PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640690

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640690

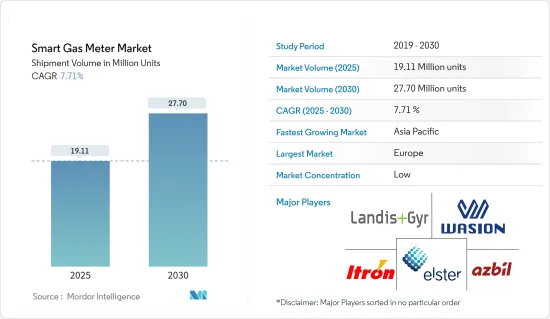

Smart Gas Meter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Smart Gas Meter Market size in terms of shipment volume is expected to grow from 19.11 million units in 2025 to 27.70 million units by 2030, at a CAGR of 7.71% during the forecast period (2025-2030).

The rise in global demand for natural gas, along with increasing demand for drill-down data among end-users, are the driving factors of the market growth.

Key Highlights

- The adoption of smart gas meters on a large scale improves grid and distribution operations by allowing communication between other smart meters. The region under study's climate target and associated energy efficiency initiatives further encourage the adoption. Gas heating systems with smart meters use less fuel, indirectly contributing to developing a wholly automated grid. These developments are anticipated to accelerate the implementation of smart gas meters.

- Moreover, With the availability of next-generation IoT-optimized 5G technology, it is expected that there will be a shift from legacy RF platforms to emerging standards, like NB-IoT, in smart gas meters. Major companies, such as ITRON and Sensirion, are launching next-generation gas meters, like the SGM6200 series, with competitive prices and ultra-low current consumption to leverage the opportunity.

- Smart gas meters improve operational security while lowering gas companies' costs, which helps to drive the industry. The adoption of smart gas meters is fueled by the functional benefits they provide gas companies, such as the elimination of manually recording monthly readings, ongoing pipeline monitoring, and the availability of real-time data. Additionally, gas utility providers can use prioritized alarms and real-time data to raise the bar on safety.

- Moreover, Smart gas meters are technologically advanced compared with traditional gas meters. As a result, the cost of installing smart meters is typically higher than that of conventional meters, as a smart gas meter combines measurement and communication systems.

- The outbreak of COVID-19 significantly hampered the demand for gas meters from the regional gas sector. However, in 2021, the decline in COVID-19 cases led to the resumption of drilling activities and businesses reopening. This resulted in a slow economic recovery across the regions.

Smart Gas Meter Market Trends

The Rise in Global Demand for Natural Gas to Drive the Market Growth

- One of the fundamental forces driving the market expansion for smart gas meters is the increase in natural gas demand on a global scale. Due to its dominance as a fuel for the production of electricity and the industrial sector, natural gas is in greater need.

- The International Energy Agency predicts that between the current year and 2025, the world's natural gas consumption will increase at an average annual rate of 0.8%, reaching about 4,240 bcm.

- Additionally, natural gas is impacted by the economy's strength. Increased demand for goods and services from the commercial and industrial sectors might increase natural gas consumption during economic expansion. The industrial sector, where natural gas is used as a fuel and feedstock to create numerous products, is one where the growth in consumption tied to the economy can be exceptionally high.

- Energy consumption costs account for a sizeable portion of all expenses made by industrial establishments. As a result, these industries frequently utilize gas meters to track natural gas consumption.

- Due to the high volume of natural gas consumption, accuracy in the measurement of gas consumption would result in significant anomalies in the billing amount. In manufacturing plants or electrical utilities, this could be harmful.

- The production plant or power supplier might install gas meters to ensure accuracy and dependability in both use and metering. This will guarantee that these discrepancies are kept to a minimum. These developments are fueling the market's growth.

Europe to Hold Significant Market Growth

- In Europe, the United Kingdom accounts for the most significant single country share due to the government initiatives for the simultaneous rollout of energy meters supported by current infrastructure.

- The Department of Energy and Industrial Policy is in charge of the nation's crystal-clear rollout plan. According to the National Audit Office (NAO), the United Kingdom is set to complete the installation process of smart meters. Over 27.8 million smart meters were installed in the United Kingdom by the end of 2021. Additionally, due to a high population density and high connectivity, the country has a good cost-benefit analysis, further adding to the growth.

- The utility sector in the region is adopting sophisticated technologies, and the increasing investments in smart grids are further expected to accelerate the adoption of smart gas meters in the country.

- Also, the increasing greenhouse gas emissions from residential and commercial buildings in the country are expected to drive the adoption of smart gas meters further. They help maintain the efficiency of the gas flow.

- Further, the region is witnessing various developments for installing gas meters for larger gas supplies. For instance, in Oct 2022, the UK's first U16 gas smart meter was placed in Berwick-on-Tweed, Northumberland, at a residential building. The SMS PLC company installed the U16 gas smart meter, which is nearly twice as large as the U6 gas meter. Customers can now switch to smart meters if they have a more excellent gas supply than 16 cubic meters per hour, such as large residential or commercial premises.

Smart Gas Meter Industry Overview

The global smart gas meters market is fragmented and consists of several major players. In some areas, the demand for smart gas meters has reached maturity. Due to this, businesses are working hard to keep their competitive edge in the market. Companies are using smart joint ventures to grow their market share and profitability. To improve the capabilities of their products, the firms are also buying up start-ups and developing market technologies for smart gas meters. Wasion Group Holdings, Landis + GYR Group AG, and others are essential players.

In November 2022, Itron Inc. announced the release of the Itron Intelis gFlex prepayment gas meter. Ingenious ultrasonic solid-state measurement technology and Itron's 30 years of expertise in prepayment metering solutions are combined in the next-generation meter. Intelis gFlex assists utilities in ensuring their revenue and lowering their financial exposure by being integrated into an easy-to-deploy SaaS solution and managed through various combinations of vending channels and credit transfer alternatives. Asia Pacific, Middle East Europe, Africa (EMEA), Latin America, and the region can now purchase the meter.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter Five Forces

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes Products and Services

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Industry

- 4.5 Natural Gas Domestic Consumption Statistics (2010-2020)

- 4.5.1 North America

- 4.5.2 Europe and CIS

- 4.5.3 Asia Pacific

- 4.5.4 Latin America

- 4.5.5 Middle East

- 4.5.6 Africa

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Drill-down Data Among End-users

- 5.1.2 Smart Gas Meter Augment Operational Safety and Curtail Cost of Gas Companies

- 5.1.3 The Rise in Global Demand for Natural Gas to Drive the Market Growth

- 5.2 Market Challenges

- 5.2.1 High Cost and Security Concerns Pertaining to User Data

- 5.2.2 Huge Capital Investment for Infrastructure Installation and Slow/Delayed ROI

6 MARKET SEGMENTATION

- 6.1 By Geography

- 6.1.1 North America

- 6.1.1.1 United States

- 6.1.1.2 Canada and Central America

- 6.1.2 Europe, Middle East and Africa

- 6.1.2.1 Europe

- 6.1.2.2 CIS

- 6.1.2.3 Middle East

- 6.1.2.4 Africa

- 6.1.3 Asia Pacific

- 6.1.3.1 China

- 6.1.3.2 Japan

- 6.1.3.3 South Korea

- 6.1.3.4 Australia and New Zealand

- 6.1.3.5 India

- 6.1.3.6 Rest of Asia Pacific

- 6.1.4 Latin America

- 6.1.4.1 Brazil

- 6.1.4.2 Mexico

- 6.1.4.3 Argentina

- 6.1.4.4 Rest of Latin America

- 6.1.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Landis + GYR Group AG

- 7.1.2 Wasion Group Holdings

- 7.1.3 Elster Group GmbH (Honeywell International Inc.)

- 7.1.4 Itron Inc.

- 7.1.5 Azbil Kimmon Co. Ltd (Azbil Corporation)

- 7.1.6 Sagemcom SAS

- 7.1.7 Diehl Stiftung GmbH & Co. KG

- 7.1.8 Holley Technology Ltd (Zhejiang Huamei Holding Co. Ltd)

- 7.1.9 Apator SA

- 7.1.10 Yazaki Corporation

- 7.1.11 Aichi Tokei Denki Co. Ltd

- 7.1.12 Pietro Fiorentini SpA

- 7.1.13 AEM

- 7.1.14 Zenner International GmbH & Co. KG

- 7.1.15 Sensus Usa Inc. (Xylem Inc.)

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS