PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686630

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686630

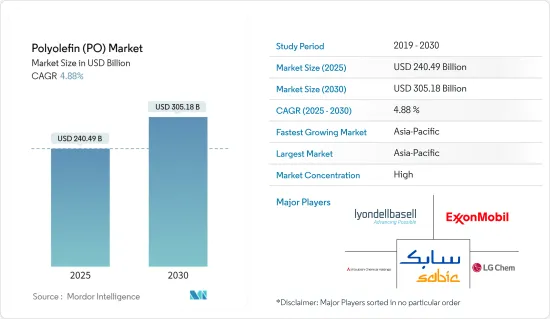

Polyolefin (PO) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Polyolefin Market size is estimated at USD 240.49 billion in 2025, and is expected to reach USD 305.18 billion by 2030, at a CAGR of 4.88% during the forecast period (2025-2030).

The spread of COVID-19 severely affected the market, causing many end-user industries to shut down. During the pandemic, China hampered the polyolefins market intensively, as it is one of the major consumers of polyolefins owing to its strong industries such as packaging, toy manufacturing, construction, and automotive. However, as the industries resumed their manufacturing activities in 2021, the market studied may also recover.

Key Highlights

- Polyolefin is used in electronics, cars, and other industries because of its advanced properties. This is expected to help the market grow in the short term.

- However, growing environmental regulations on plastic imposed by various governments may restrain the market.

- The growing focus on green polyolefin is likely to create new opportunities in the coming years.

- Asia-Pacific dominated the market worldwide, with the largest consumption coming from India and China.

Polyolefin (PO) Market Trends

Increasing Demand in the Films and Sheets Segment to Drive Market Growth

- Films and sheets can be used in the transportation, packaging, construction, and building industries.

- The agricultural sector is driving the market's expansion, with demand for polyolefin films and sheets for greenhouses, mulch, and silage stretch films. The demand is also seen in silage sheets and window films, as well as in the medical industry.

- Polyolefin-based agricultural films also protect vegetables from frost, wind, rain, and pests while speeding up the ripening of fruits, vegetables, and flowers, allowing farmers to grow several crops in a year. Polyolefin films also help reduce evaporation, thus saving water.

- On the other hand, polyolefin sheets are used in the building industry. Polyethylene sheeting, which works as a vapor retarder, is installed beneath the slab. These sheets can retard for a longer time without degrading. As a result, the demand for polyolefin from the construction industry is expanding.

- The Asia-Pacific construction industry is projected to become the world's largest and fastest-growing industry, with a 45% share of global construction spending coming from the region. In the coming years, this is likely to make more people opt for films and sheets.

- In fiscal year 2022, India had a total polyolefins production capacity of over 12 thousand kilotons. Most polyolefins were made by Reliance Industries Limited, which made up almost 47% of India's total polyolefins production capacity.

- Thus, due to these factors, the polyolefin market is likely to grow in the coming years as the demand for films and sheets rises.

Asia-Pacific to Dominate the Market

- Asia-Pacific is the dominant region in the polyolefins market, owing to China being the major consumer of polyolefins worldwide. The growth is driven by increasing e-commerce, as the strong courier business led to a spike in demand for plastic packaging. The country's manufacturing industry is one of the major contributors to its economy.

- The Chinese government announced big building plans for the next 10 years, including plans to move 250 million people to new megacities. This is a big chance for construction chemicals to be used in a variety of ways to improve building properties during construction.

- Electronic items, such as smartphones, OLED TVs, tablets, and other consumer electronics, are recording the fastest growth in the market. With more money in the pockets of the middle class, there will be more demand for electronics, which may drive the demand for polyolefins in the country.

- In China, the electronics segment was projected to reach over USD 385 billion by the end of 2023.

- All the above-mentioned factors are expected to increase the demand for polyolefins over the forecast period.

Polyolefin (PO) Industry Overview

The polyolefin market is consolidated in nature. Some of the major players (not in any particular order) include LyondellBasell Industries Holdings BV, ExxonMobil Corporation, SABIC, LG Chem, and Mitsubishi Chemical Holdings Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Shift in Preferences from Rigid Packaging to Flexible Packaging

- 4.1.2 Growing Demand for Low-Cost Interior Furnishings

- 4.2 Restraints

- 4.2.1 Growing Environmental Regulations

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Material Type

- 5.1.1 Polyethylene (PE)

- 5.1.1.1 High Density Polyethylene (HDPE)

- 5.1.1.2 Low Density Polyethylene (LDPE)

- 5.1.1.3 Linear Low-density Polyethylene (LLDPE)

- 5.1.2 Polypropylene (PP)

- 5.1.1 Polyethylene (PE)

- 5.2 Application

- 5.2.1 Films and Sheets

- 5.2.2 Injection Molding

- 5.2.3 Blow Molding

- 5.2.4 Extrusion Coating

- 5.2.5 Fibers and Raffia

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Arkema Group

- 6.4.2 BASF SE

- 6.4.3 Braskem

- 6.4.4 Chevron Phillips Chemical Company

- 6.4.5 China National Petroleum Corporation

- 6.4.6 China Petrochemical Corporation

- 6.4.7 Daelim

- 6.4.8 Dow

- 6.4.9 ExxonMobil Corporation

- 6.4.10 Formosa Plastics Corporation

- 6.4.11 Japan Polypropylene Corporation

- 6.4.12 LG Chem Ltd.

- 6.4.13 LyondellBasell Industries Holdings BV

- 6.4.14 Mitsubishi Chemical Holdings Corporation

- 6.4.15 Mitsui Chemicals Incorporated

- 6.4.16 Nova Chemicals Corporation

- 6.4.17 PetroChina Company Limited

- 6.4.18 Reliance Industries Limited

- 6.4.19 SABIC (Saudi Basic Industries Corporation)

- 6.4.20 Sasol Ltd.

- 6.4.21 Tosoh Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Focus on Green Polyolefin