PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907233

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907233

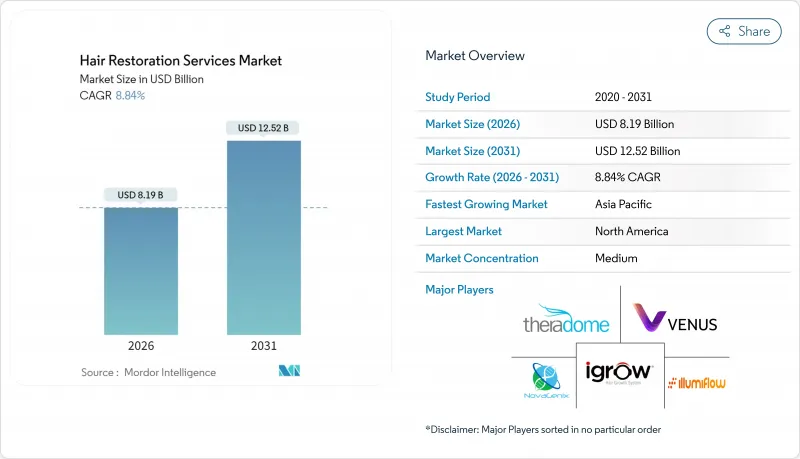

Hair Restoration Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The hair restoration services market is expected to grow from USD 7.53 billion in 2025 to USD 8.19 billion in 2026 and is forecast to reach USD 12.52 billion by 2031 at 8.84% CAGR over 2026-2031.

Momentum is driven by the clinical success of regenerative compounds such as Pelage Pharmaceuticals' PP405, next-generation devices like the ARTAS iXi robot with 44-micron resolution, and a widening pool of prospective patients aware of permanent, confidence-enhancing outcomes. Wider social acceptance, influencer visibility, and flexible payment plans are accelerating first-time procedures among adults aged 26-35, while device-based adjuncts such as FoLix fractional laser therapy extend care to consumers unwilling or unfit for surgery. Parallel growth in medical tourism, notably to Turkey and India, lowers cost barriers and adds volume, whereas supportive regulation-evident in the FDA's Class II rules for scalp-cooling systems-signals institutional recognition of hair loss as a quality-of-life issue.

Global Hair Restoration Services Market Trends and Insights

Growing Global Burden of Alopecia and Hair Loss Disorders

Androgenetic alopecia now afflicts up to 50% of adults worldwide, a prevalence climbing as dihydrotestosterone (DHT) sensitivity intensifies across generations. More than 700,000 hair restoration procedures were performed globally in 2024, up 16% from 2016, underscoring unmet clinical need. Younger patients aged 26-35 are acting earlier, generating higher lifetime procedure demand and improving compliance with maintenance regimens. Expanding research into autoimmune-related alopecia and chemotherapy-induced hair loss enlarges the candidate pool beyond traditional male pattern baldness. As populations age in high-income countries, awareness, affordability, and access combine to keep demand on a steep upward curve.

Rising Disposable Income and Willingness to Spend on Aesthetic Procedures

Disposable income growth in the United States, Germany, China, and Gulf Cooperation Council economies is steering healthcare dollars toward appearance-enhancing services. First-time transplant patients now average 26-35 years old, when surgery is simpler and yields superior density over time. Consumer surveys indicate 77% of decisions are career- or relationship-motivated, equating fuller hair with social capital. Financed payment plans, zero-interest clinic loans, and buy-now-pay-later apps expand affordability to middle-income cohorts. Celebrity stories such as former soccer player Wayne Bridge's GBP 7,000 procedure validate outcomes and normalize spending.

High Procedure Costs and Limited Reimbursement Coverage

Surgical outlays at USD 4,000-15,000 in developed regions remain prohibitive, while private insurers classify hair transplantation as elective, leaving patients to self-fund. The disparity is sharper in emerging markets where per-capita income trails procedure fees, even as awareness rises. Financing plans and third-party credit mitigate sticker shock, yet many prospects delay treatment, risking further follicular miniaturization. Medical tourism narrows cost gaps but adds travel costs that can offset savings for intra-regional patients. Meanwhile, device-based therapies such as low-level laser caps enter the market below USD 1,000, offering an entry point for price-sensitive consumers but diverting some volume from surgical channels.

Other drivers and restraints analyzed in the detailed report include:

- Continuous Technological Advancements in Surgical and Non-Surgical Restoration

- Increasing Acceptance of Cosmetic Tourism for Cost-Effective Procedures

- Shortage of Skilled Hair Transplant Surgeons

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Scalp procedures accounted for 87.02% of the Hair Restoration Services market in 2025, reflecting the prevalence of androgenetic alopecia and well-established surgical protocols. Eyebrow restoration, propelled by social media beauty standards, is forecast to expand at 10.22% CAGR and diversify clinic revenue beyond traditional male segments. Beard procedures hold niche appeal among millennials seeking a fuller facial aesthetic, while eyelash and body-hair work remains limited by donor-hair scarcity and surgical complexity. Robotic direct-hair-implantation (DHI) designed for Afro-textured follicles unlocks underserved demographic clusters, sharpening competitive positioning for clinics that adopt early. Growing awareness among female patients and advanced micropunch tools decrease downtime and scarring, reinforcing scalp surgery's centrality yet widening the portfolio of high-margin facial services.

Second-order impacts span procurement and marketing. Clinics tailoring campaigns to eyebrow and beard prospects secure incremental sessions without cannibalizing core scalp demand, lifting overall Hair Restoration Services market revenue. Device makers, meanwhile, are optimizing punch diameters and implanter pens to minimize trauma across delicate facial zones. Regulatory bodies are adapting certification pathways for non-scalp work, ensuring standardized safety despite anatomical variation. As a result, recipient-area diversification cushions providers against cyclical scalp demand swings while expanding total addressable Hair Restoration Services market.

The Hair Restoration Services Market Report is Segmented by Recipient Area (Scalp, Beard/Moustache, and More), Treatment (Surgical Techniques and Non-Surgical/Adjunct Therapies), End User (Specialty Hair Clinics, and More), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with 40.05% share of the Hair Restoration Services market in 2025, buoyed by high income and early adoption of AI-assisted robotics. U.S. clinics such as Bosley have diversified into fractional laser and exosome add-ons, deepening wallet share per patient. Canada's favorable medical-device approval pathway catalyzes cross-border patient inflow seeking newer technologies unavailable elsewhere. Reimbursement gaps persist, but third-party financing and employer wellness stipends soften cost obstacles.

Europe represents a mature yet innovative arena. Germany mandates specialized certification for PRP and device operators, raising quality while compressing provider counts. Patient flows run both ways: cost-conscious Germans travel to Istanbul for budget FUE, whereas Gulf residents fly to Berlin for combined transplant-plus-filler packages. Smile Hair Clinic's 2025 expansion into Hamburg signals confidence in premium European demand. EU vigilance on advertising standards ensures transparent outcome claims, bolstering trust in the Hair Restoration Services market.

Asia-Pacific is the growth engine with a 9.44% CAGR projection. China counts more than 3,000 transplant providers, yet consolidation pressures elevate quality as consumers favor branded networks over mom-and-pop rooms. India leverages English-language teleconsultations and pricing at one-quarter U.S. levels to draw Westerners chasing affordability. Turkey, though technically in Europe, serves APAC, MEA, and U.S. clients alike, illustrating geographic crossover. Afro-hair optimized robotics debuting in Istanbul and Lagos widen inclusion and fortify medical-tourism positioning. Government agencies in Thailand and South Korea now target cosmetic-tourism visas, formally integrating hair restoration into national health-export strategies. Collectively, these factors align to expand the Hair Restoration Services market beyond historical Western confines.

- Aderans Co., Ltd. (HairClub)

- Bosley Inc.

- Venus Concept Inc.

- Bernstein Medical - Center for Hair Restoration

- The Cole Clinic

- Elite Hair Restoration

- Hairline International Hair & Skin Clinic

- Apira Sciences Inc. (iGrow)

- Lexington Intl. LLC (HairMax)

- Illumiflow

- National Hair Centers

- NovaGenix

- Theradome Inc.

- Restoration Robotics Inc. (ARTAS)

- Neograft Solutions

- Follica Inc.

- Advanced Hair Studio

- DHI Global Medical Group

- Eugenix Hair Sciences

- Sisram Medical

- Solta Medical (Bausch Health)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Global Burden of Alopecia and Hair Loss Disorders

- 4.2.2 Rising Disposable Income and Willingness to Spend on Aesthetic Procedures

- 4.2.3 Continuous Technological Advancements in Surgical And Non-Surgical Hair Restoration

- 4.2.4 Expansion of Specialized Hair Transplant Clinics and Franchise Chains

- 4.2.5 Increasing Acceptance of Cosmetic Tourism for Cost-Effective Procedures

- 4.2.6 Proliferation of Social Media Marketing and Influencer Endorsements

- 4.3 Market Restraints

- 4.3.1 High Procedure Costs and Limited Reimbursement Coverage

- 4.3.2 Shortage of Skilled Hair Transplant Surgeons

- 4.3.3 Post-Operative Risks and Variable Success Rates

- 4.3.4 Availability of Less-Invasive Cosmetic Alternatives

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Recipient Area

- 5.1.1 Scalp

- 5.1.2 Beard / Moustache

- 5.1.3 Eyebrows

- 5.1.4 Eyelashes

- 5.1.5 Other Body Areas

- 5.2 By Treatment

- 5.2.1 Surgical Techniques

- 5.2.1.1 Follicular Unit Extraction (FUE)

- 5.2.1.2 Follicular Unit Transplant (FUT)

- 5.2.1.3 Direct Hair Implantation (DHI)

- 5.2.1.4 Robotic FUE

- 5.2.2 Non-Surgical / Adjunct Therapies

- 5.2.2.1 Low-Level Laser Therapy (LLLT)

- 5.2.2.2 Platelet-Rich Plasma (PRP)

- 5.2.2.3 Stem-Cell & Exosome Therapy

- 5.2.2.4 Topical & Injectable Adjuvants

- 5.2.1 Surgical Techniques

- 5.3 By End User

- 5.3.1 Specialty Hair Clinics

- 5.3.2 Multispecialty Hospitals

- 5.3.3 Ambulatory Surgical Centers

- 5.3.4 Medical Spas & Wellness Centers

- 5.3.5 Other End Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Aderans Co., Ltd. (HairClub)

- 6.3.2 Bosley Inc.

- 6.3.3 Venus Concept Inc.

- 6.3.4 Bernstein Medical - Center for Hair Restoration

- 6.3.5 The Cole Clinic

- 6.3.6 Elite Hair Restoration

- 6.3.7 Hairline International Hair & Skin Clinic

- 6.3.8 Apira Sciences Inc. (iGrow)

- 6.3.9 Lexington Intl. LLC (HairMax)

- 6.3.10 Illumiflow

- 6.3.11 National Hair Centers

- 6.3.12 NovaGenix

- 6.3.13 Theradome Inc.

- 6.3.14 Restoration Robotics Inc. (ARTAS)

- 6.3.15 Neograft Solutions

- 6.3.16 Follica Inc.

- 6.3.17 Advanced Hair Studio

- 6.3.18 DHI Global Medical Group

- 6.3.19 Eugenix Hair Sciences

- 6.3.20 Sisram Medical (Alma Lasers)

- 6.3.21 Solta Medical (Bausch Health)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment