PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1637776

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1637776

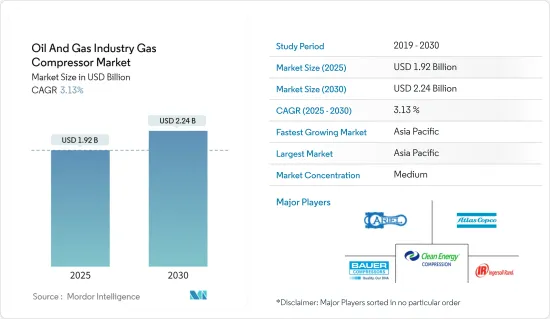

Oil And Gas Industry Gas Compressor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Oil And Gas Industry Gas Compressor Market size is estimated at USD 1.92 billion in 2025, and is expected to reach USD 2.24 billion by 2030, at a CAGR of 3.13% during the forecast period (2025-2030).

Key Highlights

- Over the long term, the market is largely driven by the growth in natural gas consumption for various applications, which has led to more gas production and transmission projects and reasonable natural gas prices in the current scenario, which has a positive impact on the upstream sector.

- On the other hand, the growing penetration of renewables in the energy sector offers stiff competition to natural gas consumption and thus impedes the growth of gas compressor deployment in numerous applications.

- Nevertheless, the increase in natural gas proved reserves, particularly offshore gas fields in the recent picture, places a tremendous opportunity for the gas compressor market. The very recent Russian group's Lukoil's oil and gas field discovery off the coast of Mexico is an example of the same. The new upcoming producing fields will lead to a greater deployment of gas compressors for gathering lines.

Oil and Gas Compressor Market Trends

Midstream Sector Expected to Dominate the Market

- The gas compressors used in the midstream oil and gas industry are deployed either within the gas transmission pipeline network or at the compressed gas storage units. Gas flowing in pipelines suffers from pressure losses that increase with flow velocity and the length of the pipe. Therefore, every 50 to 100 miles, a compressor station is necessary to recompress the gas and compensate for the pressure losses.

- Natural gas consumption continuously showed an advancing trend over the last 10 years, with around 3941.3 billion cubic meters of consumption in 2022. The demand is expected to grow in the coming years due to the government's push for cleaner methods of energy generation in many countries. A number of pipeline and LNG projects are about to be added to the list of accomplished projects of many midstream companies in the coming years.

- For instance, the Adelphia Gateway Project received approval for the construction of the second phase of the project from the Federal Energy Regulatory Commission (FERC), United States. The project includes the conversion of an existing 84-mile oil pipeline to a gas supply pipeline for distribution in the Philadelphia region. The developer, Adelphia Gateway LLC, is expected to be able to supply the first gas from the pipeline by the end of 2023.

- Furthermore, in February 2023, Oil and Natural Gas Corporation, India's state-owned hydrocarbon giant, initiated a big-buck pipeline replacement project, a crucial project for the company's production from key west coast fields. The USD 446 million project will ensure a stable supply of oil and gas from ONGC wells covering an area of 40,000 square kilometers along the western coast. Since compressors play a crucial role in the oil and gas industry in increasing the pressure of natural gas and allowing natural gas transportation from the production site, this kind of project will, in turn, promote the usage of compressors across the industry.

- Such developments will inevitably have a positive impact on the gas compressor market in the oil and gas industry during the forecast period.

Asia-Pacific Expected to Dominate Market Growth

- Asia-Pacific can account for half of the incremental gas demand in the near future due to increased consumption in the transport and industrial sectors. To serve the natural gas demand for the power generation industry and other applications, the region has witnessed an expansion in the pipeline network, mainly in countries like India and China.

- China's LNG and pipeline imports of natural gas reached record levels in 2022, with an increment of more than 16.6% in LNG imports during the last decade, whereas the gas pipeline monthly imports approached a peak level of 4 million metric tons. The surge in imports will lead to an expansion of the supporting pipeline infrastructure in the country. Moreover, India is expected to bring 34,384 km of new pipelines online by 2023.

- In March 2023, Aramco and joint venture partners Panjin Xincheng Industrial Group and NORINCO Group announced plans to start the construction of a significant integrated refinery and petrochemical complex in northeast China. The complex is going to have combination of a 300,000 barrels per day refinery and a petrochemical plant with an annual production capacity of 1.65 million tons of ethylene and 2 million metric tons of paraxylene. Construction is expected to start in the second quarter of 2023 after the project has secured administrative approvals. It is expected to be fully operational by 2026.

- Also, the rapidly growing network of CNG fueling stations has led to the development of the gas compressor market in the Asia-Pacific region. For example, in April 2023, the government of India announced the target has been fixed to establish around 17,700 CNG stations across the country by 2030.

- Owing to such developments, the gas compressor market is expected to flourish to the greatest extent in the Asia-Pacific region during the study period.

Oil and Gas Compressor Industry Overview

The oil and gas industry's gas compressor market is semi-consolidated. Some of the major companies (in no particular order) include Atlas Copco AB, Ariel Corporation, Bauer Compressor Inc., Clean Energy Fuels Corp., and Ingersoll Rand PLC, among others.

Atlas Copco AB has adopted many strategies like focus on research and development, increase market coverage, increase operational efficiency, develop new sustainable products and solutions offering better value and improved energy efficiency. As an example, in February 2023, the company launched its next generation GA and GA+fixed speed smart industrial air compressors,. Such technological innovations would enable the company to better respond to the changing needs of the industrial customers with diversified product portfolio. These new type of compressors can also be used for clean energy applications like natural gas processing, and hydrogen production.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growth in Natural Gas Consumption for Various Applications

- 4.5.2 Restraints

- 4.5.2.1 Growing Penetration of Renewables in the Energy Sector

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Reciprocating

- 5.1.2 Screw

- 5.2 Application

- 5.2.1 Upstream

- 5.2.2 Downstream

- 5.2.3 Midstream

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 Spain

- 5.3.2.4 United Kingdom

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Malaysia

- 5.3.3.4 Indonesia

- 5.3.3.5 Rest of Asia-Pacifc

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirated

- 5.3.5.3 Nigeria

- 5.3.5.4 South Africa

- 5.3.5.5 Rest of Middle East & Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Ariel Corporation

- 6.3.2 Atlas Corporation AB

- 6.3.3 Bauer Compressors Inc.

- 6.3.4 Burckhardt Compression Holding AG

- 6.3.5 Clean Energy Fuels Corp.

- 6.3.6 General Electric Company

- 6.3.7 HMS Group

- 6.3.8 Howden Group Ltd

- 6.3.9 Ingersoll Rand PLC

- 6.3.10 Siemens AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increase in Natural Gas Proved Reserves, Particularly Offshore Gas Fields