PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906925

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906925

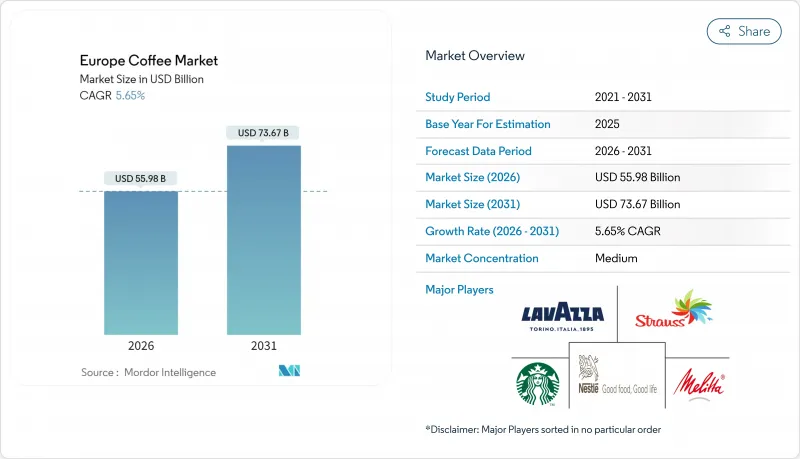

Europe Coffee - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The European coffee market is expected to grow from USD 52.99 billion in 2025 to USD 55.98 billion in 2026 and is forecast to reach USD 73.67 billion by 2031 at 5.65% CAGR over 2026-2031.

Europe remains one of the world's largest coffee-consuming regions, supported by established cultural practices and a strong cafe culture across many countries. While traditional coffee products maintain market dominance through widespread availability and an established consumer base, the market is experiencing increased demand for specialty, organic, and sustainably sourced varieties. Product format innovations are expanding consumer options and attracting younger consumers. The market growth is further supported by premium coffee experiences in both retail and foodservice segments. Market development is also influenced by digital transformation, environmental consciousness, and increased investments from major coffee chains. The European coffee market continues to evolve as consumers demand higher quality, ethical sourcing, and customized coffee options, creating a competitive and diverse market environment.

Europe Coffee Market Trends and Insights

Growing Demand for Specialty and Premium Coffee

The growing demand for specialty and premium coffee in Europe is driven by a sophisticated consumer base that increasingly prioritizes quality, unique flavor profiles, and ethical sourcing over mass-produced coffee products. European coffee drinkers demonstrate increased awareness of coffee origins, processing methods, and brewing techniques, which has enhanced the market for artisanal, single-origin, organic, and sustainable coffee varieties. The third-wave coffee movement, emphasizing craftsmanship, traceability, and product origin stories, reinforces this premium market segment. Consumers demonstrate a readiness to pay higher prices for coffee that delivers specific taste experiences while adhering to environmental and fair trade standards. In August 2024, John Farrer & Co of Kendal expanded its signature specialty coffee collection with three new products, focusing on small-batch, seasonal single-origin coffees from global sources. This product launch illustrates how established coffee roasters are adapting their offerings to address consumer preferences for distinctive, high-quality coffee products that highlight origin, seasonality, and production expertise.

Rising Cafe Culture and Social Coffee Consumption

The growing cafe culture and social coffee consumption in Europe are transforming the coffee market by focusing on experiences beyond the beverage. European consumers view coffee shops as social spaces for connecting, working, relaxing, and enjoying quality coffee. This shift is driven by demand for specialty coffees in appealing environments, often complemented by food options, events, and spaces suitable for socializing or remote work. The cafe experience represents lifestyle, community, and personal expression, drawing consumers seeking authentic experiences that combine traditional and modern elements. The expansion of independent cafes alongside established chains demonstrates consumer preference for distinctive, local coffee experiences. The Department for Environment, Food & Rural Affairs of the United Kingdom reported average out-of-home coffee consumption of 40 mL per person per week in 2023, highlighting the significance of social coffee drinking. This data indicates the recovery of on-trade coffee consumption as cafes strengthen their position as community spaces in modern consumer lifestyles.

Price Volatility and Supply Chain Disruptions

The European coffee market faces significant constraints due to price volatility and supply chain disruptions, which create uncertainty throughout the value chain. Multiple factors influence coffee prices, including climate variability, extreme weather events, geopolitical tensions, and labor shortages in major producing countries. These challenges reduce crop yields and quality while constricting supply volumes and increasing production and logistics costs. The resulting price inflation directly affects retail coffee prices in Europe, impacting consumer purchasing behavior and consumption patterns. The highly globalized coffee supply chain remains susceptible to transportation delays, increasing freight costs, and regulatory changes, which add further cost pressures and complicate market operations. In Germany, one of Europe's largest coffee-consuming countries, the Federal Statistical Office reported a 12.2% year-over-year increase in consumer prices for ground coffee in April 2025 . This price surge demonstrates how inflationary pressures can influence consumer behavior, potentially driving shifts toward more affordable alternatives such as instant coffee or blends with higher robusta content.

Other drivers and restraints analyzed in the detailed report include:

- Sustainability Emerges as Key Market Driver

- Product Innovation Fuel Market Development

- Competition from Alternative Beverages

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Coffee pods and capsules constituted 33.22% of the market share in 2025, demonstrating European consumers' pronounced strategic orientation toward systematized home brewing methodologies. The segment's substantial market presence is fundamentally attributed to its operational sophistication, standardized preparation protocols, and quantifiable beverage quality parameters. The systematic implementation of single-serve coffee machines, in conjunction with technological advancements in capsule manufacturing specifications and comprehensive flavor taxonomies, continues to facilitate this segment's methodical market progression.

The whole bean coffee segment is projected to grow at a CAGR of 7.28% through 2031, driven by consumers who prioritize freshness, quality, and customized brewing options. This growth reflects an increasing preference for premium coffee experiences, with consumers seeking authentic flavors and aromas that whole beans preserve better than pre-ground alternatives. Supporting this trend, the United States Department of Agriculture (USDA) reports that the European Union dominated domestic consumption of green coffee beans in the 2024/2025 marketing year, utilizing over 42.0 million 60-kilogram bags. This high consumption level indicates a growing preference among European consumers for freshly roasted coffee and home roasting, which enables greater control over their coffee preparation.

Plain coffee maintains a commanding market position with an 81.72% share in 2025, demonstrating the predominant preference among European consumers for traditional coffee consumption. Market analysis indicates a significant consumer orientation toward authentic characteristics derived from coffee origin, bean varieties, and precise roasting profiles rather than flavored alternatives. This substantial market concentration in plain coffee consumption illustrates the European market's refined appreciation for premium quality and distinctive taste characteristics inherent in regional coffee varieties and specialized roasting methodologies, aligning with the continent's established coffee heritage.

The flavored coffee is growing at a CAGR of 7.64%, driven by younger consumers seeking diverse and seasonal varieties beyond traditional coffee options. This market segment attracts consumers looking for enhanced taste experiences and customized selections that align with modern lifestyle preferences. Product innovations featuring natural flavorings without added sugar address health-conscious consumer demands while meeting the need for premium offerings. For instance, in 2024, Nestle S.A. expanded its Nescafe Classic range in Central and Eastern Europe by introducing caramel and hazelnut flavors, both containing natural flavorings without added sugar.

The European Coffee Market Report is Segmented by Product Type (Whole Bean, Ground Coffee, Instant Coffee, and More), by Flavor (Plain, and Flavored), Category (Conventional, and Specialty), Bean Type (Arabica, Robusta, and Others), Distribution Channel (On-Trade and Off-Trade), and Geography (Germany, United Kingdom, Italy, France, Spain and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Tons).

List of Companies Covered in this Report:

- Nestle SA

- Luigi Lavazza SpA

- Starbucks Corporation

- Strauss Group

- Melitta Group

- JDE Peet's (Jacobs Douwe Egberts)

- Bewley's Limited

- J.J. Darboven GmbH & Co. KG

- Kruger GmbH & Co. KG

- Tchibo GmbH

- Gruppo Illy S.p.A.

- The J.M. Smucker Company

- Massimo Zanetti Beverage Group (Segafredo)

- Paulig Oy

- Julius Meinl Industrieholding GmbH

- J.J. Darboven GmbH & Co. KG

- The Kraft Heinz Company

- Aldi Sud & Nord (Private-Label Coffee)

- Dak Coffee Roasters

- Lofbergs Roastery

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand for specialty and premium coffee

- 4.2.2 Rising cafe culture and social coffee consumption

- 4.2.3 Sustainability emerges as key market driver

- 4.2.4 Product innovation fuel market development

- 4.2.5 Health consciousness and awareness of coffee benefits

- 4.2.6 Premiumization of whole bean and fresh coffee

- 4.3 Market Restraints

- 4.3.1 Price volatility and supply chain disruptions

- 4.3.2 Competition from alternative beverages

- 4.3.3 Climate change impact on coffee production

- 4.3.4 High operational and raw material costs

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Whole Bean

- 5.1.2 Ground Coffee

- 5.1.3 Instant Coffee

- 5.1.4 Coffee Pods and Capsules

- 5.1.5 Ready-to-Drink (RTD) Coffee

- 5.2 By Flavor

- 5.2.1 Plain

- 5.2.2 Flavored

- 5.3 By Category

- 5.3.1 Conventional

- 5.3.2 Speciality (Organic/Single-Origin)

- 5.4 By Bean Type

- 5.4.1 Arabica

- 5.4.2 Robusta

- 5.4.3 Others

- 5.5 By Distribution Channel

- 5.5.1 On-trade

- 5.5.2 Off-trade

- 5.5.2.1 Supermarkets/Hypermarkets

- 5.5.2.2 Convenience Stores

- 5.5.2.3 Online Retail Stores

- 5.5.2.4 Other Distribution Channels

- 5.6 By Geography

- 5.6.1 Germany

- 5.6.2 United Kingdom

- 5.6.3 Italy

- 5.6.4 France

- 5.6.5 Spain

- 5.6.6 Netherlands

- 5.6.7 Poland

- 5.6.8 Belgium

- 5.6.9 Sweden

- 5.6.10 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Nestle SA

- 6.4.2 Luigi Lavazza SpA

- 6.4.3 Starbucks Corporation

- 6.4.4 Strauss Group

- 6.4.5 Melitta Group

- 6.4.6 JDE Peet's (Jacobs Douwe Egberts)

- 6.4.7 Bewley's Limited

- 6.4.8 J.J. Darboven GmbH & Co. KG

- 6.4.9 Kruger GmbH & Co. KG

- 6.4.10 Tchibo GmbH

- 6.4.11 Gruppo Illy S.p.A.

- 6.4.12 The J.M. Smucker Company

- 6.4.13 Massimo Zanetti Beverage Group (Segafredo)

- 6.4.14 Paulig Oy

- 6.4.15 Julius Meinl Industrieholding GmbH

- 6.4.16 J.J. Darboven GmbH & Co. KG

- 6.4.17 The Kraft Heinz Company

- 6.4.18 Aldi Sud & Nord (Private-Label Coffee)

- 6.4.19 Dak Coffee Roasters

- 6.4.20 Lofbergs Roastery

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK