PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689768

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689768

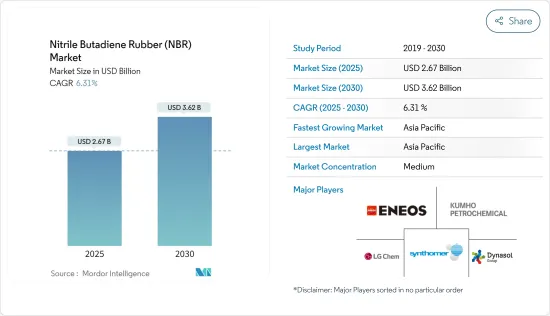

Nitrile Butadiene Rubber (NBR) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Nitrile Butadiene Rubber Market size is estimated at USD 2.67 billion in 2025, and is expected to reach USD 3.62 billion by 2030, at a CAGR of 6.31% during the forecast period (2025-2030).

COVID-19 hampered the nitrile butadiene rubber market. The pandemic disrupted the global supply chains, impacting the availability of raw materials, logistics, and manufacturing operations for NBR producers. However, the continued focus on hygiene and safety post-pandemic led to sustained demand for NBR gloves and other medical-related applications.

Key Highlights

- The increasing demand for nitrile butadiene rubber from the expanding automotive industry and from the industrial and infrastructure development projects are factors that are expected to drive the nitrile butadiene rubber market.

- However, the availability of substitute materials and fluctuating raw material prices are expected to hinder the growth of nitrile butadiene rubber market.

- The increasing demand for nitrile butadiene rubber from renewable energy sector and healthcare and medical devices are expected to provide various opportunities to the market players in the upcoming peroiod.

- The Asia-Pacific region dominates the nitrile butadiene rubber market globally, with the largest consumption from countries such as China, India, and ASEAN Countries.

Nitrile Butadiene Rubber (NBR) Market Trends

Automotive and Transportation Sector Dominates the Market

- NBR is extensively used in the manufacturing of hoses and tubing for automotive applications, including fuel lines, radiator hoses, and brake hoses. Its resistance to petroleum-based fluids, aging, and ozone makes it suitable for these demanding applications.

- NBR's high tensile strength and resistance to abrasion make it an ideal material for automotive belts, such as timing belts, fan belts, and conveyor belts used in the transportation industry.

- The exceptional durability and chemical resistance of NBR makes it a preferred choice for seals, gaskets, and other components in industrial vehicles, heavy-duty trucks, and construction equipment.

- According to the latest estimates published by the International Organization of Motor Vehicle Manufacturers (OICA), in 2023, global production of motor vehicles stood at 93,546,599 units, a 17% increase from that in 2021.

- According to the estimate released by the International Energy Agency (IEA), the sales of electric vehicles increased from 1.0 million units in 2022 to 1.6 million units in 2023 in the United States.

- In addition, the sales of electric vehicles also increased from 2.7 million in 2022 to 3.4 million units in 2023 in Europe, according to the estimate released by the IEA.

- According to an estimate published by the Indian Brand Equity Foundation (IBEF), the civil aviation industry in India has emerged as one of the fastest-growing industries in the country in the last three years. The air traffic movement in India stood at 327.28 million in Financial Year 2023 compared to 188.89 million in 2022.

- The demand for nitrile butadiene rubber (NBR) is anticipated to be affected by all of these factors over the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is home to major automotive manufacturing hubs, including China, Japan, South Korea, and India. The thriving automotive industry in these countries drives the demand for NBR, which is extensively used in various automotive components, including seals, gaskets, hoses, and belts.

- According to the data released by the International Organization of Motor Vehicle Manufacturers (OICA), in China, 30,160,966 units of vehicles were produced in 2023, which increased from 27,020615 units in 2022.

- Rapid urbanization and infrastructure development projects in countries like China, India, and Southeast Asian nations have led to an increase in the need for construction equipment, heavy-duty vehicles, and transportation systems. NBR is widely used in the manufacturing of components for these industries, contributing to its market growth.

- According to the estimate released by the Indian Brand Equity Foundation (IBEF), the investment in infrastructure development in India has helped India become an economy of USD 26 trillion. The government of India has launched the National Infrastructure Pipeline (NIP) to augment the growth of the infrastructure sector.

- Several major NBR manufacturers and production facilities are located in the Asia-Pacific region, particularly in countries like China, Japan, and South Korea. This established manufacturing base ensures a reliable supply of NBR to meet the region's growing demand.

- All such factors, coupled with the increasing consumption from other emerging economies of the Asia-Pacific region, are driving the market's growth in the region.

Nitrile Butadiene Rubber (NBR) Industry Overview

The nitrile butadiene rubber market is partially consolidated. Some of the major players include KUMHO PETROCHEMICAL, Synthomer PLC, LG Chem, ENEOS Materials Corporation, and Dynasol Group, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Expanding Automotive Industry

- 4.1.2 Industrial and Infrastructure Development Projects

- 4.2 Restraints

- 4.2.1 Availability of Substitute Materials

- 4.2.2 Fluctuating Raw Material Prices

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Application

- 5.1.1 Adhesives and Sealants

- 5.1.2 Belts and Cables

- 5.1.3 Gloves

- 5.1.4 Hoses

- 5.1.5 Gaskets and O-Rings

- 5.1.6 Other Applications (Consumer Goods)

- 5.2 End-user Industry

- 5.2.1 Automotive and Transportation

- 5.2.2 Building and Construction

- 5.2.3 Industrial

- 5.2.4 Medical

- 5.2.5 Other End-user Industries (Oil and Gas, Aerospace)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Vietnam

- 5.3.1.8 Indonesia

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 Turkey

- 5.3.3.7 Russia

- 5.3.3.8 NORDIC

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Egypt

- 5.3.5.5 Qatar

- 5.3.5.6 UAE

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Apcotex

- 6.4.2 ARLANXEO

- 6.4.3 China Petrochemical Corporation (Sinopec)

- 6.4.4 Dynasol Group

- 6.4.5 ENEOS Materials Corporation

- 6.4.6 KUMHO PETROCHEMICAL

- 6.4.7 Lanxess

- 6.4.8 LG Chem

- 6.4.9 SIBUR

- 6.4.10 Synthomer PLC

- 6.4.11 Synthos

- 6.4.12 TSRC

- 6.4.13 Versalis S.p.A.

- 6.4.14 ZEON CORPORATION

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand from Renewable Energy Sector

- 7.2 Increasing Demand from Healthcare and Medical Devices