PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851528

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851528

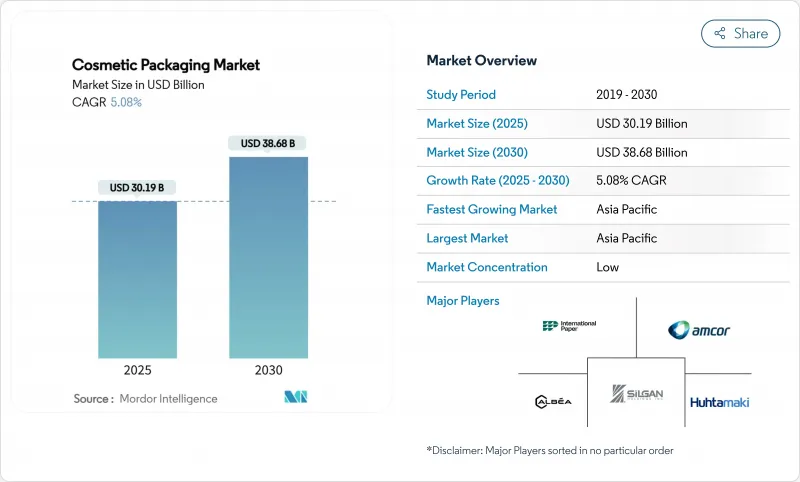

Cosmetic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The cosmetic packaging market size reached USD 30.19 billion in 2025 and is set to climb to USD 38.68 billion by 2030, reflecting a steady 5.08% CAGR.

The advance mirrors brand responses to the European Union's Packaging and Packaging Waste Regulation, effective February 2025, which obliges recyclability and extended producer responsibility compliance. Brands counter rising polyethylene terephthalate costs driven by geopolitical tension and production cuts in China and Europe by accelerating recycled-content usage and lightweight designs. Asia-Pacific remains the growth engine, propelled by sophisticated consumer routines and strong e-commerce logistics; Chinese facial sheet-mask success and premiumization across South Korea and Japan typify the region's influence. Material choice continues to bifurcate: plastics retain cost leadership while glass advances on luxury, refillable, and circular-economy appeal. Meanwhile, corporate consolidation highlighted by Amcor's USD 8.43 billion merger with Berry Global bundles scale and R&D to quicken sustainable-packaging rollouts.

Global Cosmetic Packaging Market Trends and Insights

Growing Consumption of Premium and Masstige Beauty Products

Luxury cues have migrated into mainstream channels as tactile finishes, heavy-wall glass, and ornate closures shape brand storytelling. L'Oreal's 2025 World Refill Day push lifted refillable options seventeen-fold in five years without diluting premium positioning. Estee Lauder already supplies 71% of its portfolio in sustainable formats, confirming that environmental progress and upscale image can co-exist. Suppliers thus prioritise high-clarity glass and mono-material pumps that tolerate prestige formulations. The opportunity extends to refill kits that guarantee adjacency sales and invite higher margins. Luxury's embrace of environmental performance raises the bar for all tiers of the cosmetic packaging market.

Shift Toward E-commerce-Friendly Lightweight Formats

Online sales make damage resistance and dimensional-weight savings decisive. Flexible pouches grow at 7.67% CAGR because they ship flat, cut void fill, and slash freight spend. KISS Cosmetics automated its 480,000 ft2 facility with intelligent cart-picking and A-Frame dispensing, demonstrating fulfilment economics that favour uniform, lighter packs. Packaging-robot investments are projected to reach USD 7.5 billion by 2032, underlining automation's role in smoothing multi-SKU flows. Brands that optimise for courier networks rather than retail shelves secure faster cycle times and lower emissions, fortifying the global cosmetic packaging market against logistics volatility.

Escalating Global Recycled-Resin Price Volatility

European PET hovered at EUR 1,130-1,170 per t in 2024 as anti-dumping rules tightened supply, forcing converters into spot-market bidding wars. Polyethylene and polypropylene followed with five-cent and four-cent per-lb upticks in early 2025 as feedstock costs rose. Brands with 50%-recycled-content pledges thus absorb margin shocks or hedge via vertical integration, such as on-site washing plants. Because high-quality food-grade PCR commands premiums, availability risk constrains design freedom and may slow substitutions away from virgin resin in the cosmetic packaging market.

Other drivers and restraints analyzed in the detailed report include:

- Rise of Refillable/Reusable Delivery Systems in Prestige Channels

- Rapid Adoption of Robot-Ready Secondary Packs in 3-PL Fulfilment

- Regulatory Caps on Single-Use Plastic

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastics held a 64.58% cosmetic packaging market share in 2024 thanks to cost efficiency, clarity, and line-speed compatibility. Polyethylene terephthalate leads for personal-care bottles, polypropylene secures pump stems and closures, while low-density polyethylene shapes flexible tubes. Yet glass races ahead at 8.67% CAGR to 2030 because prestige brands crave heft, scratch resistance, and infinite recyclability. The premium shift lifts the cosmetic packaging market size for glass to meaningful double-digit revenue slices even as total pack count stays lower than plastic. Glass-recycling initiatives such as Estee Lauder's work with Strategic Materials Inc.improve cullet quality and furnace yields, soothing environmental criticisms[2]. Metallised aluminium and steel remain niche for fragrances and gifting editions where barrier performance and tactile coolness drive shelf impact. Fibre-based board escalates in transit shippers and gift sets, answering e-commerce cushioning needs without raising plastic tax exposure.

Second-generation materials blur lines between categories. Multi-layer PET-aluminium laminates once seen in tubes migrate toward mono-material EVOH-barrier PET that retains recycling stream compatibility. Bio-sourced resins such as polylactic acid win trial runs for limited-edition labels but still battle heat resistance and filling-line friction, limiting scale. Suppliers addressing these hurdles gain early-mover contracts, reflecting how sustainability performance now shapes vendor selection criteria across the cosmetic packaging market. Meanwhile, returnable glass programs aligned with refill stations exemplify how premium credentials fuse with low-impact ambitions to pull glass farther into mainstream assortments.

Bottles and jars delivered 44.56% revenue in 2024, supported by high filling speeds and shopper familiarity. Wide-mouth jars continue to anchor face creams, while narrow-neck PET bottles dominate shampoos and micellar waters. However, sachets and stand-up pouches compound at a brisk 7.67% CAGR, cutting grams per dose and resisting breakage during courier drops. Right-size technology lets brands switch from one bottle-per-month to five flat sachets per envelope, lowering freight-emissions intensity. Tubes and sticks address on-the-go sunscreen, solid serum, and colour-balm trends, meshing with travel-size regulation and zero-leak expectations. Folding cartons remain favoured in luxury presentations, housing glass flacons or booster vials while conveying brand narratives through soft-touch varnish and foil embossing.

Transit boxes evolve too. Corrugated suppliers deploy algorithmic box-making to trim void fill, supported by Packsize machines that cut board in line with real-time order dimensions. Consumer unboxing gains differentiate omnichannel experiences, prompting QR-printed inserts that trigger digital loyalty rewards. Flexible-pack barrier coatings upgrade to silicon oxide or aluminium oxide, securing fragrance retention and reducing oxygen transmission without disqualifying recyclability. Such advances swell the cosmetic packaging market size credited to flexible formats and re-define mass-premium aesthetics away from solely rigid containers.

Cosmetic Packaging Market is Segmented by Material Type (Plastic, Glass, Metal, Paper and Paperboard), Product Type (Bottles and Jars, Tubes and Sticks, Folding Cartons, Corrugated Transit Boxes, and More), Dispensing Mechanism (Pump-Based, Dropper / Pipette, Spray / Mist, and More), Cosmetic Type (Hair Care, Color Cosmetics, Skin Care, and More), and Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific owned 42.89% of cosmetic packaging market revenue in 2024 and will grow at a 7.45% CAGR to 2030, lifted by rising disposable income, advanced K-beauty regimens, and high mobile-commerce penetration. Sheet-mask dominance in China illustrates local appetite for single-use but sophisticated pack forms, making the region a hotbed for minimalist yet functional pouches. Japan and South Korea export design cues globally, such as airless cushion compacts and slim twist balms, giving regional converters first-mover advantages.

North America holds firm value through premium skincare adoption and rapid e-commerce. Refill station pilots appear in beauty specialty retailers, rewarding glass cartridge suppliers with new service contracts. Automation readiness drives widespread acceptance of robot-friendly corrugate and linerless labels. State-level plastic-reduction bills add urgency to lightweight mono-material shifts, redirecting investment towards recycled-content PET and fibre substitution. These moves keep the cosmetic packaging market buoyant despite mature category penetration.

Europe shapes regulatory frameworks that ripple worldwide. Enforcement of the PPWR and escalating eco-contribution fees in France imposes clear packaging recyclability thresholds, accelerating investment in design for disassembly. Luxury fragrance clusters in France and Italy champion glass innovation, including advanced hot-end coating for scratch reduction. Meanwhile, Central and Eastern Europe attract bottle moulding capacity expansions to serve both local brands and export production. Collectively, global regions influence material strategies and technology transfer rates, interlocking demand drivers for the cosmetic packaging market.

- Albea SA

- AptarGroup Inc.

- Amcor Group GmbH

- Silgan Holdings Inc.

- DS Smith PLC

- Graham Packaging LP

- Quadpack Industries SA

- Libo Cosmetics Co. Ltd

- Gerresheimer AG

- Ball Corporation

- Verescence France SA

- SKS Bottle & Packaging Inc.

- Altium Packaging

- Cosmopak Ltd

- Raepak Ltd

- Rieke Corporation

- Essel Propack Ltd

- Huhtamaki Oyj

- Alpla Werke Alwin Lehner GmbH

- RPC M&H Plastics

- HCP Packaging Co. Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing consumption of premium and masstige beauty products

- 4.2.2 Shift toward e-commerce-friendly lightweight formats

- 4.2.3 Rise of refillable / reusable delivery systems in prestige channels

- 4.2.4 Authentication-enabled smart packaging to curb counterfeits

- 4.2.5 Brand demand for carbon-label-ready packs

- 4.2.6 Rapid adoption of robot-ready secondary packs in 3-PL fulfilment

- 4.3 Market Restraints

- 4.3.1 Escalating global recycled-resin price volatility

- 4.3.2 Regulatory caps on single-use plastics

- 4.3.3 Filling-line incompatibility of novel bio-materials

- 4.3.4 Shrinking landfill capacity driving extended-producer-responsibility fees

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material Type

- 5.1.1 Plastics

- 5.1.1.1 Polyethylene Terephthalate (PET)

- 5.1.1.2 polypropylene (PP)

- 5.1.1.3 Polyethylene (PE)

- 5.1.1.4 Other Plastics

- 5.1.2 Glass

- 5.1.3 Metal

- 5.1.4 Paper and Paperboard

- 5.1.1 Plastics

- 5.2 By Product Type

- 5.2.1 Bottles and Jars

- 5.2.2 Tubes and Sticks

- 5.2.3 Folding Cartons

- 5.2.4 Corrugated Transit Boxes

- 5.2.5 Flexible Sachets and Pouches

- 5.2.6 Other Product Type

- 5.3 By Dispensing Mechanism

- 5.3.1 Pump-based

- 5.3.2 Dropper / Pipette

- 5.3.3 Spray / Mist

- 5.3.4 Stick / Twist-up

- 5.3.5 Jar / Scoop

- 5.4 By Cosmetic Type

- 5.4.1 Skin Care

- 5.4.1.1 Facial Care

- 5.4.1.2 Body Care

- 5.4.2 Hair Care

- 5.4.3 Color Cosmetics

- 5.4.4 Perfumes and Fragrances

- 5.4.5 Other Cosmetics Type

- 5.4.1 Skin Care

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacifc

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 Saudi Arabia

- 5.5.4.1.2 United Arab Emirates

- 5.5.4.1.3 Turkey

- 5.5.4.1.4 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Nigeria

- 5.5.4.2.3 Kenya

- 5.5.4.2.4 Rest of Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Albea SA

- 6.4.2 AptarGroup Inc.

- 6.4.3 Amcor Group GmbH

- 6.4.4 Silgan Holdings Inc.

- 6.4.5 DS Smith PLC

- 6.4.6 Graham Packaging LP

- 6.4.7 Quadpack Industries SA

- 6.4.8 Libo Cosmetics Co. Ltd

- 6.4.9 Gerresheimer AG

- 6.4.10 Ball Corporation

- 6.4.11 Verescence France SA

- 6.4.12 SKS Bottle & Packaging Inc.

- 6.4.13 Altium Packaging

- 6.4.14 Cosmopak Ltd

- 6.4.15 Raepak Ltd

- 6.4.16 Rieke Corporation

- 6.4.17 Essel Propack Ltd

- 6.4.18 Huhtamaki Oyj

- 6.4.19 Alpla Werke Alwin Lehner GmbH

- 6.4.20 RPC M&H Plastics

- 6.4.21 HCP Packaging Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment