Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686225

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686225

Small Satellite - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 214 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

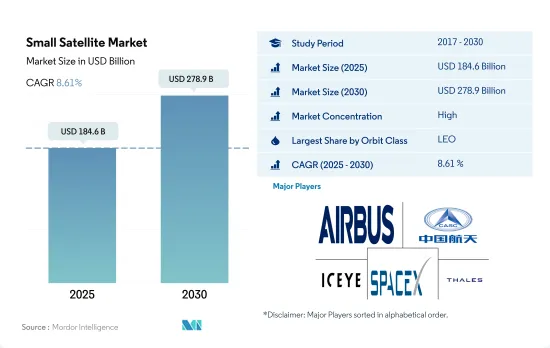

The Small Satellite Market size is estimated at 184.6 billion USD in 2025, and is expected to reach 278.9 billion USD by 2030, growing at a CAGR of 8.61% during the forecast period (2025-2030).

LEO satellites dominate the market's growth by occupying majority of the market share

- A satellite or spacecraft is usually placed into one of many special orbits around the Earth or launched into an interplanetary journey. Small satellites revolutionized the space industry in recent years as they have enabled low-cost access to space for a wide range of applications, from scientific research to commercial and military applications. To fully realize the potential of small satellites, it is essential to understand the different types of orbits they can be launched into. Most science satellites, including NASA's Earth Observation System, are in low Earth orbit.

- The small satellite market continues to experience strong growth, driven by the increasing demand for LEO satellites used for communication, navigation, Earth observation, military reconnaissance, and scientific missions. Between 2017 and 2022, around 2900 small LEO satellites were manufactured and launched, primarily used for communication purposes. This led companies such as SpaceX, OneWeb, and Amazon to plan the launch of thousands of satellites into LEO. With the rising demand for low earth orbit from various sectors like Earth observation, navigation, meteorology, and military communications, the market has witnessed a rise in the number of launches of LEO satellites.

- Though the launch of small satellites into GEO and MEO is very few in recent years, despite this fact, the military's use of MEO and GEO satellites has grown. It is also expected to increase, owing to the advantages, such as increased signal strength, improved communications and data transfer capabilities, and greater coverage area. For instance, Raytheon Technologies' and Boeing's Millennium Space Systems are developing the first prototype Missile Track Custody (MTC) MEO OPIR payloads for the US Space Force.

North America may witness significant growth during the forecast period

- The global small satellite market is expected to grow significantly in the coming years, driven by increasing demand for high-speed internet, communication services, and data transfer across different industries. The market is analyzed with respect to North America, Europe, and Asia-Pacific, which are the major regions in terms of market share and revenue generation.

- North America is expected to dominate the global small satellite market during the forecast period due to the presence of several leading players, such as Swarm Technologies, Planet Labs, and SpaceX. The US government has also been investing heavily in developing advanced satellite technology, which is expected to drive the North American small satellite market. During 2017-2022*, the region accounted for 75% of the total small satellites manufactured.

- The small satellite market in Europe is expected to grow significantly during the forecast period due to the rising demand for high-speed internet and communication services. The European Space Agency (ESA) has been investing heavily in developing advanced satellite technology, which is expected to drive the growth of the European small satellite market. During 2017-2022*, the region accounted for 13% of the total small satellites manufactured.

- Asia-Pacific is expected to witness significant growth in the small satellite market during the forecast period due to the increasing demand for satellite-based communication services and navigation systems in countries such as China, India, and Japan. During 2017-2022*, the region accounted for 6% of the total small satellites manufactured.

Global Small Satellite Market Trends

The trend of for better fuel and operational efficiency is expected to positively impact the market

- Satellites continue to be small-sized nowadays. They are capable of almost every task a conventional satellite does at a fraction of the cost of the conventional satellite, thereby making the building, launching, and operation of small satellite constellations increasingly viable. Correspondingly, our reliance on them continues to grow exponentially. Small satellites typically have shorter development cycles, smaller development teams, and cost much less for launch. Revolutionary technological advancements facilitated the miniaturization of electronics, leading to a push for the invention of smart materials and reducing satellite bus size and mass over time for manufacturers.

- Satellites are classified according to mass. Those with a mass of less than 500 kg are considered small satellites. Globally, around 3800+ small satellites were launched. There has been a growing trend for small satellites worldwide owing to their shorter development time, which could reduce overall mission costs. They significantly reduce the time required to obtain scientific and technological results. Small spacecraft missions tend to be flexible and can, therefore, be more responsive to new technological opportunities or needs. The small satellite industry in the United States is supported by the presence of a robust framework for the design and manufacture of small satellites tailored to serve specific application profiles. Owing to the growing demand in the commercial and military space sector, a rise in the number of small satellites is expected during 2023-2030.

Increasing space expenditures of different space agencies are expected to positively impact the small satellites industry

- According to the Canadian government, the space sector adds USD 2.3 billion to the Canadian GDP. The government reports that 90% of Canadian space firms are small- and medium-sized businesses. The Canadian Space Agency budget is modest, and the estimated budgetary spending for 2022-2023 is USD 329 million. In November 2022, as per the announcement that was made by ESA, a 25% boost was proposed in space funding over the next three years, which was designed to maintain Europe's lead in Earth observation, expand navigation services, and remain a partner in exploration with the United States

- For instance, in December 2020, IABG and BMWi signed a EUR 230 million contract to create satellites with high-resolution cameras, image sensors, and image converters. The new technology began mass production in Munich by the end of 2022 and will be used to install satellites needed for mapping and navigation around the world. Germany is also gradually developing its satellite observation capabilities. New observation satellite technologies were launched into orbit in a significant effort to reduce the environmental impact across the nation.

- In terms of research and investment grants, governments globally governments and the private sector have dedicated funds for research and innovation in the space sector. For instance, till February 2023, the National Aeronautics and Space Administration (NASA) distributed USD 333 million as research grants. Small satellites are increasingly being preferred for scientific research, military, and defense sectors, compared to commercial applications. The demand for small satellites reached a new high owing to the increasing requirements of data-intense applications like Earth and celestial observation, space research, and communication,

Small Satellite Industry Overview

The Small Satellite Market is fairly consolidated, with the top five companies occupying 98.09%. The major players in this market are Airbus SE, China Aerospace Science and Technology Corporation (CASC), ICEYE Ltd., Space Exploration Technologies Corp. and Thales (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50772

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Satellite Mass

- 4.2 Spending On Space Programs

- 4.3 Regulatory Framework

- 4.3.1 Global

- 4.3.2 Australia

- 4.3.3 Brazil

- 4.3.4 Canada

- 4.3.5 China

- 4.3.6 France

- 4.3.7 Germany

- 4.3.8 India

- 4.3.9 Iran

- 4.3.10 Japan

- 4.3.11 New Zealand

- 4.3.12 Russia

- 4.3.13 Singapore

- 4.3.14 South Korea

- 4.3.15 United Arab Emirates

- 4.3.16 United Kingdom

- 4.3.17 United States

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Application

- 5.1.1 Communication

- 5.1.2 Earth Observation

- 5.1.3 Navigation

- 5.1.4 Space Observation

- 5.1.5 Others

- 5.2 Orbit Class

- 5.2.1 GEO

- 5.2.2 LEO

- 5.2.3 MEO

- 5.3 End User

- 5.3.1 Commercial

- 5.3.2 Military & Government

- 5.3.3 Other

- 5.4 Propulsion Tech

- 5.4.1 Electric

- 5.4.2 Gas based

- 5.4.3 Liquid Fuel

- 5.5 Region

- 5.5.1 Asia-Pacific

- 5.5.2 Europe

- 5.5.3 North America

- 5.5.4 Rest of World

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Airbus SE

- 6.4.2 Astrocast

- 6.4.3 Axelspace Corporation

- 6.4.4 Chang Guang Satellite Technology Co. Ltd

- 6.4.5 China Aerospace Science and Technology Corporation (CASC)

- 6.4.6 German Orbital Systems

- 6.4.7 GomSpaceApS

- 6.4.8 ICEYE Ltd.

- 6.4.9 Planet Labs Inc.

- 6.4.10 Satellogic

- 6.4.11 Space Exploration Technologies Corp.

- 6.4.12 SpaceQuest Ltd

- 6.4.13 Spire Global, Inc.

- 6.4.14 Swarm Technologies, Inc.

- 6.4.15 Thales

7 KEY STRATEGIC QUESTIONS FOR SATELLITE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.