PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852011

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852011

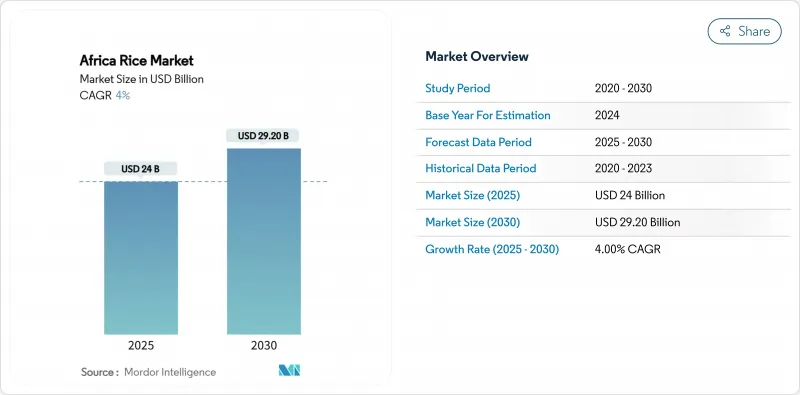

Africa Rice - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Africa rice market size reached USD 24.0 billion in 2025 and is projected to reach USD 29.2 billion by 2030, reflecting a 4.0% CAGR during the forecast period.

Rising urban populations, changing dietary patterns favoring convenient staple foods, and a persistent production deficit underpin this growth trajectory. The sub-Saharan region is experiencing strong demand for imported and locally milled rice due to increased consumption. Government initiatives, including expanded irrigation, input subsidies, and modern technologies such as solar-powered systems and precision farming, are helping increase domestic production yields. However, Asian exporters maintain a significant market share in Africa's rice market, pressuring local millers to improve efficiency and quality. Infrastructure development under the African Continental Free Trade Area (AfCFTA) is anticipated to reduce transport costs and increase regional paddy rice trade. These changes may decrease Africa's dependence on external suppliers and transform regional rice supply chains.

Africa Rice Market Trends and Insights

Exploding Urban Demand for Calorie-dense Staples

The growing urban population in Africa is changing rice consumption patterns, transforming it from a luxury item to a daily staple food. Nigerian households now show rice consumption habits similar to traditional Asian rice-consuming nations. Parboiled rice has gained popularity among urban consumers due to its reduced cooking time and enhanced storage stability in tropical conditions. Recent policy changes, including Ghana's restrictions on staple food exports, highlight the widening gap between domestic demand and supply. Urban markets have responded by introducing premium long-grain rice varieties, which command higher prices and support investments in advanced rice processing equipment, including color sorters and polishing machines. Rice millers supplying to urban supermarkets can now achieve profit margins that compensate for higher local production costs.

Expansion of Small-scale Gravity and Solar Irrigation Schemes

African rice yields have historically depended on unreliable rainfall patterns. Tanzania's transition to irrigation systems, backed by Chinese investment in agricultural infrastructure, represents a continental shift toward systematic water management. In Mali and Senegal, the implementation of solar-powered irrigation pumps has increased paddy yields compared to traditional rain-dependent farming. Madagascar's highland regions utilize gravity-fed canal systems, reducing operational costs for small-scale farmers. In 2024, the African Development Bank allocated USD 12 million to The Gambia's food security project to expand irrigated rice cultivation by 1,500 hectares. These irrigation developments enable continuous cultivation throughout the year, enhance labor productivity, and reduce the region's dependence on rice imports.

Post-harvest Losses from Rudimentary Drying and Storage Systems

Rice production in Africa faces significant challenges due to post-harvest losses, which reduce farmer incomes and increase consumer prices. The prevalent sun-drying methods expose grains to pests and weather damage, while storage in jute sacks leads to moisture reabsorption, resulting in mold and spoilage. Mechanical dryers and hermetic silos present effective solutions; however, their high initial investment costs restrict widespread adoption. The African Development Bank's initiatives in Liberia demonstrate positive developments through the establishment of integrated processing hubs with drying, milling, and storage facilities. The expansion of such infrastructure becomes critical as urban retailers require consistent grain quality and impose penalties for quality variations.

Other drivers and restraints analyzed in the detailed report include:

- AfCFTA Tariff Cuts Accelerating Intra-Africa Paddy Trade

- Public Fertilizer/Seed Subsidy Programs Reviving Yields

- Domestic Cost of Production still above Asian Import Parity

For complete list of drivers and restraints, kindly check the Table Of Contents.

List of Companies Covered in this Report:

- Market Overview

- Market Drivers

- Market Restraints

- Value / Supply-Chain Analysis

- Regulatory Landscape

- Technological Outlook

- PESTLE Analysis

- List of Stakeholders

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Exploding Urban Demand for Calorie-dense Staples

- 4.2.2 Expansion of Small-scale Gravity and Solar Irrigation Schemes

- 4.2.3 AfCFTA Tariff Cuts Accelerating Intra-Africa Paddy Trade

- 4.2.4 Public Fertilizer/Seed Subsidy Programs Reviving Yields

- 4.2.5 Adoption of Flood-tolerant, Early-maturing Rice Genetics

- 4.2.6 Monetising Paddy-methane Abatement via Voluntary Carbon Credits

- 4.3 Market Restraints

- 4.3.1 Post-harvest Losses from Rudimentary Drying and Storage Systems

- 4.3.2 Domestic Cost of Production still above Asian Import Parity

- 4.3.3 Currency and Diesel-price Volatility Squeezing Milling Margins

- 4.3.4 Land-tenure Insecurity Limiting Long-term On-farm Investment

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 PESTLE Analysis

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Geography (Production Analysis (Volume), Consumption Analysis (Volume and Value), Import Analysis (Volume and Value), Export Analysis (Volume and Value), and Price Trend Analysis)

- 5.1.1 Nigeria

- 5.1.2 Tanzania

- 5.1.3 Cote d'Ivoire

- 5.1.4 Madagascar

- 5.1.5 Mali

- 5.1.6 Ghana

- 5.1.7 Senegal

- 5.1.8 Cameroon

- 5.1.9 Guinea

- 5.1.10 Sierra Leone

- 5.1.11 Niger

- 5.1.12 South Africa

6 Competitive Landscape

- 6.1 List of Stakeholders

7 Market Opportunities and Future Outlook