PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1643041

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1643041

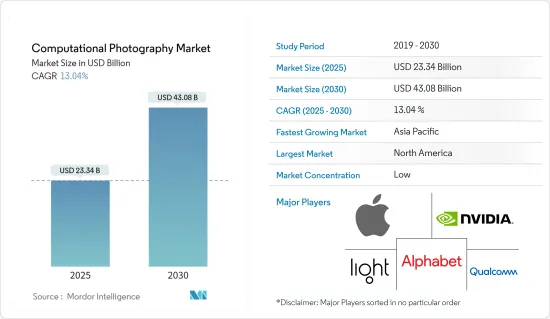

Computational Photography - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Computational Photography Market size is estimated at USD 23.34 billion in 2025, and is expected to reach USD 43.08 billion by 2030, at a CAGR of 13.04% during the forecast period (2025-2030).

Key Highlights

- Computational photography enhances images through image processing algorithms by reducing motion blur, incorporating artificial depth of field, and improving color, contrast, and light range.

- The market is driven by the increasing use of the Picture Fusion Method to produce high-quality images. Methods that may objectively, methodically, and statistically analyze or evaluate the performance of various fusion technologies have been recognized as urgently needed since picture fusion techniques have developed quickly in multiple applications in recent years. Improving nighttime color images is crucial to computational photography and computer vision.

- The device has sophisticated computational capabilities that are used in computing imaging. By compressing, enlarging, and mosaicking an image, these software solutions enhance and extend the capabilities of computational photography-based devices. Smartphones enable amateur photographers to create photographs of higher quality as computational photography technology develops.

- Additionally, during the forecast period, the industry for computer cameras is anticipated to experience growth due to improvements in sensor image resolution, technological innovation in camera modules, components, and design, and a rise in demand for superior vision technology in the computer vision sector.

- However, the market growth of computational camera modules is held back by high maintenance and manufacturing costs. Mobile phone prices rise as smartphone vendors strive to improve image quality.

- The global market for computational photography was considerably disrupted by the COVID-19 epidemic. The development of new initiatives around the globe halted, which consequently reduced the market for analog semiconductors.

Computational Photography Market Trends

Smartphone Cameras to Witness Significant Market Growth

- Computational photography is now available in-camera software and camera modules for standalone cameras, machine vision cameras, standalone cameras for smartphones, mixed reality imaging, digital imaging, augmented reality imaging, and other applications.

- The growing use of software-based imaging techniques in machine vision, the development of 4K and super HD technologies, the penetration of smartphones, and the adoption of high-end smartphones with sophisticated cameras.

- Moreover, computational photography uses computer software to improve pictures produced by cameras. It is primarily utilized in cell phones. In reality, computational photography produces the stunning photographs people see in their smartphone photo galleries.

- The ability to take pictures on smartphones has increased over the past ten years, and the cameras have advanced rapidly in recent years. Mobile phone manufacturers are announcing their plans to include machine learning and artificial intelligence (AI) in their products.

- Instead of modifying the camera sensor, the fast progress in smartphone cameras over the past few years may largely be credited to better software. Several smartphone producers, such as Apple and Google, consistently enhance the photo-taking capabilities of their products year after year without ever significantly modifying the actual camera sensors.

Asia Pacific region is set to witness highest market growth

The market for computational photography is predicted to see rapid growth and a surge in the number of Chinese manufacturers like Huawei and Xiaomi.

- These companies develop sophisticated AI-based cameras with potent chipsets and processors for cutting-edge image applications. However, the adoption of computational cameras over DSLR cameras in other nations like India, South Korea, Australia, and Japan will primarily depend on pricing practices and public understanding of these advantages.

- An important driver boosting market expansion in the region is the increasing usage of computational photography in smartphone cameras, the growing use of image fusion techniques to produce high-quality photographs, and high-end algorithms to have sophisticated photography.

- Computational photography has grown throughout the region due to its benefits, which include providing better machine vision systems at a reduced cost and upgrading photographs with better color, contrast, and lighting techniques. The popular computational photography technique, HDR (High Dynamic Range) Imaging with Panoramic, effectively combines data from several overlapping and underexposed shots that are exposed differently.

Computational Photography Industry Overview

The computational photography market is fragmented, and the major players have used strategies such as new product launches, agreements, partnerships, acquisitions, and others to increase their footprints in this market. Key players are Alphabet Inc., Apple Inc., etc.

In February 2023, Qualcomm Technologies, Inc and Samsung Partner announced a collaboration. They launched Snapdragon 8 Gen 2 for Galaxy powers Samsung Galaxy S23 series globally, bringing accelerated performance, making it the fastest Snapdragon ever, and defining a new standard for connected computing, including desktop-level gaming features, professional-grade photography, and more to consumers around the world. In contrast, the Galaxy S23 series launch underscores Qualcomm Technologies and Samsung's mutual commitment to delivering premium consumer experiences for flagship Galaxy devices.

In September 2022, Apple announced the iPhone 14 Pro and iPhone 14 Pro Max, the most advanced Pro lineup, featuring Dynamic Island. This new design introduces an intuitive way to experience iPhone and the Always-On display, iPhone 14 Pro introduces a new class of pro camera system, with the first-ever 48MP Main camera on iPhone featuring a quad-pixel sensor and Photonic Engine. This enhanced image pipeline dramatically improves low-light photos.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of Image Fusion Technique to Achieve High-quality Image

- 5.1.2 Increasing Demand for High-resolution Computational Cameras in Machine Vision for Autonomous Vehicle

- 5.2 Market Restraints

- 5.2.1 High Manufacturing and Maintenance Costs

6 MARKET SEGMENTATION

- 6.1 By Offerings

- 6.1.1 Camera Modules

- 6.1.2 Software

- 6.2 By Type

- 6.2.1 Single- and Dual-Lens Cameras

- 6.2.2 16-Lens Cameras

- 6.3 By Application

- 6.3.1 Smartphone Cameras

- 6.3.2 Machine Vision Cameras

- 6.3.3 Other Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 South America

- 6.4.5 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Apple Inc.

- 7.1.2 Alphabet Inc.

- 7.1.3 Qualcomm Technologies Inc.

- 7.1.4 Nvidia Corporation

- 7.1.5 Light Labs Inc.

- 7.1.6 CEVA Inc.

- 7.1.7 FotoNation Inc.

- 7.1.8 Algolux Inc.

- 7.1.9 Pelican Imaging Corporation

- 7.1.10 Almalence Inc.

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS