PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850179

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850179

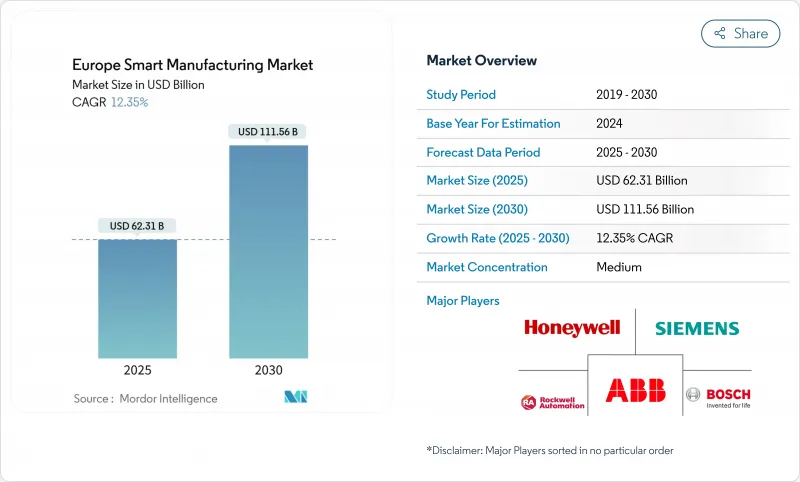

Europe Smart Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

Europe smart manufacturing market size is currently valued at USD 62.31 billion in 2025 and is forecast to reach USD 111.56 billion by 2030, expanding at a 12.35% CAGR.

Intensifying labor-cost inflation, high-profile public funding such as the EUR 200 billion (USD 213 billion) InvestAI program, and escalating regulatory pressure under the Cyber Resilience Act collectively accelerate adoption of connected production technologies. Industrial robotics continues to anchor plant-floor automation, while edge AI and digital-twin deployments unlock real-time process insights that magnify asset utilization. Enterprises pursue platform-based ecosystems that fuse control hardware, IIoT connectivity, and analytics software so they can curb energy consumption and comply with net-zero mandates. The competitive field tightens as incumbents absorb AI specialists, and governments link fiscal incentives to local data-sovereignty safeguards, turning the Europe smart manufacturing market into a strategic pillar of economic resilience.

Europe Smart Manufacturing Market Trends and Insights

EU Industry-4.0 Funding Schemes

Robust European funding unlocks unprecedented capital for digital transformation. Germany's Manufacturing-X program supplies EUR 150 million (USD 160 million) to create interoperable industrial data spaces, while the broader InvestAI architecture mobilizes EUR 200 billion (USD 213 billion) across AI infrastructure. SME access to matching grants lowers entry barriers; the UK's Made Smarter pilot has already funnelled GBP 22 million (USD 28 million) into 350 technical projects that generated 1,600 new jobs. Venture momentum follows public outlays, illustrated by Germany's 67% jump in AI-enabled manufacturing start-ups and hyperscaler commitments from AWS, Microsoft, and Apple. These capital flows position the Europe smart manufacturing market as a credible alternative to Asian contract manufacturing while defending regional technology sovereignty.

Rising Labor-Cost Pressure Driving Factory Automation

Average EU hourly labor costs climbed 5% year over year to EUR 33.5 (USD 35.7) in 2024, widening the delta between Western Europe and lower-wage regions. Luxembourg tops the bloc at EUR 55.2 (USD 58.8) per hour, sharpening competitive urgency for automation among premium producers. Employers also confront an acute talent gap: 75% of firms surveyed across 21 countries report difficulty filling skilled roles. These intertwined pressures convert automation from a discretionary efficiency lever into an existential requirement, accelerating replacement of repetitive tasks with robotics and computer-vision systems across the Europe smart manufacturing market.

Cyber-Security and Data-Sovereignty Concerns

The Cyber Resilience Act enforces risk-tiered conformity assessments and may levy penalties up to EUR 15 million (USD 16 million) or 2.5% of global turnover. Overlapping GDPR and NIS 2 rules escalate documentation workloads, especially for SMEs with limited cyber teams. Fear of extraterritorial data transfer slows migration to hyperscale platforms hosted outside the EU, compelling suppliers to offer sovereign clouds or edge-analytics appliances. These compliance costs elongate deployment cycles and temper the near-term growth pace of the Europe smart manufacturing market

Other drivers and restraints analyzed in the detailed report include:

- Rapid Adoption of IIoT Connectivity

- Net-Zero Mandates Accelerating Energy-Optimization Solutions

- High Brown-Field Integration CAPEX

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Industrial robotics held 28% of Europe smart manufacturing market share in 2024, supported by automotive final-assembly automation and standardized welding cells. FANUC's expansion in Spain signals pursuit of underserved Southern European clusters, while its explosion-proof collaborative paint robot opens hazardous-environment applications. Digital twin & simulation platforms are scaling at a 16.8% CAGR, embedding physics-based models alongside AI to forecast asset behaviour and shrink commissioning intervals. Simulation convergence with MES unlocks closed-loop optimisation, positioning digital twins as the fastest lever inside the Europe smart manufacturing market.

Automation control systems (PLC, SCADA, DCS) experience replacement demand as plants migrate to Ethernet-based fieldbuses. AI-augmented HMI layers such as Honeywell's Experion Operations Assistant surface contextual recommendations that cut alarm fatigue. MES penetration quickens through acquisitions like Valmet-FactoryPal, enriching OEE dashboards with prescriptive insights. Additive manufacturing maintains a niche foothold in spare-parts fulfillment, where geometry complexity outweighs volume economics. This broadening toolset cements diversified revenue streams across the Europe smart manufacturing market.

Europe Smart Manufacturing Market is Segmented by Technology (Automation Control Systems, Industrial Robotics, and More), Component (Hardware, Software, Services), End-User Industry (Automotive, Aerospace and Defense, Chemicals and Petrochemicals, and More), and Country. The Market Sizes and Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- ABB Ltd

- Siemens AG

- Schneider Electric SE

- Rockwell Automation Inc.

- Honeywell International Inc.

- Emerson Electric Co.

- General Electric Co.

- Robert Bosch GmbH

- FANUC Corporation

- IBM Corporation

- Dassault Systems SE

- SAP SE

- Mitsubishi Electric Corp.

- KUKA AG

- Yokogawa Electric Corp.

- PTC Inc.

- Hexagon AB

- Omron Corp.

- Beckhoff Automation GmbH

- Endress+Hauser AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EU Industry-4.0 funding schemes

- 4.2.2 Rising labor-cost pressure driving factory automation

- 4.2.3 Rapid adoption of IIoT connectivity

- 4.2.4 Net-zero mandates accelerating energy-optimisation solutions

- 4.2.5 Edge-AI quality-inspection deployment in European SMEs

- 4.2.6 Industrial-grade 5G private-network roll-outs

- 4.3 Market Restraints

- 4.3.1 Cyber-security and data-sovereignty concerns

- 4.3.2 High brown-field integration CAPEX

- 4.3.3 Fragmented legacy machine protocols in CEE plants

- 4.3.4 Scarcity of digital-twin engineering talent

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape (EU Digital Decade, Gaia-X)

- 4.6 Technological Outlook (IIoT, Digital Twin, 5G, Edge-AI)

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology

- 5.1.1 Automation Control Systems (PLC, SCADA, DCS)

- 5.1.2 Industrial Robotics

- 5.1.3 Industrial IoT Platforms

- 5.1.4 Human-Machine Interface (HMI)

- 5.1.5 Manufacturing Execution System (MES)

- 5.1.6 Product Lifecycle Management (PLM)

- 5.1.7 Digital Twin and Simulation

- 5.1.8 Additive Manufacturing / 3-D Printing

- 5.2 By Component

- 5.2.1 Hardware

- 5.2.1.1 Sensors

- 5.2.1.2 Controllers / IPC

- 5.2.1.3 Edge-Computing Devices

- 5.2.1.4 Machine-Vision Systems

- 5.2.1.5 Robotics

- 5.2.2 Software

- 5.2.2.1 SCADA and HMI Software

- 5.2.2.2 Analytics and AI Software

- 5.2.2.3 ERP and PLM Software

- 5.2.3 Services

- 5.2.3.1 Integration and Consulting

- 5.2.3.2 Maintenance and Support

- 5.2.3.3 Managed Services

- 5.2.1 Hardware

- 5.3 By End-user Industry

- 5.3.1 Automotive

- 5.3.2 Aerospace and Defense

- 5.3.3 Chemicals and Petrochemicals

- 5.3.4 Food and Beverage

- 5.3.5 Pharmaceuticals and Biotechnology

- 5.3.6 Metals and Mining

- 5.3.7 Electronics and Semiconductors

- 5.3.8 Oil and Gas

- 5.3.9 Utilities and Energy

- 5.4 By Country

- 5.4.1 Germany

- 5.4.2 United Kingdom

- 5.4.3 France

- 5.4.4 Italy

- 5.4.5 Spain

- 5.4.6 Russia

- 5.4.7 Netherlands

- 5.4.8 Sweden

- 5.4.9 Poland

- 5.4.10 Belgium

- 5.4.11 Austria

- 5.4.12 Switzerland

- 5.4.13 Norway

- 5.4.14 Finland

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market-share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 ABB Ltd

- 6.4.2 Siemens AG

- 6.4.3 Schneider Electric SE

- 6.4.4 Rockwell Automation Inc.

- 6.4.5 Honeywell International Inc.

- 6.4.6 Emerson Electric Co.

- 6.4.7 General Electric Co.

- 6.4.8 Robert Bosch GmbH

- 6.4.9 FANUC Corporation

- 6.4.10 IBM Corporation

- 6.4.11 Dassault Systems SE

- 6.4.12 SAP SE

- 6.4.13 Mitsubishi Electric Corp.

- 6.4.14 KUKA AG

- 6.4.15 Yokogawa Electric Corp.

- 6.4.16 PTC Inc.

- 6.4.17 Hexagon AB

- 6.4.18 Omron Corp.

- 6.4.19 Beckhoff Automation GmbH

- 6.4.20 Endress+Hauser AG

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment