PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687341

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687341

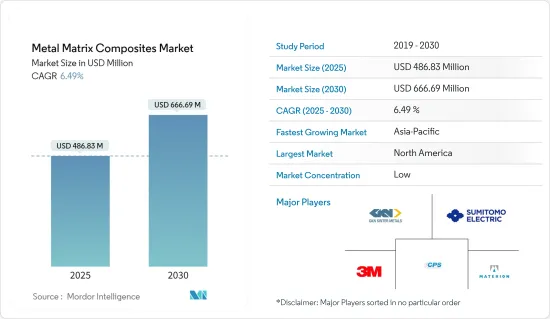

Metal Matrix Composites - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Metal Matrix Composites Market size is estimated at USD 486.83 million in 2025, and is expected to reach USD 666.69 million by 2030, at a CAGR of 6.49% during the forecast period (2025-2030).

During the pandemic period in 2020 due to COVID-19, there were nationwide lockdowns and social distancing mandates which led to supply chain disruption and the closure of various manufacturing industries. This impacted the market negatively. However, in the post-pandemic period, the market is getting back on track.

Key Highlights

- Increasing demand for lightweight materials in the aerospace and defense industry and superior properties of metal matrix composites over metals are the major driving factors for the market.

- However, the complicated manufacturing process is likely to hinder the market growth.

- Growing use in the locomotive industry and increasing adoption of electric vehicles are expected to provide new opportunities for the market.

- North America accounted for the highest market share. However, Asia-Pacific is projected to dominate the market during the forecast period.

Metal Matrix Composites Market Trends

Electrical and Electronics Segment to Register Fastest Growth

- Metal matrix composites are used in various electrical and electronic components and devices. For instance, aluminum-graphite composites are employed in power electronic modules due to their excellent thermal conductivity, tunable coefficient of thermal expansion, and low density.

- Al and Cu reinforced by SiC are used in various industries due to their excellent thermo-physical properties, such as low coefficient of thermal expansion (CTE), high thermal conductivity, and improved mechanical properties, such as higher specific strength, better wear resistance and specific modulus.

- Because of its high heat conductivity, dymalloy, a copper-silver alloy matrix containing 55% diamond particles (by volume), is utilized as a substrate for high-power, high-density multi-chip modules in electronics.

- In addition, PRMMCs (particulate reinforced metal matrix composites), with a high-volume fraction, have a wide range of applications in the electronics industry, including radiator panels, power semiconductor packages, microwave modules, battery sleeves, black box enclosures, printed circuit board heat sinks, and others.

- According to the global electronics statistics published by the Japan Electronics and Information Technology Industries Association (JEITA), the Production by the global electronics and IT industries is expected to grow 11% year on year in 2021 to reach USD 3,360.2 billion, with 2022 production too lifting 5% to USD 3,536.6 billion.

- The production of cellular phones, portable computing devices, gaming systems, and other personal electronic devices will continue to spark the demand for electronic components, which is expected to boost the demand for metal matrix composites.

- Owing to all the factors mentioned above, the demand for electrical and electronic equipment is likely to increase the demand in the market studied during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific accounts for more than 70% of global electronics production, with countries like South Korea, Japan, and China involved in manufacturing various electrical components and supplies to various industries globally.

- The Asia-Pacific region recorded 32.67 million of total automotive production in the nine months of 2021, an increase of 11% from the same period in 2020.

- Overall, the consistent growth in demand in countries like China, India, Japan, and South Korea is likely to boost the metal matrix composites market in the region.

- Industrial production in China increased by 4.3% year-on-year in December 2021. Thus, the expansion of the industrial sector in the country is anticipated to benefit the growth of the metal matrix composites market during the forecast period.

- According to China's data from the Ministry of Industry and Information Technology, the electronic information manufacturing sector maintained steady growth in the first five months of 2022. The value-added output of electronic information manufacturers with annual operating revenue of at least CNY 20 million (about USD 3 million) expanded 9.9 percent year-on-year during the period.

- The government launched the PLI scheme, which is likely to offer incentives as manufacturers increase production in India with USD 5.5 billion available over five years. This is likely to boost the production of electronics in the country, thus benefiting the demand for metal matrix composites.

- In the aerospace sector, according to the India Brand Equity Foundation (IBEF), the country's aviation industry is expected to witness INR 35,000 crore (USD 4.99 billion) investment in the next four years.

- Moreover, in the first four months of 2022, the production by the Japanese electronics industry accounted for JPY 3,656.44 billion (USD 32.60 billion), registering a growth rate of around 0.2% compared to the same period in 2021.

- The factors mentioned above are likely to ascend the demand for metal matric composites across the application industries in Asia-Pacific.

Metal Matrix Composites Industry Overview

The global metal matrix composites market is partially fragmented in nature, with the presence of a large number of global and local players in the industry. The major players in the market include GKN Sinter Metals Engineering GmbH, Materion Corporation, 3M, Sumitomo Electric Industries Ltd, and CPS Technologies Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Lightweight Materials in Aerospace and Defense Industry

- 4.1.2 Superior Properties of Metal Matrix Composites over Metals

- 4.2 Restraints

- 4.2.1 Compilicated Manufacturing Process

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Technological Snapshot

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Nickel

- 5.1.2 Aluminium

- 5.1.3 Refractory

- 5.1.4 Other Types

- 5.2 Fillers

- 5.2.1 Silicon Carbide

- 5.2.2 Aluminum Oxide

- 5.2.3 Titanium Carbide

- 5.2.4 Other Fillers

- 5.3 End-user Industry

- 5.3.1 Automotive and Locomotive

- 5.3.2 Electrical and Electronics

- 5.3.3 Aerospace and Defense

- 5.3.4 Industrial

- 5.3.5 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Spain

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3A Composites

- 6.4.2 3M (Ceradyne Inc.)

- 6.4.3 ADMA Products Inc.

- 6.4.4 CPS Technologies Corp.

- 6.4.5 DAT Alloytech

- 6.4.6 Denka Company Limited

- 6.4.7 GKN Sinter Metals Engineering GmbH

- 6.4.8 Hitachi Metals Ltd

- 6.4.9 Materion Corporation

- 6.4.10 MTC Powder Solutions AB

- 6.4.11 Plansee Group

- 6.4.12 Sumitomo Electric Industries Ltd

- 6.4.13 Thermal Transfer Composites LLC

- 6.4.14 TISICS Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Use in Locomotive Industry

- 7.2 Increasing Adoption of Electric Vehicles