PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851070

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851070

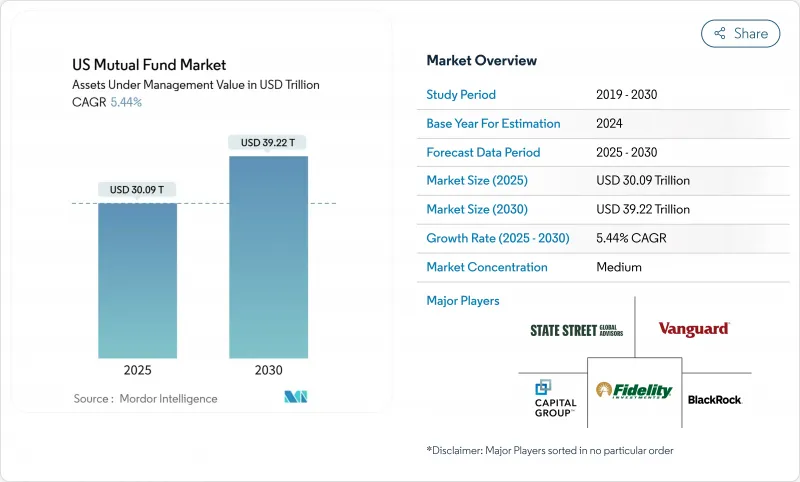

US Mutual Fund - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The US mutual fund market commands assets of USD 30.09 trillion in 2025 and is forecasted to reach USD 39.22 trillion by 2030, expanding to a 5.44% CAGR.

Fee compression, automatic enrollment under SECURE Act 2.0, steady passive-fund inflows, and technology-enabled distribution channels reinforce this growth path. Persistent Treasury-bill yields have redirected cash toward money-market funds, yet large managers convert headwinds into scale advantages through operational efficiency. Regulatory modernization, including the SEC's approval of ETF share classes for mutual funds, accelerates product innovation that blends active skill with passive structures. Taken together, these dynamics signal an inflection point in which the US mutual fund market rewards firms able to pair low-cost core offerings with specialized strategies and digital client experiences.

US Mutual Fund Market Trends and Insights

Fee Compression Driven by Index-Fund Price Wars

Vanguard's USD 350 million fee reductions in 2024 sparked industry-wide expense cuts that have pushed average index-ETF ratios below 10 basis points. Charles Schwab halved several ETF fees in June 2025, magnifying competitive pressure that smaller managers cannot absorb. Scale leaders now compete on technology, client service, and specialized products rather than price alone. The resulting bifurcation pushes mid-tier firms toward consolidation, elevating concentration risk yet creating room for boutique specialists. Over time, the US mutual fund market sees commodity-priced beta coexist with premium-priced alpha solutions.

401(k)/IRA Automatic Enrollment Boosts Recurring Inflows

Mandatory auto-enrollment and escalation under the SECURE Act 2.0 generate predictable cash streams that cushion assets during market volatility. Default allocations into target-date funds strengthen balanced strategies, while competition among fund families intensifies for qualified default status. This regulatory shift benefits target-date funds and balanced allocation strategies that serve as default investment options for newly enrolled participants. The automatic enrollment mandate creates a structural tailwind for asset accumulation that compounds over time, as participants who might otherwise delay retirement savings are immediately captured into the system. However, this also intensifies competition among fund families to secure default option status within employer plans, where selection decisions can determine billions in asset flows.

SEC Swing-Pricing & Hard-Close Rule Raises Operational Cost

The SEC's swing pricing implementation has created operational complexity that disproportionately burdens mid-sized fund companies lacking the technological infrastructure to efficiently calculate and apply daily pricing adjustments. New rules require funds to adjust NAVs for large flow costs and accept trades only until 4 p.m. ET, forcing distributors to move internal cut-offs earlier. Mid-sized firms must invest millions in real-time systems or outsource, eroding margins and accelerating consolidation inside the US mutual fund market. Smaller fund families face a strategic dilemma between investing heavily in compliance infrastructure or outsourcing these functions to third-party administrators, both of which erode profit margins and competitive positioning. The cumulative effect has accelerated industry consolidation as firms seek scale economies to absorb these regulatory costs.

Other drivers and restraints analyzed in the detailed report include:

- Tax-Efficient ETF Share-Class Conversions of Mutual Funds

- Rising DC Plan Participation Under SECURE Act 2.0

- Retail Rotation to Low-Cost ETFs Cannibalizes Active AUM

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Equity funds retained 56.67% of the US mutual fund market share in 2024, underscoring their central portfolio role. The "Others" bucket is projected to outpace with a 9.21% CAGR through 2030. Goldman Sachs's U.S. Large Cap Buffer 3 ETF launch illustrates a brisk pipeline that deepens downside-protection choices. Bond funds still stabilize allocation during rate gyrations, while hybrid strategies prosper from target-date demand linked to automatic enrollment. Money-market reforms in October 2024 cut institutional prime offerings from 25 to 9, cementing large-provider dominance.

These shifts indicate significant growth potential in the US mutual fund market for alternative structures, driven by investor interest in non-traditional risk-return profiles. Interval funds and tender-offer designs bridge retail and private-market exposure, as Franklin Templeton's FLEX fund amassed USD 904.5 million at inception. Consolidation among money-market managers highlights how regulatory cost burdens favor scale, while equity fund providers diversify into buffered and defined-outcome wrappers to retain flows.

Retail accounts controlled 86.34% of the US mutual fund market size in 2024, with a 5.82% annual growth projection over the forecast period. Schwab's Alternative Investments Select platform targets clients above USD 5 million, democratizing private-market strategies once off-limits to individuals. Institutional segments provide stability but grow more slowly, often validating innovative funds before retail uptake.

Millennials form the fastest-expanding cohort, preferring mobile guidance over branch visits. Vanguard's AI-driven advisor summaries exemplify how technology personalizes advice without sacrificing human oversight. As robo-assisted tools improve, low-balance investors gain institutional-grade analytics, leveling the playing field inside the US mutual fund market.

The US Mutual Fund Market is Segmented by Fund Type (Equity, Bond, Hybrid, and More), by Investor Type (Retail, Institutional), by Management Style (Active, Passive), and by Distribution Channel (Online Trading Platform, Banks, Securities Firm, Others). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- BlackRock

- Vanguard Group

- Fidelity Investments

- State Street Global Advisors

- Capital Group (American Funds)

- J.P. Morgan Asset Management

- Charles Schwab Investment Management

- T. Rowe Price

- PIMCO

- Invesco

- Franklin Templeton

- BNY Mellon IM

- Dimensional Fund Advisors

- PGIM

- UBS Asset Management

- Allianz Global Investors

- Amundi US

- Columbia Threadneedle Investments

- Nuveen

- Dodge & Cox

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Fee compression driven by index-fund price wars

- 4.2.2 401(k)/IRA automatic-enrolment boosts recurring inflows

- 4.2.3 Tax-efficient ETF share-class conversions of mutual funds

- 4.2.4 Rising DC plan participation under SECURE Act 2.0 boosts stable inflows

- 4.2.5 ETF share-class approvals drive hybrid mutual fund product design

- 4.2.6 Advisor-driven fund selection shifts mutual fund demand toward multi-asset and flexible strategies

- 4.3 Market Restraints

- 4.3.1 SEC swing-pricing & hard-close rule raises operational cost

- 4.3.2 Retail rotation to low-cost ETFs cannibalises active AUM

- 4.3.3 Cyber-security breaches erode investor confidence

- 4.3.4 Persistent Treasury-bill yields divert cash to money-market funds

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Fund Type

- 5.1.1 Equity

- 5.1.2 Bond

- 5.1.3 Hybrid

- 5.1.4 Money Market

- 5.1.5 Others

- 5.2 By Investor Type

- 5.2.1 Retail

- 5.2.2 Institutional

- 5.3 By Management Style

- 5.3.1 Active

- 5.3.2 Passive

- 5.4 By Distribution Channel

- 5.4.1 Online Trading Platform

- 5.4.2 Banks

- 5.4.3 Securities Firm

- 5.4.4 Others

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for Key Companies, Products & Services, and Recent Developments)

- 6.4.1 BlackRock

- 6.4.2 Vanguard Group

- 6.4.3 Fidelity Investments

- 6.4.4 State Street Global Advisors

- 6.4.5 Capital Group (American Funds)

- 6.4.6 J.P. Morgan Asset Management

- 6.4.7 Charles Schwab Investment Management

- 6.4.8 T. Rowe Price

- 6.4.9 PIMCO

- 6.4.10 Invesco

- 6.4.11 Franklin Templeton

- 6.4.12 BNY Mellon IM

- 6.4.13 Dimensional Fund Advisors

- 6.4.14 PGIM

- 6.4.15 UBS Asset Management

- 6.4.16 Allianz Global Investors

- 6.4.17 Amundi US

- 6.4.18 Columbia Threadneedle Investments

- 6.4.19 Nuveen

- 6.4.20 Dodge & Cox

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment