PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851025

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851025

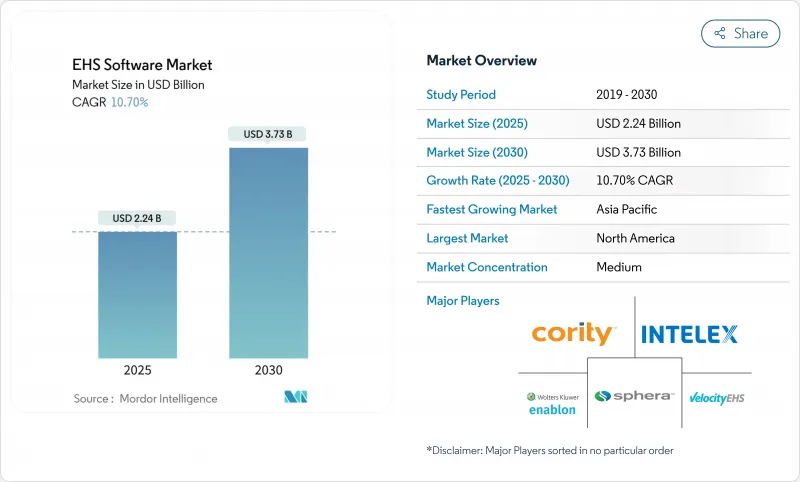

EHS Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The environmental health safety software market is valued at USD 2.24 billion in 2025 and is forecast to reach USD 3.73 billion by 2030, advancing at a 10.7% CAGR.

Persistent regulatory tightening, rapid ESG formalization and the shift toward AI-enabled safety analytics collectively anchor this expansion. European delays in the Corporate Sustainability Reporting Directive (CSRD) are generating pent-up demand for automated compliance workflows, while New York's mandatory greenhouse-gas disclosures preview similar obligations in other jurisdictions. At an operational level, enterprises favor software-as-a-service architectures to reduce total cost of ownership; cloud deployments already account for 62% of active installations, and services commanding 60% illustrate that implementation expertise remains critical for adoption.Large enterprises leverage platform breadth to address cross-border risk, yet small and mid-sized firms are the fastest movers because subscription pricing removes upfront capital barriers.

Global EHS Software Market Trends and Insights

Stringent regulatory enforcement & rising liability exposure

The European Union's CSRD markedly widens disclosure scope and frequency, compelling multinationals to automate multi-jurisdictional reporting workflows. Parallel action in the United States-such as New York's greenhouse-gas reporting requirement-signals rising liability for non-compliance. Businesses therefore treat environmental health safety software market solutions as a pre-emptive legal safeguard. Asian regulators are converging; Japan's cybersecurity strategy now requires Software Bills of Materials to protect supply chains, elevating demand for integrated risk platforms . The cumulative result is an unprecedented volume of structured data that exceeds manual processing capacity, turning automation into necessity rather than choice.

Expansion of ESG & sustainability reporting mandates

Mandatory ESG disclosures have expanded from investor-led expectations to statutory obligations. The EU's Carbon Border Adjustment Mechanism forces importers to track embedded emissions, compelling global suppliers to institutionalize environmental data capture. Only 19% of UK SMEs have any ESG awareness, revealing white-space adoption potential as new penalties take hold. Emerging economies are aligning; Kenya's Green Finance Taxonomy now directs lenders toward climate-aligned projects, institutionalizing disclosure frameworks. Industry practitioners therefore view the environmental health safety software market as a scalable route to compliance, embedding audit-ready ESG analytics into day-to-day operations.

High upfront implementation & change-management cost

Small manufacturers in Italy cite purchase price, system migration complexity and workforce training as principal inhibitors to digital safety adoption. Similar feedback is recorded across, economies, where 40% of SMEs collect environmental data but only 18% integrate it into performance metrics . Vendors respond with packaged onboarding services and templated configurations, yet budget constraints still delay conversions and trim near-term growth in the environmental health safety software market.

Other drivers and restraints analyzed in the detailed report include:

- SaaS-first, mobile-first EHS platforms reduce TCO

- AI-driven predictive safety & compliance analytics

- Cyber-security & data-privacy concerns in cloud roll-outs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Services held 60% of environmental health safety software market share in 2024 . Organizations acknowledge that platform acquisition addresses only a fraction of compliance complexity; regulatory interpretation, data migration and user training determine project success. The implementation lifecycle set out by ERA Environmental-assessment, tandem deployment and validation-illustrates why consultancy talent remains integral. Over the forecast period, the environmental health safety software market size linked to Services will expand steadily as AI and ESG modules add intricacy that many firms outsource.

Software revenue grows at an aligned 10.7% CAGR as buyers progress toward cloud-native suites and mobile extensions. Vendors embed configurable ESG templates and AI-based risk engines, compressing setup time and increasing stickiness. Consequently, long-term margin expansion favors platform licensors, yet near-term scale depends on service partners to accelerate enterprise roll-outs.

Cloud solutions commanded 62% of environmental health safety software market size in 2024. Centralized data management, elastic storage and instant patching outweigh long-standing security concerns. Japanese corporates have progressed to the third stage of digital transformation-data analytics underscoring how cloud infrastructure underpins efficiency gains .

On-premise installations persist where latency, sovereignty or bespoke workflows require localized control, but growth lags cloud by six percentage points. Vendors increasingly sunset native desktop editions, encouraging hybrid strategies in heavily regulated verticals. As multinationals rationalize server estates, the environmental health safety software market tilts further toward usage-based pricing that aligns cost with scale.

EHS Software Market is Segmented by Deployment Mode (Cloud, On-Premise), by Component (Software, Services) by End-User Vertical (Oil and Gas, Energy and Utilities, and More), by Solution Type (Incident and Safety Management, Audit and Inspection and More), by Organization Size (Large Enterprises and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retains 37.5% of environmental health safety software market size in 2024, underpinned by mature OSHA compliance culture and early AI adoption by state transportation agencies. Healthcare networks such as UC San Diego Health invest USD 22 million in AI to elevate patient outcomes, demonstrating broad management commitment to digital safety tools . Federal guidance on cyber hygiene further accelerates trust in cloud platforms

Asia-Pacific is the growth engine, poised for 10.1% CAGR through 2030. Japan's Digital Society priority program and JPY 1.54 trillion (USD 10.7 billion) quarterly software investments exemplify government-private collaboration on productivity gains. Regional regulators-from Vietnam to India-are rolling out harmonized chemical and climate frameworks, expanding the environmental health safety software market addressable base.

Europe shows measured growth as CSRD deadlines loom. Corporates mobilize audit teams to integrate sustainability metrics with financial statements, creating recurring demand for reporting modules . The EU Carbon Border Adjustment Mechanism indirectly pulls adoption in trading partners, broadening the environmental health safety software industry footprint.

- Enablon (Wolters Kluwer NV)

- Intelex Technologies ULC

- VelocityEHS Holdings Inc.

- Cority Software Inc.

- Sphera Solutions Inc.

- Sai Global Pty Ltd (Intertek Group PLC)

- Dakota Software Corporation

- Benchmark Digital Partners LLC

- ProcessMAP Corporation

- Quentic GmbH

- IsoMetrix

- SAP SE

- iPoint-Systems GmbH

- Evotix (SHE Software)

- DNV Business Assurance

- EcoOnline

- ETQ, part of Hexagon

- Origami Risk LLC

- Alcumus Group

- Ideagen PLC

- Vector Solutions

- KPA

- EHS Insight

- Quber Tech

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent regulatory enforcement & rising liability exposure

- 4.2.2 Expansion of ESG & sustainability reporting mandates

- 4.2.3 SaaS-first, mobile-first EHS platforms reduce TCO

- 4.2.4 AI-driven predictive safety & compliance analytics

- 4.2.5 Convergence with digital-twin/asset-management stacks

- 4.3 Market Restraints

- 4.3.1 High upfront implementation & change-management cost

- 4.3.2 Cyber-security & data-privacy concerns in cloud roll-outs

- 4.3.3 Shortage of data-science talent for next-gen EHS tools

- 4.3.4 Vendor consolidation creating integration lock-in risk

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porters Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE & GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Software

- 5.1.2 Services

- 5.2 By Deployment Mode

- 5.2.1 Cloud

- 5.2.2 On-premise

- 5.3 By Solution Type

- 5.3.1 Incident & Safety Management

- 5.3.2 Audit & Inspection

- 5.3.3 Compliance & Risk Management

- 5.3.4 ESG / Carbon Management

- 5.3.5 Training & Learning

- 5.4 By Organization Size

- 5.4.1 Large Enterprises

- 5.4.2 Small & Mid-Sized Enterprises (SME)

- 5.5 By End-user Industry

- 5.5.1 Energy & Utilities

- 5.5.2 Oil & Gas

- 5.5.3 Chemicals & Petro-chemicals

- 5.5.4 Healthcare & Life Sciences

- 5.5.5 Construction & Manufacturing

- 5.5.6 Mining & Metals

- 5.5.7 Food & Beverages

- 5.5.8 Other Industries

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 France

- 5.6.3.3 United Kingdom

- 5.6.3.4 Russia

- 5.6.3.5 Rest of Europe

- 5.6.4 Asia

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 Rest of Asia

- 5.6.5 Middle East & Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Enablon (Wolters Kluwer NV)

- 6.4.2 Intelex Technologies ULC

- 6.4.3 VelocityEHS Holdings Inc.

- 6.4.4 Cority Software Inc.

- 6.4.5 Sphera Solutions Inc.

- 6.4.6 Sai Global Pty Ltd (Intertek Group PLC)

- 6.4.7 Dakota Software Corporation

- 6.4.8 Benchmark Digital Partners LLC

- 6.4.9 ProcessMAP Corporation

- 6.4.10 Quentic GmbH

- 6.4.11 IsoMetrix

- 6.4.12 SAP SE

- 6.4.13 iPoint-Systems GmbH

- 6.4.14 Evotix (SHE Software)

- 6.4.15 DNV Business Assurance

- 6.4.16 EcoOnline

- 6.4.17 ETQ, part of Hexagon

- 6.4.18 Origami Risk LLC

- 6.4.19 Alcumus Group

- 6.4.20 Ideagen PLC

- 6.4.21 Vector Solutions

- 6.4.22 KPA

- 6.4.23 EHS Insight

- 6.4.24 Quber Tech

7 MARKET OPPORTUNITIES & FUTURE OUTLOOK

- 7.1 White-space & Unmet-Need Assessment