PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444636

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444636

Spain Alfalfa Hay - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

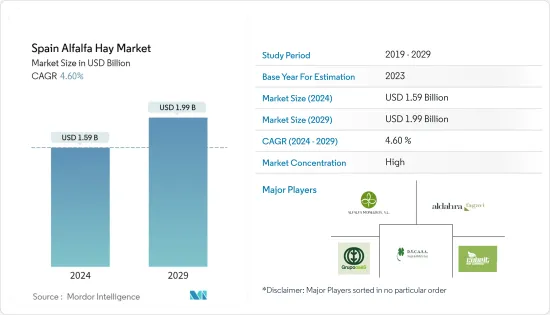

The Spain Alfalfa Hay Market size is estimated at USD 1.59 billion in 2024, and is expected to reach USD 1.99 billion by 2029, growing at a CAGR of 4.60% during the forecast period (2024-2029).

Key Highlights

- Spain is one of the significant alfalfa producers in Europe. The rich nutritional content of alfalfa drives the market as the need for quality feed for animals is increasing. In Spain, there has been an increase in the population of animals for dairy products or meat. According to Eurostat, an increase in the total number of animals was observed in 2022. The increased number of animals drives the need for hay for survival. Alfalfa is considered to be the best hay of all.

- Spain is the major producer of alfalfa hay, which is majorly grown on irrigated land, particularly in the valley of Valle de Ebro. According to the AEFA (Spanish Manufacturers Association of Dehydrated Alfalfa), 80% of alfalfa produced during the 2020-2021 season was sent abroad. The principal alfalfa-growing areas in Spain are Castilla y Leon and the Ebro Valley, and alfalfa produced in the Aragon region is mainly destined for the export market.

- After the United States, Spain is the largest alfalfa hay exporter globally. The United Arab Emirates, China, and France are the major export destinations to Spain. Increased domestic production, with the growing demand for hay from the Middle East and the United Arab Emirates, are the dominant factors driving the market for alfalfa hay in the country.

Spain Alfalfa Hay Market Trends

Increasing Demand for Dairy and Meat Products

Livestock is a major factor responsible for the growth of the alfalfa hay market. Due to its nutritional benefits, alfalfa is one of the most important feed sources for animals worldwide. Alfalfa hay is used primarily as an animal feed for dairy cows, horses, beef cattle, sheep, chickens, turkeys, and other farm animals. It has the most feed value of all perennial pasture forages. Spain is the largest manufacturer as well as exporter of Alfalfa in Europe. Alfalfa hay is a better source of protein for animals. Animals consume more alfalfa than grass hay. Alfalfa is a versatile plant that can be used as high-quality animal feed. Alfalfa hay is considered ideal because of its availability. It is the only forage that is produced and sold in every state.

The increase in meat production in the country is driving the production of alfalfa in Spain. The number of animals in Spain was observed to increase in 2021. According to Eurostat, in 2021, the population of bovines, pigs, sheep, and goats was observed to be 6576.30, 34,454.09, 15081.35, and 2589.09 thousand heads, respectively. Meat production in the country also increased in 2021 compared to the previous year. Animal farming is increasing to meet the increasing demand for high-value animal protein. The demand for alfalfa hay is increasing significantly due to the increasing animal population, driven by the demand for meat and other animal products. The cattle and buffaloes population in Spain is recording steady growth.

High Nutritional Property of Alfalfa is Driving the Export Market

Due to the nutritional benefits, alfalfa hays are higher in protein and minerals and more palatable than grass hays. Alfalfa, in particular, is high in energy and is an excellent source of vitamins and minerals. It contains 15 to 22% crude protein and is an excellent source of a wide range of vitamins and minerals. High-quality hay contains a high percentage of leaves. Leaves provide 50-75% of digestible matter,75% protein, and 90% of carotene in the hay.

According to ITC Trade Map, in 2021, Spain was one of the world's leading exporters of alfalfa meals and pellets. In 2020 the amount of meal and pellets exported was 321.099 tons, which increased to 486,216 tons in 2021. Spain accounted for the export value of USD 112,015 thousand in 2021 compared to USD 71,569 thousand in 2020. In 2021, United Arab Emirates, France, and China were the major importers of alfalfa from Spain. According to the AEFA (The Spanish Association of Manufacturers of Dehydrated Alfalfa), during the 2020/2021 season, 80% of all alfalfa produced in Spain was sent abroad.

Alfalfa is highly digestible and usually contains more cell solubles, less cellulose, and hemicellulose, a higher protein, lower fiber, and higher relative feed value than grass. As the alfalfa plant matures from the vegetative to the flowering stage, the number of fiber increases while crude protein and digestibility decrease. Early-cut alfalfa is more palatable and highly consumed.

Spain Alfalfa Hay Industry Overview

Spain's alfalfa market is highly consolidated with five dominant players. Companies compete on new product launches and focus on strategic moves such as mergers, acquisitions, and expansions to acquire larger market shares. Some of the key players in the market are Alfalfa Monegros SL, Al Dahra Agriculture, DYCASA, Cubeit Hay Company, and Grupo Oses.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Bales

- 5.1.2 Pellets

- 5.1.3 Cubes

- 5.2 Application

- 5.2.1 Meat/Dairy Animal Feed

- 5.2.2 Poultry

- 5.2.3 Horse feed

- 5.2.4 Other Animal Types

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Competitor Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Cubeit Hay Company

- 6.3.2 Al Dahra Agriculture

- 6.3.3 Grupo Oses

- 6.3.4 Alfalfa Monegros SL

- 6.3.5 DYCASA

- 6.3.6 Bailey Farms Inc.

- 6.3.7 Anderson Hay & Grain Co.

- 6.3.8 Coaba

- 6.3.9 The Accomazzo Company

- 6.3.10 S&S Agrisource Holding LLC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS