PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644309

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644309

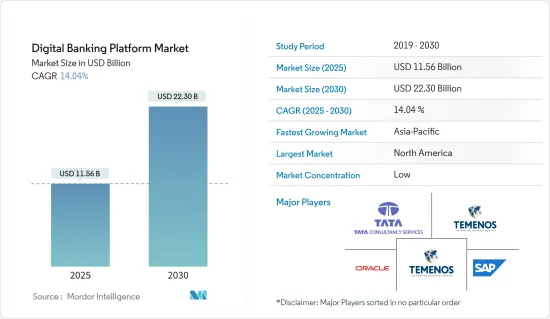

Digital Banking Platform - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Digital Banking Platform Market size is estimated at USD 11.56 billion in 2025, and is expected to reach USD 22.30 billion by 2030, at a CAGR of 14.04% during the forecast period (2025-2030).

The banking industry is going through a digital transformation quickly, and consumers want smart mobile devices and digital banking services. These are some of the main things that are driving the market's growth.

Key Highlights

- The majority of the banks prefer digital banking platforms due to the various benefits offered, such as reduced IT cost, fast time to market, open banking, out-of-the box yet configurable capabilities, omnichannel customer experience, and microservice architecture, to name a few. For example, in December 2022, Deloitte announced a collaboration with AWS to address a chronic difficulty in banking: the transition to digital-first systems that span the client interface to back office operations.

- Though neo-banks are still a niche market, they are witnessing a higher growth rate in terms of market share and serving customers at around one-third of the cost of traditional banks. Fintechs are targeting lucrative niches in the value chain. The big tech players, with their large customer bases, pose a real threat, and a few incumbents are investing heavily in innovation, putting laggards in the shade.

- However, issues such as integrating digital banking platforms with legacy systems, network outages, and security concerns can cause banks severe losses, and thus such factors might hamper the growth of the market.

- As a result of the COVID-19 crisis, there was a rise in online banking activity, such as increased digital transactions, and a decline in trips to brick-and-mortar branches. The pandemic forced individual consumers as well as corporations that once resisted online banking to adopt digital banking apps as their new default. The pandemic resulted in increased convenience among consumers, which might grow demand in the long run. On the vendors part, the majority of the vendors have been concentrating on customer acquisition by providing services demanded by the challenging times.

Digital Banking Platform Market Trends

Increasing Adoption of Cloud-Based Platforms to Boost the Market Growth

- In January 2023, the digital bank in the Philippines, GoTyme Bank, collaborated with the worldwide cloud banking platform Mambu to create an innovative digital banking solution that seeks to increase Filipinos' access to high-quality financial services.

- Many banks prefer cutting the IT infrastructure cost needed for on-premise setup by leveraging cloud-based services, which enable them to deploy new products and scale infrastructure quickly, cater to a broader customer base with varied needs at a faster speed, and manage rapidly increasing real-time payments while ensuring compliance and security standards.

- As a subscription fee is paid to a SaaS provider, system maintenance costs and legacy technology issues are reduced. Rather than spending a small fortune on IT, SaaS provides banks with the ability to reallocate budgets so they can focus on innovation, customer satisfaction, and business growth.

- The use of the cloud has also helped mobile banking platforms offer a responsive user interface (UI) and support the bank customers' entire banking journey, right from onboarding to transactional banking requests, on their mobile devices. Banks are rapidly adopting mobile banking platforms, owing to their changing preference toward mobile banking.

- Moreover, increased adoption of third-party applications for real-time payments, such as Whatsapp Pay and PhonePay, has led to increased demand for reliable infrastructure by the banks to carry out UPI transactions smoothly. For instance, Visa recently completed a USD 5.3 billion acquisition of Plaid, a fintech startup that allows applications to connect with customers' bank accounts easily and instantly. Technological shifts such as these have led to increased demand for cloud infrastructure in the digital banking industry.

North America is Expected to Hold Major Share

- Many of the biggest banks are in North America, which is a big reason why the market for digital banking platforms is growing. Digital banking companies in the region offer software as a service so that legacy systems can be turned into digital ones. For instance, Temenos helps new U.S. digital banks go live in 90 days with the most functionally rich and technologically advanced front-to-back SaaS digital banking offering.

- Digital banking platforms are becoming more popular as blockchain technology, which makes security better, is used more and more, especially in the BSFI sector. This factor is fueling the market's growth in the country. Many companies are developing blockchain-based cloud digital banking platforms.

- North America is also one of the most innovative and first places to use the cloud. Cloud infrastructure providers have a strong foothold in the region, which helps the market grow even more.

- The steady rise in the use of digital banking platforms follows a similar rise in the use of fintech apps, which are notable for being one of the fastest-growing types of apps in the US. Due to the global coronavirus (COVID-19) pandemic, people in the United States stayed at home more and used their phones more. This led to more digital banking across the region.

Digital Banking Platform Industry Overview

The market for digital banking platforms is moving toward fragmentation. This is because of the entry of companies and solutions into the market, creating a fragmented landscape within the digital banking ecosystem. However, with technological advancements and product innovation, midsize to smaller companies are increasing their market presence by securing new contracts and partnerships.

In January 2023, Axis Bank collaborated with OPEN to provide its clients, who include SMEs, freelancers, homepreneurs, influencers, and others, with a completely native digital current account. This collaboration gives the larger business community access to Axis Bank's comprehensive banking experience and OPEN's end-to-end financial automation capabilities for business administration, such as payments, accounting, payroll, compliance, expenditure management, and other services.

In November 2022, Capco and Savana announced that they would work together in a strategic way to speed up the transformation of banks and drive continuous innovation in digital products. This partnership will support banks in overcoming the technical challenges they face in meeting evolving customer expectations and needs for seamless modern omnichannel experiences.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Increasing Adoption of Cloud-Based Platforms to Obtain Higher Scalability

- 4.4.2 Rising demand for smart mobile devices and digital banking services among consumers

- 4.5 Market Restraints

- 4.5.1 Increasing Security Concerns

- 4.6 Assessment of Impact of COVID-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 By Deployment

- 5.1.1 Cloud

- 5.1.2 On-Premises

- 5.2 By Type

- 5.2.1 Corporate Banking

- 5.2.2 Retail Banking

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Asia Pacific

- 5.3.3 Europe

- 5.3.4 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Appway AG

- 6.1.2 CREALOGIX Holding AG

- 6.1.3 EdgeVerve Systems Limited

- 6.1.4 Fiserv, Inc.

- 6.1.5 Oracle Corporation

- 6.1.6 SAP SE

- 6.1.7 Sopra Steria

- 6.1.8 Tata Consultancy Services Limited

- 6.1.9 Temenos Headquarters SA

- 6.1.10 Worldline SA

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS