PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851406

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851406

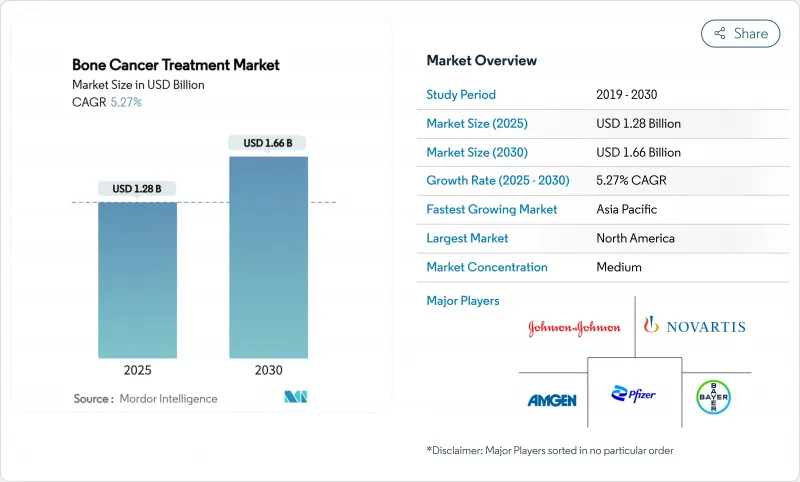

Bone Cancer Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Bone Cancer Treatment Market size is estimated at USD 1.28 billion in 2025, and is expected to reach USD 1.66 billion by 2030, at a CAGR of 5.27% during the forecast period (2025-2030).

Demand is expanding on the back of breakthrough regulatory approvals, wider adoption of 3D-printed implants, and steady diffusion of targeted biologics. The market's growth is further sustained by earlier diagnosis through AI-enabled imaging, wider reimbursement for orphan drugs, and improved clinical outcomes delivered by limb-salvage procedures. North America holds structural advantages in R&D and reimbursement, while Asia-Pacific is adding capacity rapidly as disease-awareness programmes scale. Competition is intensifying as niche biotechnology firms win fast-track approvals, forcing incumbents to recalibrate portfolios toward precision-medicine assets. High treatment costs and limited physician capacity in low-resource settings remain the main countervailing forces.

Global Bone Cancer Treatment Market Trends and Insights

Increasing Global Incidence of Primary Bone Sarcomas

Osteosarcoma continues to be the most common primary bone malignancy among children and adolescents, and epidemiological data confirm a sustained rise in Ewing sarcoma cases in major economies. A national burden study in China reported higher incidence, prevalence and disability-adjusted life-years, with projections indicating continued growth to 2036. Larger patient pools are prompting governments to expand orthopaedic oncology capacity and are attracting venture funding for paediatric-focused therapies. Diagnostic improvements, such as nationwide MRI screening pilots, are capturing earlier-stage presentations and fuelling demand for limb-preserving procedures.

Approvals & Pipeline Momentum of Targeted Biologics

Regulatory agencies accelerated the pace of approvals in 2024-2025. The United States Food and Drug Administration cleared afamitresgene autoleucel, the first gene therapy for synovial sarcoma, after the product delivered a 43.2% overall response in heavily pre-treated patients. In February 2025 the agency also approved vimseltinib for tenosynovial giant cell tumour, with a 40% objective response versus placebo in the pivotal MOTION trial. Breakthrough therapy designations for additional programmes, including GSK5764227 in relapsed osteosarcoma, validate targeted approaches and shorten development cycles. Collectively, these milestones are expanding clinical protocols and hastening payor adoption across mature markets.

Limited Therapeutic Options for Metastatic or Refractory Tumours

Five-year survival drops below 30% for metastatic osteosarcoma, underscoring the inadequacy of current regimens. The immunosuppressive bone micro-environment blunts checkpoint inhibitor efficacy, while dose-limiting toxicities cap the gains from intensified chemotherapy. Investigational adoptive cell transfers, such as HER2-targeted T-cells, are showing early promise but remain confined to small cohorts. Real-world data from tertiary centres in India and Brazil illustrate that less than 15% of refractory cases gain access to clinical trials, perpetuating poor outcomes.

Other drivers and restraints analyzed in the detailed report include:

- Government & NGO-Led Sarcoma Awareness Programmes

- Advances in Functional Imaging & AI Diagnostics

- High Cost of Novel Biologics & Cell Therapies Limiting Access

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Primary malignancies accounted for 76.97% of bone cancer treatment market share in 2024, reflecting entrenched clinical pathways and high incidence among paediatric and adolescent populations. Osteosarcoma remains the prototypical diagnosis and anchors first-line MAP (methotrexate, doxorubicin, cisplatin) protocols. The segment's scale is drawing disproportionate R&D attention, from RUNX2-inhibiting small molecules to GD2-directed antibody-drug conjugates that cut pulmonary metastasis in preclinical models. Ewing sarcoma is positioned as the fastest-growing niche, registering a projected 9.27% CAGR to 2030 as adoptive gene therapies enter commercialisation. Meanwhile, chondrosarcoma growth is supported by PD-1/PD-L1 checkpoint regimens demonstrating partial responses in early-phase trials.

Therapeutic innovation is narrowing historical survival gaps. A UK-based programme achieved a 50% survival improvement in murine osteosarcoma by blocking RUNX2 transcription now entering human toxicology studies. At the same time, radiopharmaceutical conjugates for metastatic lesions are moving through Chinese and European regulatory channels, broadening indications beyond primary tumours. Collectively, these pipelines are expected to expand the bone cancer treatment market size across each histology subtype.

Conventional cytotoxic regimens accounted for 32.89% of the bone cancer treatment market in 2024 and remain first-line therapy for most high-grade sarcomas. However, adverse-event profiles and plateauing survival are catalysing a pivot toward precision approaches. Cell and gene therapies are forecast to expand at a 6.78% CAGR as regulatory precedents lower the bar for additional approvals. CAR-T constructs targeting B7-H3 and GD2 are in multi-centre phase II trials, while allogeneic NK-cell platforms seek to combat the immunosuppressive tumour milieu.

Targeted small-molecule inhibitors, including multi-kinase agents, are gaining off-label traction after demonstrating progression-free benefits in compassionate-use registries. Denosumab's head-to-head superiority over zoledronic acid in preventing skeletal-related events has cemented RANKL blockade as standard adjunct therapy. Concurrently, 3D-printed implant technology and gallium-doped bioactive glass inserts are redefining local control strategies, raising expectations for limb-salvage uptake.

The Bone Cancer Treatment Market Report Segments the Industry Into Bone Cancer Type (Primary Bone Cancer, Secondary (Metastatic) Bone Cancer), Therapy Type (Chemotherapy, Targeted Therapy, and More), Age Group (Pediatric, Adolescent & Young Adult, Adult, Geriatric), End User (Hospitals, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained a 45.76% hold on the bone cancer treatment market in 2024, propelled by the United States' early-access framework for orphan drugs and mature reimbursement for 3D-printed implants. Federal funding for paediatric sarcoma consortia keeps trial density high, and widespread adoption of AI-augmented imaging is eliminating diagnostic delays. Canada's universal coverage further broadens biologic uptake, offsetting higher per-patient costs.

Europe follows with cohesive sarcoma-care pathways that require referral to designated centres within two weeks. The region's established limb-salvage culture and the European Medicines Agency's ten-year exclusivity bolster innovation. Nevertheless, divergent reimbursement policies across member states temper uniform adoption of high-cost cell therapies. Germany retains leadership in additive-manufacturing deployments, while Italy is piloting national genomic screening for bone sarcomas.

Asia-Pacific is the fastest-growing bloc, forecast at a 7.12% CAGR as China, Japan and India expand orthopaedic oncology capacity. China's National Medical Products Administration cleared a radionuclide-drug conjugate for bone metastases in 2025, positioning domestic companies as regional leaders. Japan's focus on high-dose chemotherapy and autologous marrow rescue continues to yield incremental survival gains. India's challenge remains late presentation and limited specialist coverage, but locally fabricated modular prostheses and tier-two city treatment programmes are improving disease-free survival to 61% in selected centres.

Latin America and Africa lag behind due to fragmented reimbursement and clinician shortages. Nonetheless, multinational NGOs are increasing training fellowships and funding limb-salvage initiatives that are expected to seed regional centres of excellence within the next decade.

- Amgen

- Bayer

- Novartis

- Johnson & Johnson

- Pfizer

- Takeda Pharmaceuticals

- Eli Lilly and Company

- Hikma Pharmaceuticals

- Recordati S.p.A

- Spectrum Pharmaceuticals

- Debiopharm Group

- Atlanthera

- Adaptimmune Therapeutics plc

- Daiichi Sankyo

- Roche

- Ipsen

- OncoTherapy Science Inc.

- Legend Biotech

- Merck

- Gilead Sciences

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Global Incidence of Primary Bone Sarcomas

- 4.2.2 Approvals & Pipeline Momentum of Targeted Biologics

- 4.2.3 Expanded Government & NGO-Led Sarcoma Awareness Programmes

- 4.2.4 Advances In Functional Imaging & AI Diagnostics Enabling Earlier Detection

- 4.2.5 3D-Printed, Patient-Specific Orthopedic Implants Boosting Limb-Salvage Adoption

- 4.2.6 Orphan-Drug Exclusivity and Tax Incentives Accelerating Niche Therapy R&D

- 4.3 Market Restraints

- 4.3.1 Limited Therapeutic Options for Metastatic or Refractory Bone Tumours

- 4.3.2 High Cost of Novel Biologics & Cell Therapies Limiting Access

- 4.3.3 Post-Operative Morbidity and Lengthy Rehabilitation Deterring Surgery Uptake

- 4.3.4 Shortage of Specialised Orthopaedic Oncologists in Emerging Markets

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Bone Cancer Type

- 5.1.1 Primary Bone Cancer

- 5.1.1.1 Osteosarcoma

- 5.1.1.2 Chondrosarcoma

- 5.1.1.3 Ewing Sarcoma

- 5.1.1.4 Other Primary Types

- 5.1.2 Secondary (Metastatic) Bone Cancer

- 5.1.1 Primary Bone Cancer

- 5.2 By Therapy Type

- 5.2.1 Chemotherapy

- 5.2.1.1 Anthracyclines

- 5.2.1.2 Alkylating Agents

- 5.2.1.3 Antimetabolites & Others

- 5.2.2 Targeted Therapy

- 5.2.2.1 RANKL Inhibitors

- 5.2.2.2 Tyrosine Kinase Inhibitors

- 5.2.2.3 mTOR/MEK & Emerging Targets

- 5.2.3 Immunotherapy

- 5.2.4 Immune Check-point Inhibitors

- 5.2.5 Cell & Gene Therapies

- 5.2.6 Radiation Therapy

- 5.2.7 Surgery & Limb-Salvage Procedures

- 5.2.8 Others

- 5.2.1 Chemotherapy

- 5.3 By Age Group

- 5.3.1 Pediatric

- 5.3.2 Adolescent & Young Adult

- 5.3.3 Adult

- 5.3.4 Geriatric

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Specialty Cancer Centres & Orthopaedic Institutes

- 5.4.3 Academic & Research Institutes

- 5.4.4 Ambulatory Surgical Centres

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Amgen Inc.

- 6.3.2 Bayer AG

- 6.3.3 Novartis AG

- 6.3.4 Johnson & Johnson (Janssen)

- 6.3.5 Pfizer Inc.

- 6.3.6 Takeda Pharmaceutical Company Ltd.

- 6.3.7 Eli Lilly and Company

- 6.3.8 Hikma Pharmaceuticals PLC

- 6.3.9 Recordati S.p.A

- 6.3.10 Spectrum Pharmaceuticals Inc.

- 6.3.11 Debiopharm Group

- 6.3.12 Atlanthera

- 6.3.13 Adaptimmune Therapeutics plc

- 6.3.14 Daiichi Sankyo Company Ltd.

- 6.3.15 F. Hoffmann-La Roche Ltd.

- 6.3.16 Ipsen S.A.

- 6.3.17 OncoTherapy Science Inc.

- 6.3.18 Legend Biotech

- 6.3.19 Merck & Co., Inc.

- 6.3.20 Gilead Sciences (Kite Pharma)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment