc., started electric vehicle production, benefitting the automotive adhesive tapes market.

- The European Union aimed to introduce 30 million electric vehicles on the road by 2030 to reduce emissions from the transportation sector in the region. Countries implemented different measures in line with the EU plan. For instance, the United Kingdom announced a ban on internal combustion engine vehicles by 2030.

- According to the Chemnitz Automotive Institute, Germany produced nearly 570,000 units in 2022 and is expected to produce nearly 1 million electric vehicles by 2023. Germany received some investments in electric vehicles, which is likely to increase EV production. For instance, Tesla, a leading manufacturer of EVs, is planning to double its production capacity in Germany.

- New electric vehicle registrations are rising in France. Until September 2023, the country's EV sales increased to 341,000 units, indicating 25% growth compared to the same period in 2022. According to media reports, Tesla is the leading EV brand in France.

- According to the International Energy Agency (IEA), the United States is the third largest market in the world. In Q3 2023, the sales of EVs surpassed 300,000 units, which is a nearly 49.8% increase compared to Q3 2022. Furthermore, the Corporate Average Fuel Economy (CAFE) regulations in the United States aim to raise the average fuel efficiency of new cars and vehicles to 54.5 miles per gallon by 2025 to reduce the nation's dependence on oil.

- According to the Brazilian Association of Electric Vehicles (ABVE), the first quarter of 2023 recorded the highest sales in the historical series, with 14,787 light electric vehicles sold, 50% more than the same period in 2022 (9,844).

- Saudi Arabia is focusing on electric vehicles. The government is promoting EVs to reduce carbon emissions. The government aims to manufacture 500,000 units by 2030.

- Furthermore, the electric vehicles are becoming popular in South Africa. In 2022, new 502 battery electric vehicles were registered in South Africa, according to the media reports.

- Policies like new energy vehicle mandates, various subsidies, and fuel economy regulations in countries across the globe are anticipated to drive the demand for lightweight electric vehicles over the coming years. It is likely to propel the demand for adhesive tapes for automotive production.

Asia-Pacific to Dominate the Market

- Asia-Pacific is the largest producer of electric vehicles in the globe. Europe and North America follow it. China, India, and Japan are some of Asia-Pacific's leading electric vehicle-producing countries.

- Adhesive tape is expected to be an essential part of the automotive industry in the future, and not just for volume reasons. The battery of an electric car produces heat and voltage that must be protected to keep the user safe. As a result, manufacturers are developing double-sided adhesive tape and a unique film that prevents power surges. Batteries can be wrapped in nonflammable products that can withstand high temperatures. It, in turn, is significantly promoting the demand for adhesive tapes from the automotive industry.

- As per the International Trade Administration (ITA), China remains the world's largest vehicle market in terms of annual sales volume and manufacturing output. Domestic production is expected to hit 35 million vehicles in 2025. In response to the pandemic, China's government implemented measures to boost automobile consumption. The measures include allowing China 5 5-emission standard vehicles to be sold without restrictions, promoting the use of electric vehicles, reducing car sales tax, and enhancing parallel import policies. The changes are expected to boost consumption by about USD 30 billion annually.

- To address the slow growth of the automotive industry and to promote the EV market, the government of China partially reinvigorated these support measures in the first six months of 2023. In June 2021, the government of the People's Republic of China announced a huge tax incentive package for the automotive industry. The package, which will be implemented over four years, is estimated to amount to CNY 72.3 billion (USD 520 billion).

- The incentives are specifically designed to promote the sale of electric vehicles and other eco-friendly vehicles. It is the most significant tax incentive package ever offered by the Chinese government for the automotive industry and reflects the government's efforts to promote growth amid slow auto sales.

- According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), automotive production in China registered an increase of 3% in 2022, increasing from 26,121,712 units in 2021 to 27,020,615 units in 2022.

- India is a growing market for EVs. In India, EV and component manufacturing is ramping up, supported by the government's USD 3.2 billion incentive program, attracting investments totaling USD 8.3 billion. In the third quarter of 2023, the electric vehicle sales reached 371,214 units, registering a growth of 40% compared to Q3 in 2022.

- In September 2023, Japan's new vehicle market grew by nearly 11% to reach 437.493 units from 395.163 units in the previous month, according to new vehicle registration data published by JAMA. The strong September growth follows a positive market development in August. After slowing for three consecutive months, the Japanese market picked up speed in August. The August sales rate reached an impressive 5,36 million units per year, a 28% increase from the weak July.

- Furthermore, as per the Japan Automobile Dealers Association (JADA), EV sales increased in 2022 to reach 58,813 battery electric vehicles (BEVs) in Japan, 2.7 times more than in 2021. To encourage demand for EVs, the Japanese government continues to offer subsidies for purchases of new EVs with a revised budget of JPY 70 billion ( USD 501 million) for the fiscal year 2022.

- The South Korean EV market is increasing at a fast pace. According to the Korea Power Exchange, EV sales reached 160 thousand units in 2022, an increase of 60% compared to 2021. The country is also receiving various investments related to electric vehicles. For instance, Hyundai Motors initiated an EV plant construction with an investment of USD 1.52 billion in November 2023.

- The market is majorly driven by the availability of low labor at low cost, low raw material prices, and the growing urban population in the region, in addition to many automotive manufacturing plants.

- All the factors above, in turn, boost the demand for automotive adhesive tapes in the Asia-Pacific region during the forecast period.

Automotive Adhesive Tape Industry Overview

The automotive adhesive tape market is partially consolidated in nature. The major players (not in any particular order) include 3M, Nitto Denko Corporation, Tesa SE, IPG, and AVERY DENNISON CORPORATION, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Use of Adhesive Tapes In Electric and Hybrid Vehicles

- 4.1.2 Adoption of Lightweight Materials in Automotive

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 High Cost of Electric Vehicles and Charging Stations

- 4.2.2 Hot-melt Adhesives are Replacing Adhesive Tapes

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size In Value)

- 5.1 Backing Material

- 5.1.1 Polyethylene Terephthalate (PET)

- 5.1.2 Polyvinyl Chloride (PVC)

- 5.1.3 Polypropylene (PP)

- 5.1.4 Paper

- 5.1.5 Polyamide

- 5.1.6 Other Backing Material (Foam, Cloth, etc.)

- 5.2 Adhesive Type

- 5.2.1 Epoxy

- 5.2.2 Acrylic

- 5.2.3 Polyurethane

- 5.2.4 Silicone

- 5.2.5 Other Adhesive Types (Rubber-Based Adhesives, Polyesters, etc.)

- 5.3 Application

- 5.3.1 Exterior

- 5.3.2 Interior

- 5.3.3 Powertrain

- 5.3.4 Electronics

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Mexico

- 5.4.2.3 Canada

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 American Biltrite Inc.

- 6.4.3 Avery Dennison Corporation

- 6.4.4 Berry Global Inc.

- 6.4.5 Certoplast Technische Klebebander Gmbh

- 6.4.6 Coroplast Fritz Muller Gmbh & Co. Kg

- 6.4.7 Godson Tapes Private Limited

- 6.4.8 IPG

- 6.4.9 L&L Products

- 6.4.10 Lintec Corporation

- 6.4.11 Lohmann Gmbh & Co. Kg

- 6.4.12 Nitto Denko Corporation

- 6.4.13 Saint-Gobain

- 6.4.14 Scapa Group Ltd

- 6.4.15 Shurtape Technologies, LLC

- 6.4.16 Sika AG

- 6.4.17 Tesa SE

- 6.4.18 VIBAC Group S.P.A.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Benefits of Automotive Adhesive Tapes

- 7.2 Demand For Heat-resistant and Low VOC Automotive Adhesive Tapes