PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686271

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686271

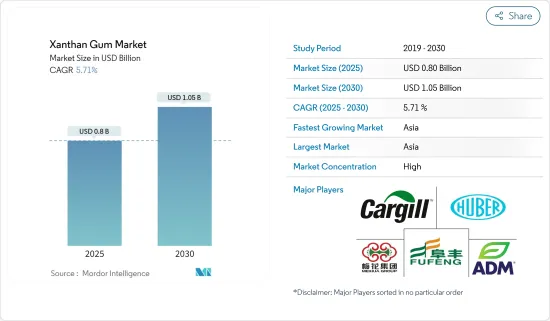

Xanthan Gum - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Xanthan Gum Market size is estimated at USD 0.80 billion in 2025, and is expected to reach USD 1.05 billion by 2030, at a CAGR of 5.71% during the forecast period (2025-2030).

Key Highlights

- Xanthan gum is derived from plant-based sugars and bacteria. It is mainly used in the food industry due to its thickening and stabilizing properties. Besides, it also improves the texture, consistency, flavor, shelf life, and appearance of food products. Additionally, due to its robust functional properties, xanthan gum is employed in formulations of bakery products, fruit juices, soups, ice cream, sauces, gravies, gluten-free products, and others.

- In addition, clear regulatory guidelines are fueling the market growth. For instance, the United States Food and Drug Administration (FDA) recognized using xanthan gum for direct human consumption as safe under the Code of Federal Regulations (CFR) 21. However, the regulatory body has set apart some prescribed conditions for using xanthan gum in food products.

- Xanthan is a vegan- and vegetarian-friendly hydrocolloid that readily complies with halal and kosher claims. Thus, it remains a promising substitute for other animal-sourced hydrocolloids for manufacturers willing to cater to a vegan consumer base.

- Prominent players in the market focus on developing new products, mergers, expansion, acquisitions, and partnerships with other companies to enhance brand presence and expand their market share. For instance, in July 2022, CP Kelco expanded its bio-gum production capacity, including xanthan gum, at its United States and China plant facilities.

Xanthan Gum Market Trends

Food and Beverage Industry is the Biggest Consumer of Xanthan Gum

Xanthan gum claims to improve the texture of bakery products and prevent them from becoming crumbly and dry. As it also helps retain moisture and enhance overall shelf life and acceptability, the increasing consumption of bakery products drives the use of xanthan gum. Furthermore, due to the growing demand for sugar-free and gluten-free chocolates, manufacturers use xanthan gum as a replacement for gluten because of its elasticity and structure in recipes lacking traditional gluten-containing ingredients. Over the medium term, the market is anticipated to expand with the rising need for healthy and functional confectionery products. The import-export of raw meat products is also increasing worldwide due to the increasing production of various meat products and rising demand for processed meat. Therefore, the demand for xanthan gum is growing as it is used as a thickening, suspending, stabilizing, and emulsifying agent in meat products. It can be used in ham, luncheon meat, red sausage, and other minced meat products to improve the water-holding capacity and tenderness.

Asia-Pacific Dominates the Market

Asia Pacific holds the largest market share and will continue to dominate due to the rapid expansion of the food and beverage sector. Also, urbanization, rising standard of living, expansion of retail stores, and supportive economic factors are projected to boost market growth. For instance, the Chinese economy is growing significantly, and the rapid urbanization and income growth contribute to diversifying the Chinese diet and creating a demand for high-value products like gluten-free, thereby increasing the demand for xanthan gum. In addition, increased investments and exploration projects initiated by governments of several countries across the region fuel the market. For instance, in July 2022, the United Arab Emirates announced its plans to invest USD 2 billion to set up food parks across India. Further, rising consumer inclination toward healthier lifestyles and increasing awareness about quality food ingredients are spurring demand for food additives such as xanthan gums in the region.

Xanthan Gum Industry Overview

The xanthan gum market is consolidated, with many domestic and multinational players competing for market share. Some prominent players in the market include Cargill Inc., Archer Daniels Midland Company, Fufeng Group, MeiHua Holdings Group Co. Ltd., and J. M. Huber Corporation. Product innovation is a compelling strategic approach adopted by leading players. Mergers, expansion, acquisitions, and partnerships with other companies are other common strategies adopted by these players to enhance brand presence and boost their market share. Further, economies of scale and high brand loyalty among consumers give these companies an upper edge.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Wide Applications and Functionality

- 4.1.2 Demand For Gluten-Free Products

- 4.2 Market Restraints

- 4.2.1 Easy Availability of Economically Feasible Alternatives

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Form

- 5.1.1 Liquid

- 5.1.2 Dry

- 5.2 Application

- 5.2.1 Food and Beverages

- 5.2.1.1 Bakery Products

- 5.2.1.2 Confectionery

- 5.2.1.3 Meat Products

- 5.2.1.4 Frozen Food

- 5.2.1.5 Dairy Products

- 5.2.1.6 Beverages

- 5.2.1.7 Others

- 5.2.2 Pharmaceuticals

- 5.2.3 Personal care and Cosmetics

- 5.2.4 Oil Refinery

- 5.2.5 Other Applications

- 5.2.1 Food and Beverages

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Spain

- 5.3.2.2 United Kingdom

- 5.3.2.3 Germany

- 5.3.2.4 France

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 South Africa

- 5.3.5.2 United Arab Emrates

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategies Adopted by Leading Players

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Cargill Incorporated

- 6.3.2 Foodchem International Corporation

- 6.3.3 The Archer-Daniels-Midland Company

- 6.3.4 Deosen Biochemical Ltd.

- 6.3.5 C.E. Roeper GmbH

- 6.3.6 Ingredion Incorporated

- 6.3.7 Solvay S.A

- 6.3.8 International Flavours and Fragrances Inc

- 6.3.9 Mitsubishi Corporation

- 6.3.10 JM Huber Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS