PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910506

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910506

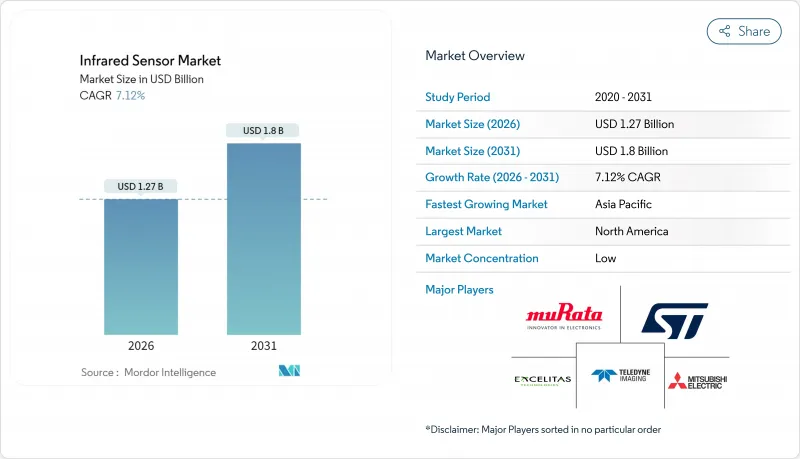

Infrared Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Infrared Sensor market is expected to grow from USD 1.19 billion in 2025 to USD 1.27 billion in 2026 and is forecast to reach USD 1.8 billion by 2031 at 7.12% CAGR over 2026-2031.

The expansion is underpinned by rising Industry 4.0 automation projects, stricter automotive safety mandates, and material-level breakthroughs that improve detector sensitivity and cost efficiency. Near-infrared (NIR) devices remain the revenue cornerstone, yet far-infrared (FIR) arrays are moving fastest as thermal imaging proliferates in automotive, industrial, and medical settings. Packaging innovation chiefly wafer-level vacuum techniques, continues to compress bill-of-materials costs, while AI-enabled on-chip processing reshapes design priorities toward power-aware, event-driven architectures. Incremental gains in quantum efficiency, pixel pitch, and dynamic range are translating into new opportunities in predictive maintenance, gas monitoring, and adaptive driver assistance, thereby sharpening competition among established semiconductor houses and agile materials specialists.

Global Infrared Sensor Market Trends and Insights

Surging Adoption of Industry 4.0 Automation

Thermal cameras, embedded in predictive-maintenance frameworks, now reduce unplanned downtime by 53% while maintaining high image fidelity, thereby accelerating payback periods for factory retrofits. Dual-sensor nodes that merge infrared thermography with acoustic emission enable anomaly detection in additive-manufacturing furnaces and rolling mills. Deployments increasingly exploit thermoelectric harvesters to power maintenance-free IIoT nodes that cut battery waste 94% and shrink total sensing cost 70%. Transformer-based predictive models are achieving 99% identification accuracy for equipment health, making infrared data a trusted input for AI-driven maintenance schedules. Together, these advances embed the infrared sensor market more deeply in industrial value chains, driving volume growth even in low-margin plant retrofits.

Expanding Smart-Home and Consumer Electronics Base

Packaging advances allow TMOS-based presence sensors to detect humans four meters away without bulky concentrators, pushing infrared sensing into battery-powered smart thermostats and gesture-controlled appliances. Multi-zone time-of-flight ranging now extends daytime detection from 170 cm to 285 cm while cutting power from 4.5 mW to 1.6 mW, an efficiency leap critical for wearables and smart speakers. Lead-free quantum-dot photodiodes deliver SWIR imaging at 1,390 nm, meeting environmental directives and enabling secure face authentication behind OLED displays. Flexible photothermoelectric films, sensitive to 0.05 °C changes, underpin emerging electronic-skin and AR-haptics categories. These innovations cement consumer electronics as an enduring demand engine for the infrared sensor market.

High Cost and Cryogenic Cooling of Cooled IR Detectors

Cooled detector assemblies impose significant capital and operating expense because Stirling engines or Joule-Thomson coolers must maintain cryogenic set-points for photon noise suppression. Even advances in multi-stage thermoelectric modules have not yet closed the cost gap against uncooled microbolometers, restraining adoption in mass-volume consumer and building-automation niches where price elasticity is high.

Other drivers and restraints analyzed in the detailed report include:

- Rising Demand from ADAS and Autonomous Vehicles

- Stricter Safety and Environmental Regulations Driving Gas Monitoring

- Temperature-Drift Induced Recalibration Overheads

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Near-infrared modules held 37.45% of overall infrared sensor market share in 2025, largely because silicon-based photodiodes and CMOS-ToF chips align with consumer-electronics cost curves. Quantum-dot SWIR prototypes from STMicroelectronics, featuring 1.62 µm pixel pitch and 60% quantum efficiency, promise single-digit-dollar dies that could swing incremental value toward higher-margin spectral bands. Meanwhile, carbon-nanotube imagers from NEC triple sensitivity at room temperature, creating an uncooled path to performance once reserved for HgCdTe focal-plane arrays. The FIR subset, buoyed by rapid thermal-imaging uptake, is tracking a 7.35% CAGR and is on course to narrow the revenue gap by the decade's close.

Manufacturers are fielding hybrid modules that fuse NIR and FIR into a single optical train, easing camera alignment and broadening scene understanding in mobile robotics. Such dual-band platforms deepen the infrared sensor market size for value-added analytics, particularly where ambient-light variability or smoke obscuration challenges RGB-only vision.

Passive infrared maintained a 61.20% hold on the infrared sensor market size during 2025 owing to its milliwatt-level power draw, which makes it indispensable in battery-powered smart-home nodes. The global roll-out of energy-code-mandated occupancy sensors in new commercial buildings has cemented demand, with California Title 24 revisions alone driving tens of millions of yearly unit sales. Conversely, active infrared is slated for a 7.55% CAGR through 2031, fueled by LiDAR-adjacent applications that exploit modulated beams for depth perception in indoor robotics and AGVs. Low-cost vertical-cavity surface-emitting lasers (VCSELs) at 850 nm and 940 nm now pair with single-photon avalanche diodes on the same PCB, enabling centimeter-grade ranging up to 15 m in broad daylight. Dual-technology detectors combining passive motion triggers with active verification pulses are gaining popularity in commercial security where false alarm rates have direct insurance cost implications.

Regulatory pressure to cut standby energy use below 0.5 W in consumer electronics favors passive architectures, but the drive for gesture recognition and human-machine interaction in infotainment systems is tipping automakers toward active NIR arrays. The eventual convergence is likely to see software-defined sensors that dynamically toggle between passive and active modes based on ambient conditions and battery state.

The Infrared Sensor Market Report is Segmented by Type (Near Infrared (NIR), Infrared, and Far Infrared (FIR)), Working Mechanism (Active, and Passive), Application (Motion Sensing, Temperature Measurement, Security and Surveillance, Spectroscopy, and More), End-User Industry (Healthcare, Aerospace and Defense, Automotive, Commercial Applications, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 31.55% of 2025 revenue on the back of entrenched aerospace suppliers, a robust automotive safety framework, and active smart-manufacturing incentives. Federal grants directed at semiconductor reshoring further encourage domestic wafer capacity additions, lowering geopolitical risk for local downstream camera makers. Europe follows with strong automotive tier-1 integration and industrial-automation depth; however, slower consumer-electronics growth moderates total expansion relative to Asia-Pacific.

The Asia-Pacific infrared sensor market is tracking an 7.95% CAGR, supported by volume smartphone production, aggressive smart-city rollouts, and policy-backed automation upgrades. China's germanium export quotas sparked regional investment in alternative optical materials, catalyzing local ecosystem diversification. Japan maintains technology leadership via firms such as NEC and Hamamatsu that continually push detector physics boundaries, while South Korea leverages advanced packaging prowess to supply microbolometers for consumer drones and security cameras.

Emerging Middle East and Africa markets are beginning to trial thermal cameras for border security and power-plant safety, with funding often sourced from sovereign-wealth initiatives. Latin America demonstrates gradual traction in mining and agricultural automation; pilot programs deploying infrared-enabled drones for crop-health surveys show promising ROI but remain sensitive to currency volatility and import tariffs.

- Murata Manufacturing Co. Ltd

- STMicroelectronics NV

- Excelitas Technologies

- Teledyne Imaging Inc.

- Mitsubishi Electric Corporation

- Amphenol Advanced Sensors (Amphenol Corporation)

- SENBA Sensing Technology Co. Ltd

- Nippon Ceramic Co. Ltd

- Panasonic Corporation

- Broadcom Inc.

- Melexis NV

- Hamamatsu Photonics kk

- InfraTec GmbH

- Honeywell International Inc.

- Texas Instruments Incorporated

- Analog Devices Inc.

- ifm electronic GmbH

- In-situ Inc.

- OMRON Corporation

- Sensirion AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging adoption of Industry 4.0 automation

- 4.2.2 Expanding smart-home and consumer electronics base

- 4.2.3 Rising demand from ADAS and autonomous vehicles

- 4.2.4 Stricter safety and environmental regulations driving gas monitoring

- 4.2.5 Wafer-level vacuum packaging cutting IR sensor costs

- 4.2.6 On-chip AI enabling ultra-low-power event-driven sensing

- 4.3 Market Restraints

- 4.3.1 High cost and cryogenic cooling of cooled IR detectors

- 4.3.2 Temperature-drift induced recalibration overheads

- 4.3.3 Supply bottlenecks for IR-grade compound semiconductors

- 4.3.4 Export-control restrictions on LWIR technologies

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of Macro-economic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Near Infrared (NIR)

- 5.1.2 Infrared

- 5.1.3 Far Infrared (FIR)

- 5.2 By Working Mechanism

- 5.2.1 Active

- 5.2.2 Passive

- 5.3 By Application

- 5.3.1 Motion Sensing

- 5.3.2 Temperature Measurement

- 5.3.3 Security and Surveillance

- 5.3.4 Gas and Fire Detection

- 5.3.5 Spectroscopy

- 5.3.6 Other Applications

- 5.4 By End-user Industry

- 5.4.1 Healthcare

- 5.4.2 Aerospace and Defense

- 5.4.3 Automotive

- 5.4.4 Commercial Applications

- 5.4.5 Manufacturing

- 5.4.6 Oil and Gas

- 5.4.7 Other End-user Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 ASEAN

- 5.5.4.6 Rest of Asia Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Murata Manufacturing Co. Ltd

- 6.4.2 STMicroelectronics NV

- 6.4.3 Excelitas Technologies

- 6.4.4 Teledyne Imaging Inc.

- 6.4.5 Mitsubishi Electric Corporation

- 6.4.6 Amphenol Advanced Sensors (Amphenol Corporation)

- 6.4.7 SENBA Sensing Technology Co. Ltd

- 6.4.8 Nippon Ceramic Co. Ltd

- 6.4.9 Panasonic Corporation

- 6.4.10 Broadcom Inc.

- 6.4.11 Melexis NV

- 6.4.12 Hamamatsu Photonics kk

- 6.4.13 InfraTec GmbH

- 6.4.14 Honeywell International Inc.

- 6.4.15 Texas Instruments Incorporated

- 6.4.16 Analog Devices Inc.

- 6.4.17 ifm electronic GmbH

- 6.4.18 In-situ Inc.

- 6.4.19 OMRON Corporation

- 6.4.20 Sensirion AG

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment