PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850076

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850076

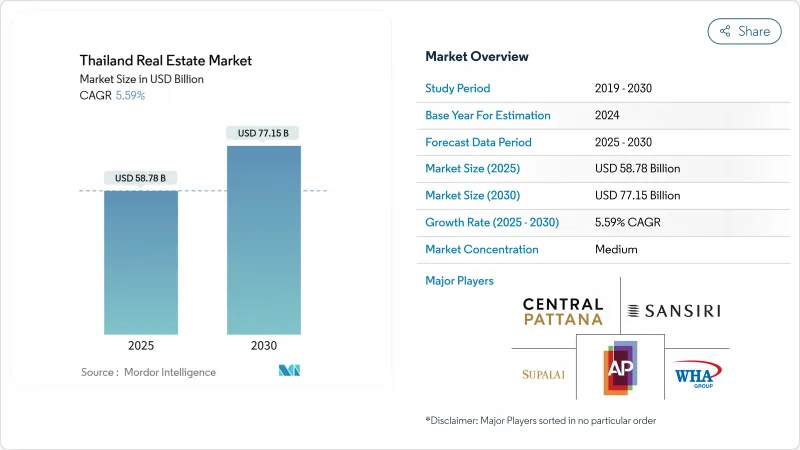

Thailand Real Estate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Thailand Real Estate Market size is estimated at USD 58.78 billion in 2025, and is expected to reach USD 77.15 billion by 2030, at a CAGR of 5.59% during the forecast period (2025-2030).

Sustained tourism recovery, fiscal stimulus, and record-scale infrastructure spending underpin short-term momentum, while the planned Bangkok 2 smart city and a national program of rail, road, and airport upgrades are expected to lift medium-term demand across residential, commercial, and logistics assets. The government's 2025-2026 transport plan covers 287 projects and channels public outlays toward light-rail links in Phuket and Chiang Mai as well as expressway extensions around the capital, expanding the development canvas for private investors. Rising foreign direct investment, particularly from China and the Middle East, continues to funnel capital into prime mixed-use projects, data centres, and hospitality portfolios. However, high household leverage, tighter mortgage rules, and an oversupply of condominiums around Bangkok remain structural drags that developers must navigate through phased launches and greater focus on rental yields.

Thailand Real Estate Market Trends and Insights

Transit Expansion and Infrastructure Upgrades Boost Urban Property Demand

Public spending worth THB 2.68 trillion (USD 76.6 billion) on rail corridors, airports, and expressways is reshaping commuter belts and unlocking new development zones. The Orange Line MRT extension alone is expected to lift ridership to 400,000 trips per day by 2030, creating land-value uplift along its 35.9 km route. Provincial light-rail projects budgeted at THB 77 billion (USD 2.2 billion) in Phuket, Chiang Mai, Nakhon Ratchasima, and Phitsanulok will further distribute growth beyond the capital. The flagship Bangkok 2 smart city in Huai Yai-costing at THB 1.34 trillion (USD 38.3 billion)-is designed for 350,000 residents and 200,000 jobs, anchoring new demand across the Eastern seaboard. Daily volumes on Bangkok Expressway & Metro routes already top 1.1 million trips, underscoring investor confidence in transit-oriented assets.

Government Incentives and Fee Cuts Stimulate Housing Market Activity

Temporary transfer-fee reductions, relaxed mortgage rules for first-home buyers, and targeted tax breaks have revived project launches, as evidenced by an 80% reservation rate at Central Pattana's Escent Nakhon Sawan condo, priced from THB 1.95 million (USD 55,700). New visa categories, including a Destination Thailand Visa and longer tourist stays, extend the pool of foreign purchasers. Meanwhile, the Land and Building Tax framework nudges underused land toward productive development and funds local infrastructure. These levers collectively cushion softer domestic demand stemming from elevated household debt levels reported by the Bank of Thailand at 86.9% of GDP.

Weak Mid-Income Housing Demand Constrains Market Expansion

Elevated household leverage-above 86% of GDP-has led banks to tighten loan-to-value (LTV) ratios, particularly on second-home mortgages over THB 10 million (USD 286,000). Developers responded by curtailing new launches 65% year-on-year in 2024, concentrating on higher-margin segments and smaller unit counts. Private investment slid 0.9% in 1H 2024, with the residential sector bearing the brunt, prompting calls for further LTV easing and income-support measures.

Other drivers and restraints analyzed in the detailed report include:

- Growing Foreign Investment Supports Premium Property Segments

- E-Commerce Growth Drives Logistics Real Estate Transformation

- Urban Condominium Oversupply Creates Absorption Challenges

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Residential assets represented 51.3% of the Thailand real estate market in 2024 as suburban migration, first-home incentives, and mortgage relaxation maintained baseline demand. Yet commercial stock is heading for the fastest 6.11% CAGR to 2030, supported by data-centre construction, upgrade cycles in Grade-A offices, and a surge in lifestyle-driven mixed-use complexes. Central Pattana's USD 131.4 million redevelopment of Central Bangna underscores sustained investment appetite in Bangkok retail nodes. Meanwhile, data-centre operator STT GDC is expanding capacity to more than 400 MW, a boost for power-dense real estate niches that depend on reliable grid connections.

The structural pivot toward commercial space aligns with Thailand's push to become a regional supply-chain hub. WHA Corporation's pipeline spans 12 domestic industrial estates serving e-commerce, EV, and semiconductor tenants. In hospitality, Asset World Corp achieved 24% year-on-year revenue growth in Q2 2024 and saw average daily rates hit USD 154, reflecting robust tourist inflows. Office performance diverges: CBD towers retain occupancy, while secondary assets negotiate discounted rents of USD 21 per square meter per month. Developers are also embedding ESG features to defend yields as utility tariffs rise.

The Thailand Real Estate Market Report is Segmented by Property Type (Residential and Commercial), by Business Model (Sales and Rental), by End User (Individuals/Households, Corporates & SMEs and Others), and by Major Cities (Bangkok, Phuket, and More). The Report Offers Market Size and Forecasts in Value (USD) for all the Above Segments.

List of Companies Covered in this Report:

- Central Pattana Plc.

- SANSIRI PUBLIC CO.,LTD

- WHA Corporation PCL

- AP (Thailand) Public Company Limited

- Supalai

- Origin Property PLC

- Asset World Corp PLC

- Ananda Development PLC

- SC Asset Corp PLC

- Pruksa Real Estate PLC

- Raimon Land PLC

- Singha Estate PLC

- Minor International PLC

- Frasers Property Thailand PLC

- Amata Corporation PCL

- CPN REIT

- Dusit Thani PLC

- LH Financial Group (Quality Houses)

- Central Retail Corporation PLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Insights and Dynamics

- 4.1 Market Overview

- 4.2 Commercial Real Estate Buying Trends - Socio-economic & Demographic Insights

- 4.3 Rental Yield Analysis

- 4.4 Capital-Market Penetration & REIT Presence

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Insights into Real Estate Tech and Startups Active in the Real Estate Segment

- 4.8 Insights into Existing and Upcoming Projects

- 4.9 Market Drivers

- 4.9.1 Transit expansion and infrastructure upgrades are boosting urban and suburban property demand.

- 4.9.2 Government incentives and fee cuts are stimulating housing sales and new project launches.

- 4.9.3 Growing foreign buyer interest supports condo sales in key tourism and business zones.

- 4.9.4 E-commerce growth and supply chain shifts are driving demand for logistics and industrial assets.

- 4.9.5 Large mixed-use developments are attracting capital and reshaping city real estate clusters.

- 4.9.6 Limited premium supply and rising build costs are sustaining prices in prime locations.

- 4.10 Market Restraints

- 4.10.1 Weak mid-income housing demand due to high household debt and tighter credit rules.

- 4.10.2 Condo oversupply in urban areas is leading to slower absorption and price stagnation.

- 4.10.3 Planning delays and zoning issues are disrupting project timelines and approvals.

- 4.10.4 Economic uncertainty and inflation are lowering buyer confidence and investment activity.

- 4.11 Value / Supply-Chain Analysis

- 4.11.1 Overview

- 4.11.2 Real Estate Developers and Contractors - Key Quantitative and Qualitative Insights

- 4.11.3 Real Estate Brokers and Agents - Key Quantitative and Qualitative Insights

- 4.11.4 Property Management Companies - Key Quantitative and Qualitative Insights

- 4.11.5 Insights on Valuation Advisory and Other Real Estate Services

- 4.11.6 State of the Building Materials Industry and Partnerships with Key Developers

- 4.11.7 Insights on Key Strategic Real Estate Investors/Buyers in the Market

- 4.12 Porter's Five Forces

- 4.12.1 Threat of New Entrants

- 4.12.2 Bargaining Power of Buyers/Occupiers

- 4.12.3 Bargaining Power of Suppliers (Developers/Builders)

- 4.12.4 Threat of Substitutes

- 4.12.5 Competitive Rivalry Intensity

5 Market Size & Growth Forecasts (Value, USD bn)

- 5.1 By Property Type

- 5.1.1 Residential

- 5.1.1.1 Apartments & Condominiums

- 5.1.1.2 Villas & Landed Houses

- 5.1.2 Commercial

- 5.1.2.1 Office

- 5.1.2.2 Retail

- 5.1.2.3 Logistics

- 5.1.2.4 Others (industrial real estate, hospitality real estate, etc.)

- 5.1.1 Residential

- 5.2 By Business Model

- 5.2.1 Sales

- 5.2.2 Rental

- 5.3 By End-user

- 5.3.1 Individuals / Households

- 5.3.2 Corporates & SMEs

- 5.3.3 Others

- 5.4 By Major Cities

- 5.4.1 Bangkok

- 5.4.2 Phuket

- 5.4.3 Pattaya

- 5.4.4 Chiang Mai

- 5.4.5 Rest of Thailand

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Joint Ventures, REIT Spin-offs)

- 6.3 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)}

- 6.3.1 Central Pattana Plc.

- 6.3.2 SANSIRI PUBLIC CO.,LTD

- 6.3.3 WHA Corporation PCL

- 6.3.4 AP (Thailand) Public Company Limited

- 6.3.5 Supalai

- 6.3.6 Origin Property PLC

- 6.3.7 Asset World Corp PLC

- 6.3.8 Ananda Development PLC

- 6.3.9 SC Asset Corp PLC

- 6.3.10 Pruksa Real Estate PLC

- 6.3.11 Raimon Land PLC

- 6.3.12 Singha Estate PLC

- 6.3.13 Minor International PLC

- 6.3.14 Frasers Property Thailand PLC

- 6.3.15 Amata Corporation PCL

- 6.3.16 CPN REIT

- 6.3.17 Dusit Thani PLC

- 6.3.18 LH Financial Group (Quality Houses)

- 6.3.19 Central Retail Corporation PLC

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment