PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687201

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687201

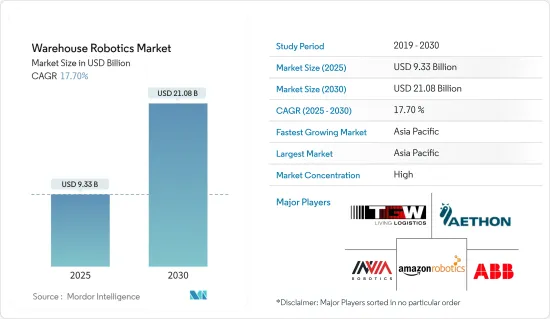

Warehouse Robotics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Warehouse Robotics Market size is estimated at USD 9.33 billion in 2025, and is expected to reach USD 21.08 billion by 2030, at a CAGR of 17.7% during the forecast period (2025-2030).

Key Highlights

- Expanding SKU Diversity Drives Warehouse Automation: The warehouse robotics market is witnessing accelerated growth driven by the surge in SKU diversity. Over 50% of businesses are expected to increase the number of SKUs to cater to long-tail consumer demands. This trend is reshaping traditional warehouse models, where large-pallet order systems are being replaced by small, multi-SKU orders. To meet this challenge, automated mini-load storage and retrieval systems (AS/RS) are becoming vital. These systems leverage lightweight cranes to manage totes, cases, and crates, optimizing storage and freeing up crucial labor and delivery resources.

- Increase in Warehouse Size: Warehouses have expanded from 65,000 sq. ft in 2000 to over 200,000 sq. ft in 2020 to accommodate the rising volume of SKUs.

- Shift in Retailer-Wholesaler Dynamics: Just-in-time ordering and direct-to-consumer distribution are reducing large-pallet orders, accelerating the need for automation.

- Picking Robots and AGVs: The latest generation of picking robots and Automated Guided Vehicles (AGVs) is ideal for handling small orders spread over vast SKU ranges in large warehouses.

- Surging Investments Fuel Technological Advancements: The influx of capital is propelling warehouse automation technologies forward. Venture capital firms have been actively investing in robotics, with funding for warehouse robotics startups reaching USD 381 million in Q1 2020, a 57% year-over-year increase.

- Locus Robotics' Expansion: In June 2020, Locus Robotics raised USD 40 million to enhance R&D and expand into the European Union.

- Amazon's Innovation Hub: Amazon's investment of USD 40 million to develop a cutting-edge robotics hub in Massachusetts is expected to boost automation advancements.

- Shopify's Strategic Acquisition: Shopify's USD 450 million acquisition of 6 River Systems in 2019 expanded its fulfillment capabilities, incorporating cloud-based software and collaborative mobile robots.

- E-commerce Boom Accelerates Adoption: The rapid growth of e-commerce continues to drive the adoption of warehouse robotics. Efficient inventory management and fulfillment operations are becoming critical as online retail surges.

- Projected Market Value: Cowen projects that the U.S. market for warehouse and logistics robots in e-commerce will reach nearly USD 8 billion by 2024.

- New Fulfillment Models: Albertsons and Takeoff Technologies have collaborated to pilot urban fulfillment centers powered by AI and robotics to streamline small urban warehouse operations.

- Kroger's Expansion: Kroger is planning to open up to 20 customer fulfillment centers in partnership with Ocado, featuring large-scale robot-driven facilities.

- Labor Shortages and Cost Reduction Drive Innovation: Warehouse robotics are being increasingly used to tackle labor shortages and reduce operational costs. Automation helps improve efficiency by reducing unnecessary labor movement and streamlining operations.

- Wasted Motion Costs: U.S. warehouses lose USD 4.3 billion annually due to wasted motion, emphasizing the importance of robotic solutions.

- Industrial Robots Growth: The operational stock of industrial robots is projected to grow from 2,408 thousand units in 2018 to 3,788 thousand units by 2021.

- Alibaba's Workforce Reduction: By deploying robotic labor, Alibaba reduced its warehouse workforce by 70%, while creating more opportunities for skilled labor.

Warehouse Robotics Market Trends

Mobile Robots (AGVs and AMRs) Largest Segment by Type

Mobile robots, particularly Automated Guided Vehicles (AGVs) and Autonomous Mobile Robots (AMRs), dominate the warehouse robotics market. This segment captured 22.80% of global revenue in 2021, making it a pivotal driver of automation.

- Strong Growth: Mobile robots are the fastest-growing segment, with a CAGR of 16.64% forecasted, indicating a clear market preference for adaptable robotic solutions.

- Revenue Projections: The segment generated USD 2.25 billion in revenue in 2021 and is expected to grow to USD 5.63 billion by 2027, underlining the increased adoption in warehouses.

- Technological Advancements: Investments in sensor technology, AI, and computer vision are enhancing the capabilities of mobile robots. Amazon's acquisition of Canvas Technology for advanced autonomous robots is a notable example.

- Industry Applications: Mobile robots are widely used across industries, particularly in retail (27.46% market share in 2021) and food and beverage sectors, where they enhance efficiency in product handling and temperature-controlled environments.

Asia Pacific is Expected to Hold Significant Market Share

Asia-Pacific is the dominant and fastest-growing region in the warehouse robotics market, capturing 46.72% of the global share in 2021.

- CAGR Projections: The region is expected to maintain its leadership with a CAGR of 16.06%, driven by the rapid adoption of robotics technologies in countries like China and India.

- Market Size: The Asia-Pacific warehouse robotics market generated USD 4.62 billion in revenue in 2021, with forecasts estimating growth to USD 11.20 billion by 2027.

- E-commerce Expansion: The booming e-commerce market in India and China is a significant driver, with India's market expected to grow from USD 46.2 billion in 2020 to USD 350 billion by 2030.

- Manufacturing Leadership: Asia-Pacific's status as a global manufacturing hub is propelling the adoption of warehouse automation technologies, especially in China, Japan, and South Korea.

- Technological Innovation: Companies in Asia are investing in AI-powered robotics solutions. Geek+, a Chinese robotics company, has made significant advancements with its AI-powered logistics robots, competing with established global players.

Warehouse Robotics Industry Overview

The warehouse robotics market is dominated by global players, with a consolidated market structure. Established automation companies and specialized robotics firms are at the forefront of the industry, leveraging research, partnerships, and acquisitions to maintain their market positions.

Honeywell's Robotics Hub: Honeywell's USD 50 million investment in a Robotics Innovation Hub showcases the company's commitment to leading the warehouse automation sector.

Investor Confidence: Emerging players such as GreyOrange and Vecna Robotics have raised substantial funds, indicating strong confidence in the growth potential of warehouse robotics.

Technology Leaders Shape Market Dynamics: Key players like ABB Limited, Fanuc Corporation, Honeywell International Inc., KUKA AG, and Yaskawa Electric Corporation lead the market. These companies are developing advanced solutions, including AMRs, AS/RS, and AI-powered systems.

Innovative Solutions: Swisslog's KR SCARA robots and Locus Robotics' RaaS (robots-as-a-service) subscription model are disrupting traditional market approaches, providing cost-effective and accessible automation solutions.

Strategic Partnerships: Collaboration with e-commerce platforms and logistics providers, such as Berkshire Grey's USD 23 million contract with a global retailer for same-day grocery fulfillment, is a key strategy for market expansion.

Factors Driving Future Success in the Market: To succeed, companies need to focus on AI and machine learning advancements to enhance robotic capabilities. Flexible solutions that adapt to various warehouse configurations, partnerships with retailers, and scalable automation platforms will be critical. Addressing high implementation costs and regulatory challenges will also be essential to ensure wider adoption across industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Number of SKUs

- 5.1.2 Increasing Investments in Technology and Robotics

- 5.2 Market Challenges

- 5.2.1 Stringent Regulatory Requirements

- 5.2.2 High Cost

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Industrial Robots

- 6.1.2 Sortation Systems

- 6.1.3 Conveyors

- 6.1.4 Palletizers

- 6.1.5 Automated Storage and Retrieval System (ASRS)

- 6.1.6 Mobile Robots (AGVs and AMRs)

- 6.2 By Function

- 6.2.1 Storage

- 6.2.2 Packaging

- 6.2.3 Trans-shipment

- 6.2.4 Other Functions

- 6.3 By End-user Industry

- 6.3.1 Food and Beverage

- 6.3.2 Automotive

- 6.3.3 Retail

- 6.3.4 Electrical and Electronics

- 6.3.5 Pharmaceutical

- 6.3.6 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 South Korea

- 6.4.3.3 Japan

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Limited

- 7.1.2 Kiva Systems (Amazon Robotics LLC)

- 7.1.3 TGW Logistics Group GMBH

- 7.1.4 Singapore Technologies Engineering Ltd (Aethon Incorporation)

- 7.1.5 InVia Robotics Inc.

- 7.1.6 Fanuc Corporation

- 7.1.7 Honeywell International Incorporation

- 7.1.8 Toshiba Corporation

- 7.1.9 Omron Adept Technologies

- 7.1.10 Yaskawa Electric Corporation (Yaskawa Motoman)

- 7.1.11 Kuka AG

- 7.1.12 Fetch Robotics Inc.

- 7.1.13 Geek+ Inc.

- 7.1.14 Grey Orange Pte Ltd

- 7.1.15 Hangzhou Hikrobot Technology Co. Ltd

- 7.1.16 Syrius Robotics

- 7.1.17 Locus Robotics

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET