Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687051

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687051

Concrete Admixtures - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 341 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

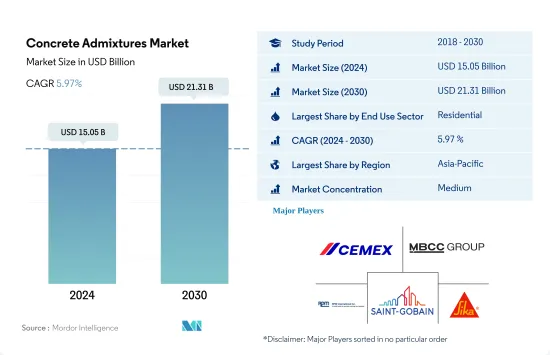

The Concrete Admixtures Market size is estimated at 15.05 billion USD in 2024, and is expected to reach 21.31 billion USD by 2030, growing at a CAGR of 5.97% during the forecast period (2024-2030).

Rise in demand for housing units to drive the demand for concrete admixtures in the future

- In 2022, the global consumption value of concrete admixtures witnessed a growth of approximately 2.31%. This growth was projected to further increase by 5.13% in 2023. The surge in demand can be attributed to the infrastructure and residential construction sectors.

- The residential sector is the largest consumer of concrete admixtures across the globe, accounting for a share of around 32.2% in 2022. Factors such as rapid urbanization, government initiatives, and both foreign and domestic investments are fueling the demand for housing. This, in turn, is expected to boost residential construction in the coming years. For instance, Germany has plans to construct a minimum of 4,000 new housing units by 2024. Consequently, the demand for concrete admixtures in the residential sector is projected to rise by USD 2.6 billion by 2030 compared to 2023.

- The residential sector is expected to be the fastest-growing consumer of concrete admixtures, recording the highest CAGR of 6.67% during the forecast period. The sector's new floor area is set to expand by 8.4 billion sq. ft by 2030, driven by sustained housing demand, increasing investments, and supportive government policies. For instance, the Government of Indonesia (GOI) set a target of constructing around 1 million housing units by 2025, as the country's housing needs are projected to reach 30 million units. Overall, the global residential sector's new floor area is expected to witness a CAGR of 3.81% during the forecast period, further bolstering the demand for concrete admixtures.

Rise in demand for housing units in the Asia-Pacific region is likely to boost the demand for concrete admixtures globally

- In 2022, the global concrete admixtures market grew by 2.31% compared to 2021, with regions like Asia-Pacific and Europe recording the highest growth of 33% and 24.5%, respectively. Concrete admixtures were estimated to grow by 5.13% globally in 2023 compared to 2022.

- In 2023, the Asia-Pacific region emerged as the global leader in concrete admixtures, accounting for approximately 33.1% of the market. Within the region, the infrastructure and residential construction sectors held the largest shares of the concrete admixtures market. In 2022, infrastructure construction alone accounted for a market share of USD 1.56 billion, and this figure was projected to grow by 7.24% in 2023. Additionally, infrastructure spending in the region was set to rise by USD 36.42 billion in 2023, compared to the previous year. The concrete admixtures market in the Asia-Pacific region was expected to witness a 5.35% growth in value from 2022 to 2023.

- The Asia-Pacific region is expected to be the fastest-growing consumer of concrete admixtures, recording a CAGR of 6.70% during the forecast period. This growth can be attributed to the residential sector's demand for concrete admixtures. The region is projected to witness a surge of 524 million sq. ft in new residential floor area by 2024 compared to 2023. By 2030, it was estimated that over 40% of India's population will reside in urban areas, leading to a demand for approximately 25 million affordable housing units. Consequently, the concrete admixtures market in the region is expected to reach USD 73 billion by 2030, up from USD 46 billion in 2023.

Global Concrete Admixtures Market Trends

Asia-Pacific's surge in large-scale office building projects is set to elevate the global floor area dedicated to commercial construction

- In 2022, the global new floor area for commercial construction witnessed a modest growth of 0.15% from the previous year. Europe stood out with a significant surge of 12.70%, driven by a push for high-energy-efficient office buildings to align with its 2030 carbon emission targets. As employees returned to offices, European companies, resuming lease decisions, spurred the construction of 4.5 million square feet of new office space in 2022. This momentum is poised to persist in 2023, with a projected global growth rate of 4.26%.

- The COVID-19 pandemic caused labor and material shortages, leading to cancellations and delays in commercial construction projects. However, as lockdowns eased and construction activities resumed, the global new floor area for commercial construction surged by 11.11% in 2021, with Asia-Pacific taking the lead with a growth rate of 20.98%.

- Looking ahead, the global new floor area for commercial construction is set to achieve a CAGR of 4.56%. Asia-Pacific is anticipated to outpace other regions, with a projected CAGR of 5.16%. This growth is fueled by a flurry of commercial construction projects in China, India, South Korea, and Japan. Notably, major Chinese cities like Beijing, Shanghai, Hong Kong, and Taipei are gearing up for an uptick in Grade A office space construction. Additionally, India is set to witness the opening of approximately 60 shopping malls, spanning 23.25 million square feet, in its top seven cities between 2023 and 2025. Collectively, these endeavors across Asia-Pacific are expected to add a staggering 1.56 billion square feet to the new floor area for commercial construction by 2030, compared to 2022.

South America's estimated fastest growth in residential constructions due to increasing government investments in schemes for affordable housing to boost the global residential sector

- In 2022, the global new floor area for residential construction declined by around 289 million square feet compared to 2021. This can be attributed to the housing crisis generated due to the shortage of land, labor, and unsustainably high construction materials prices. This crisis severely impacted Asia-Pacific, where the new floor area declined 5.39% in 2022 compared to 2021. However, a more positive outlook is expected in 2023 as the global new floor area is predicted to grow by 3.31% compared to 2022, owing to government investments that can finance the construction of new affordable homes capable of accommodating 3 billion people by 2030.

- The COVID-19 pandemic caused an economic slowdown, due to which many residential construction projects got canceled or delayed, and the global new floor area declined by 4.79% in 2020 compared to 2019. As the restrictions were lifted in 2021 and pent-up demand for housing projects was released, new floor area grew 11.22% compared to 2020, with Europe having the highest growth of 18.28%, followed by South America, which rose 17.36% in 2021 compared to 2020.

- The global new floor area for residential construction is expected to register a CAGR of 3.81% during the forecast period, with South America predicted to develop at the fastest CAGR of 4.05%. Schemes and initiatives like the Minha Casa Minha Vida in Brazil announced in 2023 with a few regulatory changes, for which the government plans an investment of USD 1.98 billion to provide affordable housing units for low-income families, and the FOGAES in Chile also publicized in 2023, with an initial investment of USD 50 million, are aimed at providing mortgage loans to families for affordable housing and will encourage the construction of new residential units.

Concrete Admixtures Industry Overview

The Concrete Admixtures Market is moderately consolidated, with the top five companies occupying 42.27%. The major players in this market are CEMEX, S.A.B. de C.V., MBCC Group, RPM International Inc., Saint-Gobain and Sika AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 54293

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End Use Sector Trends

- 4.1.1 Commercial

- 4.1.2 Industrial and Institutional

- 4.1.3 Infrastructure

- 4.1.4 Residential

- 4.2 Major Infrastructure Projects (current And Announced)

- 4.3 Regulatory Framework

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size, forecasts up to 2030 and analysis of growth prospects.)

- 5.1 End Use Sector

- 5.1.1 Commercial

- 5.1.2 Industrial and Institutional

- 5.1.3 Infrastructure

- 5.1.4 Residential

- 5.2 Sub Product

- 5.2.1 Accelerator

- 5.2.2 Air Entraining Admixture

- 5.2.3 High Range Water Reducer (Super Plasticizer)

- 5.2.4 Retarder

- 5.2.5 Shrinkage Reducing Admixture

- 5.2.6 Viscosity Modifier

- 5.2.7 Water Reducer (Plasticizer)

- 5.2.8 Other Types

- 5.3 Region

- 5.3.1 Asia-Pacific

- 5.3.1.1 By Country

- 5.3.1.1.1 Australia

- 5.3.1.1.2 China

- 5.3.1.1.3 India

- 5.3.1.1.4 Indonesia

- 5.3.1.1.5 Japan

- 5.3.1.1.6 Malaysia

- 5.3.1.1.7 South Korea

- 5.3.1.1.8 Thailand

- 5.3.1.1.9 Vietnam

- 5.3.1.1.10 Rest of Asia-Pacific

- 5.3.2 Europe

- 5.3.2.1 By Country

- 5.3.2.1.1 France

- 5.3.2.1.2 Germany

- 5.3.2.1.3 Italy

- 5.3.2.1.4 Russia

- 5.3.2.1.5 Spain

- 5.3.2.1.6 United Kingdom

- 5.3.2.1.7 Rest of Europe

- 5.3.3 Middle East and Africa

- 5.3.3.1 By Country

- 5.3.3.1.1 Saudi Arabia

- 5.3.3.1.2 United Arab Emirates

- 5.3.3.1.3 Rest of Middle East and Africa

- 5.3.4 North America

- 5.3.4.1 By Country

- 5.3.4.1.1 Canada

- 5.3.4.1.2 Mexico

- 5.3.4.1.3 United States

- 5.3.5 South America

- 5.3.5.1 By Country

- 5.3.5.1.1 Argentina

- 5.3.5.1.2 Brazil

- 5.3.5.1.3 Rest of South America

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 CEMEX, S.A.B. de C.V.

- 6.4.2 Fosroc, Inc.

- 6.4.3 Jiangsu Subote New Material Co., Ltd.

- 6.4.4 Kao Corporation

- 6.4.5 MAPEI S.p.A.

- 6.4.6 MBCC Group

- 6.4.7 MC-Bauchemie

- 6.4.8 RPM International Inc.

- 6.4.9 Saint-Gobain

- 6.4.10 Sika AG

7 KEY STRATEGIC QUESTIONS FOR CONCRETE, MORTARS AND CONSTRUCTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.