PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907288

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907288

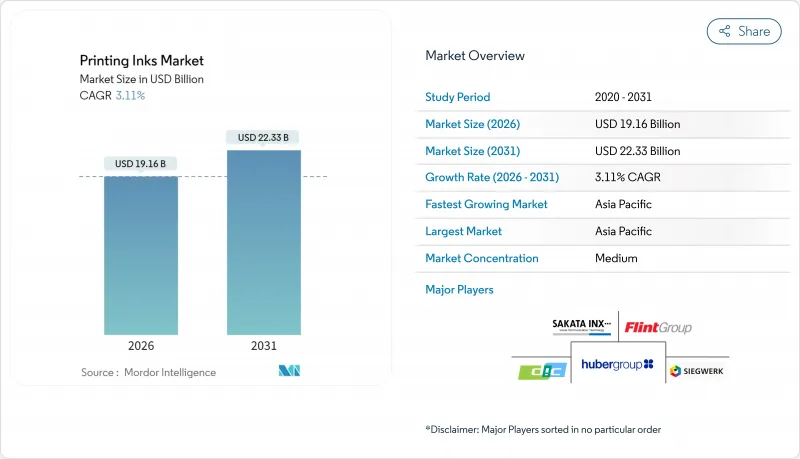

Printing Inks - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Printing Inks Market was valued at USD 18.58 billion in 2025 and estimated to grow from USD 19.16 billion in 2026 to reach USD 22.33 billion by 2031, at a CAGR of 3.11% during the forecast period (2026-2031).

Packaging, digitalization, and sustainability together shape demand patterns, capital investment, and regional shifts. Packaging already commands 55.94% of the printing inks market and remains the fastest-expanding application at 4.37% CAGR through 2030. Oil-based formulations keep a major share, but UV-LED inks post the highest 7.59% CAGR as converters pursue instant curing and lower energy use. The printing inks market, therefore, balances legacy strengths with emerging eco-friendly and digital capabilities.

Global Printing Inks Market Trends and Insights

Growth in Digital Printing Industry

Digital printing has moved from a niche concept to a mainstream production platform that reshapes the printing inks market. Continuous drops in equipment cost and head improvements allow converters to migrate short and medium runs toward inkjet, improving job turnaround and reducing inventory risk. Ink manufacturers respond with low-viscosity, high-optical-density pigment packages that maintain color consistency at high jetting speeds. Digital fabric printing already approaches 15 billion meters annually, stimulated by on-demand apparel and decor customization. Packaging converters exploit variable data to address seasonal promotions and localized languages, compressing lead times from weeks to days.

Expansion of Packaging and Labels Demand

Global demand for packaged goods expands steadily as rising urbanization, smaller household sizes, and e-commerce fulfillment change consumption habits. Corrugated boxes, paperboard sleeves, and flexible pouches all require durable, food-safe inks that withstand mechanical stress and logistics humidity. Brands rely on high-fidelity graphics and tactile finishes to stand out on crowded shelves, which boosts the value of specialty coatings and metallic pigments. Emerging economies in Asia-Pacific and parts of Africa see double-digit growth in packaged food and personal care, underpinning volume gains for water-based flexo and gravure inks. Label applications become more data-rich, integrating QR codes and anti-counterfeiting features that demand precise registration and robust color stability. The net result is sustained volume expansion even during macro-economic slowdowns, reinforcing packaging's role as the primary growth engine for the printing inks market.

Decline in Conventional Commercial Printing

Newspaper and magazine circulations shrink every quarter as advertisers reallocate budgets to digital channels. In January 2024, shipments of U.S. printing-writing paper fell 9% year on year. Offset ink consumption therefore declines, leaving surplus blending capacity and intensifying price competition. Print houses retire older presses, which trims aftermarket demand for replacement inks and dampens revenue for maintenance services. Some suppliers respond by refitting mixing facilities to produce water-based flexo systems, but pay-back periods stretch when demand for commercial print remains soft. The secular downturn subtracts 0.4 percentage points from the forecast CAGR, partially offset by new digital and packaging volumes.

Other drivers and restraints analyzed in the detailed report include:

- Shift Toward Water-Based Eco-Friendly Inks

- Emergence of UV/Energy-Curable Technologies

- Stringent VOC and Waste-Disposal Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Oil-based inks secured 40.70% of 2025 revenue due to cost efficiency and broad compatibility, yet their growth remains subdued under tightening VOC rules. UV-LED products post a 7.47% CAGR, reflecting converter preference for instant curing and energy savings. Water-based packages gain traction in corrugated cartons and paper cups, especially inside the European Union where food-contact and recyclability requirements grow stricter. Solvent systems persist in specialized industrial decals that need extreme adhesion, though volume gradually migrates toward less volatile alternatives.

Conversion logistics shape purchasing behavior. UV-LED presses avoid extended maintenance shut-downs because lamp life often exceeds 20,000 hours. Reduced scrap and lower energy bills tilt the total cost of ownership advantage toward energy-curable chemistries. In parallel, bio-based oil replacements gain interest as feedstock volatility and disclosure requirements under corporate sustainability reporting standards increase. Early adopters secure marketing premiums for plant-derived content, although supply chains for bio-solvents remain nascent. The combined trend signals a gradual, though definitive, reweighting of the printing inks market toward low-VOC, quick-cure platforms.

The Printing Inks Report is Segmented by Type (Solvent-Based, Water-Based, Oil-Based, UV, UV-LED, and Other Types), Process (Lithographic Printing, Flexographic Printing, Gravure Printing, Digital Printing, Other Processes), Application (Packaging, Commercial and Publication, Textiles, and Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Asia-Pacific holds 40.10% of global 2025 revenue and grows at 3.96% CAGR, reflecting robust manufacturing ecosystems in China, India, and Southeast Asia. Domestic consumption rises alongside expanding middle classes, boosting demand for packaged snacks, personal care, and pharmaceuticals. Local converters invest in high-speed flexo lines and adopt UV-LED retrofits to conserve energy and meet export customer audits. Governments in China and India support electronics and solar module supply chains, indirectly stimulating conductive ink opportunities for sensors and busbars. Regional raw material access, notably pigments and resin intermediates, supports competitive pricing that feeds into global trade flows of printing inks.

Europe enforces some of the most stringent environmental rules, accelerating migration to water-based and energy-curable platforms. Germany's leadership in eco-ink adoption and France's mineral-oil ban drive regional suppliers to overhaul formulations and invest in closed-loop solvent recovery. Luxury brand clusters in Italy and France pursue premium finishing, elevating the demand for metallic, pearlescent, and tactile varnish systems. Eastern European converters adopt modular flexo lines to serve cross-continent retail groups, often specifying the same low-migration inks required by Western buyers.

North America combines technological maturity with tight VOC oversight. The EPA's TSCA evaluations push formulators to validate raw-material toxicology and invest in safer alternatives. Major converters implement predictive maintenance platforms; INX International reported a 13% bump in asset availability after deploying AI analytics on production lines. Mexico gains share as a near-shoring hub for packaged food and personal care goods destined for the United States and Canada, lifting regional ink volumes. Brand owners push for recycling-ready inks that do not impair paper repulping or polyolefin reclamation, fostering collaboration across the packaging value chain. The region exemplifies how automation, sustainability, and regulatory stringency intersect to shape the future trajectory of the printing inks market.

- ALTANA

- Dainichiseika Color & Chemicals Mfg. Co., Ltd.

- DIC Corporation

- DuPont

- Epple Druckfarben AG

- Flint Group

- FUJIFILM Corporation

- hubergroup

- Nazdar

- Sakata INX Corporation

- Sanchez SA de CV

- SICPA HOLDING SA

- Siegwerk Druckfarben AG & Co. KGaA

- T&K TOKA Corporation

- Tokyo Printing Ink Mfg. Co., Ltd.

- Toyo Ink Co. Ltd (artience Co. Ltd)

- Wikoff Color Corporation

- Yip's Chemical Holdings Limited

- Zeller+Gmelin

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth in Digital Printing Industry

- 4.2.2 Expansion of Packaging and Labels Demand

- 4.2.3 Shift Toward Water-Based, Eco-Friendly Inks

- 4.2.4 Emergence of UV/Energy-Curable Technologies

- 4.2.5 Adoption of Functional Conductive Inks for Electronics

- 4.3 Market Restraints

- 4.3.1 Decline in Conventional Commercial Printing

- 4.3.2 Stringent VOC and Waste-Disposal Regulations

- 4.3.3 Nitrocellulose Raw-Material Shortages

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Solvent-Based

- 5.1.2 Water-Based

- 5.1.3 Oil-Based

- 5.1.4 UV

- 5.1.5 UV-LED

- 5.1.6 Other Types

- 5.2 By Process

- 5.2.1 Lithographic Printing

- 5.2.2 Flexographic Printing

- 5.2.3 Gravure Printing

- 5.2.4 Digital Printing

- 5.2.5 Other Processes

- 5.3 By Application

- 5.3.1 Packaging

- 5.3.1.1 Rigid Packaging

- 5.3.1.1.1 Paperboard Containers

- 5.3.1.1.2 Corrugated Boxes

- 5.3.1.1.3 Rigid Plastic Containers

- 5.3.1.1.4 Metal Cans

- 5.3.1.1.5 Other Rigid Packaging

- 5.3.1.2 Flexible Packaging

- 5.3.1.3 Labels

- 5.3.1.4 Other Packaging

- 5.3.1.1 Rigid Packaging

- 5.3.2 Commercial and Publication

- 5.3.3 Textiles

- 5.3.4 Other Applications

- 5.3.1 Packaging

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Australia and New Zealand

- 5.4.1.6 ASEAN Countries

- 5.4.1.7 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Russia

- 5.4.3.6 Spain

- 5.4.3.7 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ALTANA

- 6.4.2 Dainichiseika Color & Chemicals Mfg. Co., Ltd.

- 6.4.3 DIC Corporation

- 6.4.4 DuPont

- 6.4.5 Epple Druckfarben AG

- 6.4.6 Flint Group

- 6.4.7 FUJIFILM Corporation

- 6.4.8 hubergroup

- 6.4.9 Nazdar

- 6.4.10 Sakata INX Corporation

- 6.4.11 Sanchez SA de CV

- 6.4.12 SICPA HOLDING SA

- 6.4.13 Siegwerk Druckfarben AG & Co. KGaA

- 6.4.14 T&K TOKA Corporation

- 6.4.15 Tokyo Printing Ink Mfg. Co., Ltd.

- 6.4.16 Toyo Ink Co. Ltd (artience Co. Ltd)

- 6.4.17 Wikoff Color Corporation

- 6.4.18 Yip's Chemical Holdings Limited

- 6.4.19 Zeller+Gmelin

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment